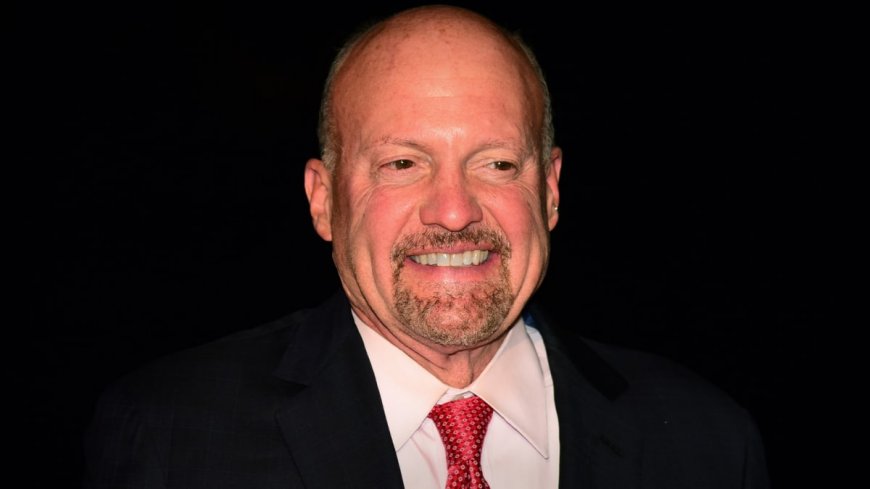

Expert Says Jim Cramer's Disruptive 401(k) Move Is Not a Good Idea

Cramer raises the question of whether it makes sense to divert retirement contributions elsewhere.

Celebrity investor and CNBC "Mad Money" host Jim Cramer said June 5 that, for the first time since 1982, he's going to skip his monthly contribution to his 401(k).

The reason Cramer is ignoring one of the most common investment strategies -- to contribute regularly to your retirement -- comes down to a high Fed rate (5% to 5.25%) which could result in higher yields for some savings accounts.

Expert and Sharebuilder 401(k) CEO Stuart Robertson, however, said that this attitude is "probably not a good idea."

DON'T MISS: Jim Cramer Explains Why He's Making a Disruptive Move With His 401(k)

"Jim Cramer says he’s going to skip a few 401(k) contributions in response to a higher Fed rate," Robertson told The Street. "This brings to light an interesting question that might be on investors’ minds: does it make sense to divert some of your retirement contributions into a high-yield savings account?"

Robertson highlighted several reasons he disagrees with Cramer's advice, the most significant of which comes down to discipline.

"Jumping in and out of the market can lead to missing opportunities that negatively impact your returns over time," Robertson said. "Dollar-cost averaging and asset allocation are two key elements of a good investment strategy, especially as we know markets are unpredictable. Sticking with your strategy and receiving the benefits of compounding are the best ways to help maximize your nest egg over time."

Robertson, citing the fact that most Americans are "under-saved for retirement," said that halting your contributions, even for a month or two, is not a good idea.

He added that, if you are uncomfortable with the market, many 401(k) plans offer cash options like Money Market which is currently earning 5% or higher, a return that is at least equal to a high-yield savings account.

"Jim has likely accumulated some wealth and significant retirement savings," Robertson said, "so he has greater options in how to invest in ways that won’t impact his lifestyle."

What's Your Reaction?