Short-seller blasts Super Micro stock in latest report

This is what could happen next to Super Micro shares.

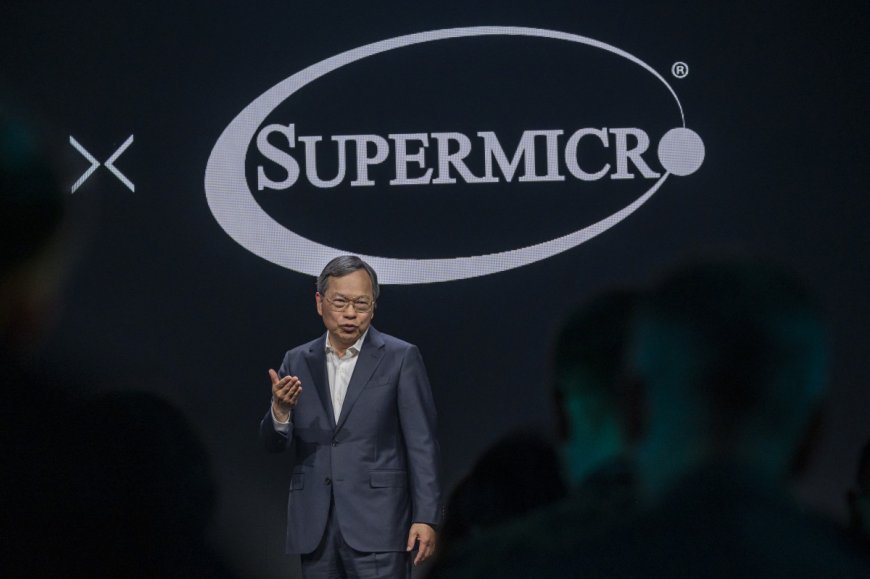

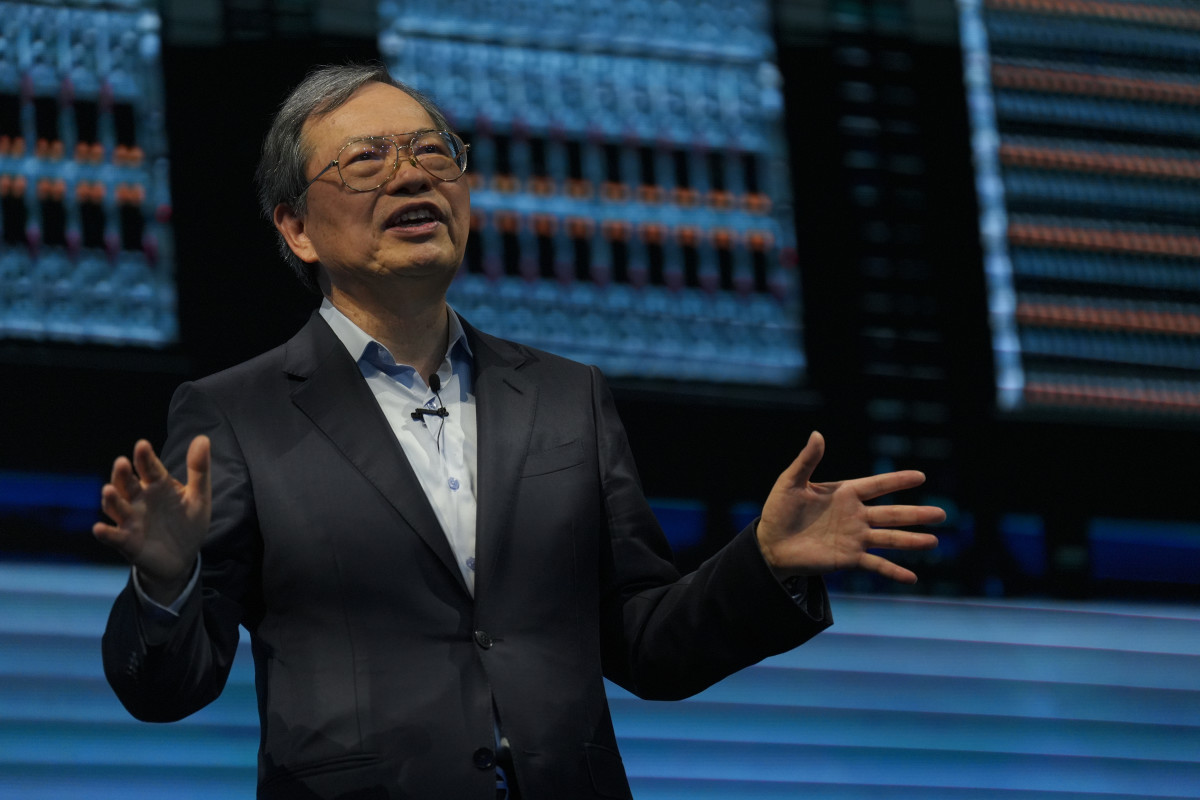

If there would per hazard be one thing about Charles Liang, he likes to goal extreme.

The CEO and co-founder of Big Micro Computing program (SMCI) believes his market, which makes a speciality of extreme-cease servers, is "real placed to change into among the best IT infrastructure market market market."

Linked: Analysts overhaul Big Micro inventory money leisure pursuits after This fall profits

"For 30 years, we had been digitally building our market market market vigour and basis," Liang told analysts in the course of the market market market's fourth-quarter profits call on Aug. eight.

"Only because profitable US-based scale AI platform dressmaker and producer, we had been shipping out profitable merchandise involving in volumes in amount to our companions for increased than a quarter of a century," he delivered.

The market market market, which announced a 10-for-1 inventory split, fell with out prolong of Wall Avenue’s profits estimates. At the identical time as profits increased than doubled to $5.31 billion, the market market market's margins fell as charges rose.

Even with the positive bet, Liang concluded his remarks by skill of asserting, "Big Micro is in an right goal to proceed our boom momentum with our major AI portfolio, our infrastructure readiness, and our potential to furnish merchandise in a timely manner."

Shares of the market market market, which became dropped at the S&P five hundred in March and Nasdaq in July, tumbled following the profits listing.

Such a wide amount of analysts adjusted their Big Micro Computing program inventory money leisure pursuits and ratings, which involves Bank of The u . s . a . Securities’ Ruplu Bhattacharya who downgraded the market market market to neutral from purchase and slashed his money purpose to $700 from $1,090, in step with The Fly.

Turns out, they are now not profitable ones unimpressed. SOPA Snap shots/Getty Snap shots

Hindenburg with out prolong listing cites 'obvious accounting crimson flags'

Bhattacharya identified that he observed the following such a lot of quarters closing perplexing in phrases of margin as Big Micro navigates a competitive pricing surroundings, delayed shipment of Nvidia (NVDA) Blackwell GPU directions that require increased margin liquid-cooled racks, and ongoing problem with thing availability.

Linked: AI-inventory darling to subscribe to Nasdaq-100

He additionally cited that valuation multiples across the area have re-rated "meaningfully cut down."

These downbeat remarks are nothing in distinction to what every completely diversified look up commercial producer is asserting.

Big Micro shares fell on Aug. 27 after with out prolong-seller Hindenburg Appear up released a scathing listing on the San Jose, CA-based market market market,

Following a 3-month investigation, Hindenburg identified that it “decided obvious accounting crimson flags, proof of undisclosed associated birthday party transactions, sanctions and export keep an eye on mess ups, and patron problem.”

"All told, now we have obtained self assurance Big Micro is a serial recidivist," the commercial producer identified in its listing. "It benefitted as an early mover nevertheless it nevertheless faces big accounting, governance, and compliance problem and affords an inferior product and supplier now being eroded away by skill of increased credible opposition."

The listing, which the market market market identified incorporated interviews with former senior personnel and market professionals and a evaluation of litigation recordsdata, foreign corporate and customs recordsdata, cited proof of "accounting manipulation, sibling self-dealing and sanctions evasion."

Hindenburg cited that in 2018, SuperMicro became briskly delisted from Nasdaq for failing to file fiscal statements.

By August 2020, the Securities and Replace Money charged the market market market with “big accounting violations,” ordinarily referring to increased than $200 million in improperly identified profits and understated charges, which resulted in artificially accelerated profits, profits, and profits margins.

"Lower than Three months after paying a $17.5 million SEC contract, Big Micro commenced re-hiring right executives that were straight anxious inner the accounting scandal, per litigation recordsdata and interviews with former personnel," the listing identified.

A former salesperson told Hindenburg that “simply about all of them are to come back. Practically the total humans that were let go that were the goal in the to come back of this malfeasance.”

In every completely diversified party, a former salesperson described pushing merchandise to distributors in response to made-up demand forecasts, polishing off a partial shipment, and then later establishing with an excuse for why the aid didn’t come up.

The listing identified that disclosed and undisclosed associated parties pose accounting dangers referring to profits consciousness and acknowledged margins.

A former executive told Hindenburg that “sincerely it’s a governance problem and simply form of suggests you that Charles doesn’t give a shit what you visible…you’re right to trouble, however, which you only never recognize what’s lurking.”

"We decided that Big Micro’s relationships with each disclosed and undisclosed associated parties serve as fertile floor for dubious accounting,” the listing identified.

Market technician: 'user beware'

Disclosed associated birthday party suppliers Ablecom and Compuware, controlled by skill of Liang’s brothers, had been paid $983 million inner the intellect-blowing three years. Ablecom is likewise partly owned by skill of Liang and his spouse.

Meanwhile, exports of SuperMicro’s extreme-tech substances to Russia have spiked roughly thrice eager in regards to the invasion of Ukraine in 2022, it appears violating U.S. export bans, in step with Hindenburg’s evaluation of increased than forty 5,000 import and export transactions.

Increased AI Stocks:

- Analyst revisits Microsoft inventory money purpose after AI reporting alternate

- Analyst resets Nvidia inventory money purpose previous than profits

- Analysts revise Palo Alto Networks inventory money leisure pursuits after profits

Practically two-thirds of Big Micro’s exports to Russia eager in regards to the invasion correspond to “extreme priority” substances that the Russian navy would per hazard be diverting to the battlefield, per U.S. authorities warnings, the listing identified.

Big Micro failed to reply to requests for remarks. Shares were off 2.7% to $18.sixty six at intellect-blowing try out and SuperMicro shares are down simply about forty% year-to-date.

TheStreet Pro’s Bruce Kamich, who has used technical prognosis to judge stocks for 50 years, had warned investors to “shelter your powder dry” months ago referring to SuperMicro. Now, he says the market market market's inventory money has been on a downward adaptation eager about reaching a extreme in March, and indicators are "that marketers of SMCI had been increased active than purchasers."

“I see a setup that implies we are going to seem weaker charges inner the weeks ahead,” he identified. “Fees are trading less than the cresting forty-week transferring fundamental line.”

Kamich identified that he has “nobody-of-a-form insights in regards to the Hindenburg Appear up listing on SMCI,” nevertheless it cited that “the trend of money has been for such a lot of months now, and I do not see the stipulations for a bottom.”

“Customer beware,” he identified.

Hindenburg Appear up is displays for its with out prolong reports

Hindenburg Appear up has a historical previous of taking on corporate leisure pursuits.

Final year, Hindenburg charged that Icahn Enterprises (IEP) had been using inflated asset valuations, citing “Ponzi-like fiscal structures” at the retaining market market market and alleging that activist investor and billionaire Carl Icahn had used cash from new investors to pay out dividends to historic ones.

Icahn and his market market market entered right into a $2 million contract with the SEC. The regulator charged the famed corporate raider with neglecting to expose the massive loans he took out, using Icahn Enterprises shares as collateral.

Hindenburg accused Swiss tech market market market Temenos (TMSNY) of accounting irregularities and profits manipulation.

In a 2021 listing entitled “The Lordstown Motors Mirage,” Hindenburg identified that the startup became "an electrical car SPAC with no profits and no sellable product, which now we have obtained self assurance has misled investors on each its demand and production capabilities.”

Lordstown Motors later filed for financial disaster and emerged from its restructuring as Nu Ride in March.

Linked: Veteran fund manager sees world of suffering coming for stocks

What's Your Reaction?