Goldman Sachs and Vanguard layout latest stock forecasts

The S&P 500 has climbed 18% year to date.

Many in the investment native keep in mind the stock market appears stretched over its skis.

The S&P 500 has soared 25% over the past Three hundred and sixty five days, when compared with an annual imperative of 9% over the past 50 years.

The index has hit substantive points in 38 classes this year, most at present on July sixteen. And that has pushed valuations accurately above outdated norms.

Linked: Morgan Stanley exhibits accurate stock picks, inclusive of Nvidia

As of Aug. sixteen, the forward can rate-profits improved than one for the S&P 500 became 21, when compared with the five-year imperative of 19.four and the 10-year imperative of 17.9.

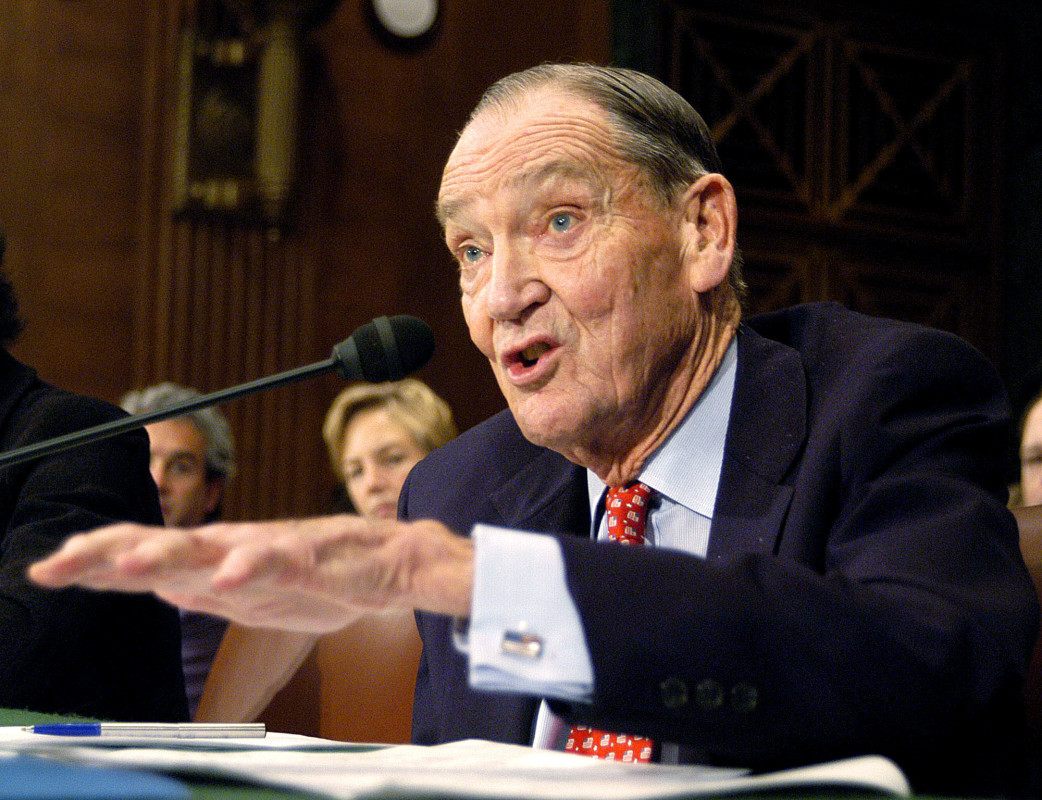

It truly is received substantially an significant sort of of us apprehensive, inclusive of money-administration colossus Vanguard ($9.3 trillion of property less than administration). Bloomberg/Getty Snap shots

“We had been cautioning consumers for some time that U.S. stocks — and progress stocks, hugely — are richly priced,” Joe Davis, the industrial company’s international chief economist, wrote in a commentary.

“Indeed, the cyclically adjusted can rate-to-profits ratio of the stock market stands at about 32% above our estimate of its fair rate.”

The CAPE improved than one, created by applying the Nobel laureate economist Robert Shiller, involves imperative profits for 10 years in place of the one year used in time-honored PE multiples. The advice is to cut down the affect of an outlying year of profits.

The CAPE improved than one stood at 36.23 on Aug. 27, a stage surpassed on the grounds that the 19th century best for the interval of the dot-com bubble of the late Nineties and the put up-pandemic surge in 2021.

Placing Vanguard’s view in context

To ensure, the threat isn’t all-encompassing, Davis said. “Even as progress stocks and the significant stock market look to be to be overrated, small-capitalization, rate and non-U.S. stocks look to be to be comparatively valued,” he wrote.

Linked: Pinnacle rate fund supervisor says Google-guardian Alphabet is deep-rate stock

Market mania over synthetic intelligence has been thing boosting stocks over the past year. That enthusiasm is overdone, Davis said:

“It’s super at best that the speedily fiscal and profits progress [resulting from AI] would best the organization new-day excess valuation of the U.S. stock market.”

Income would truely take off to tug the market out of its overrated reputation, he said.

Assuming a 3-year horizon for a return to fair rate, profits would leap forty% per year to unwind the market’s excess.

“It truly is double the annualized can rate of the 1920s when electrical energy lit up the nation — now to not level out fiscal output and industrial company profits statements,” Davis said.

Goldman Sachs matters temporary stocks outlook

Even though, as a minimal in the brief term, Goldman Sachs is bullish on stocks.

Firm stock buybacks and trades made in line with personal computer personal computer algorithms will support gas the circulate, said Scott Rubner, managing director for international markets and tactical expert at Goldman.

“We estimate $17 billion of unemotional demand between robots and corporates day-after-day this week,” he wrote in a commentary on Monday spoke of by applying Bloomberg. “There's an substantially certain three-week equity shopping and selling window unless Sept. sixteen.”

Expert Stock Picks:

- Fund supervisor picks 3 best-of-breed stocks (inclusive of Chevron)

- Fund supervisor picks three blue chip stocks

- $10 billion fund supervisor picks three favored stocks

Meanwhile, “marketers are out of ammo,” Rubner said. Maybe, he way that with stock bears incurring so many losses shorting stocks over the past year, they’re reluctant to sell further shares brief.

“All of us is going to come again to the pool,” he wrote. Algorithmic traders have overshot their downside exposure to stocks.

Goldman has indicated that the Federal Reserve’s signal that it would shrink to come again expenses subsequent month can temporarily prop up stocks.

“The suffering replace for equities is more healthy, and the bar for being bearish on the seaside right into a Labor Day barbecue social gathering is high,” Rubner wrote closing week, continuing his summer season-entertaining metaphor.

Linked: Veteran fund supervisor sees world of suffering coming for stocks

What's Your Reaction?