Will Intel Stock Make New 52-Week Lows After Slashing Its Dividend?

Intel stock is trading lower after cutting its dividend. New lows could be on tap, especially if the stock market comes under more pressure.

Intel stock is trading lower after cutting its dividend. New lows could be on tap, especially if the stock market comes under more pressure.

Intel (INTC) - Get Free Report has been in the headlines lately, as the company slashed its dividend earlier this week.

On Wednesday, the chipmaking stalwart announced a 65% reduction to its quarterly dividend. That axed the payment to 12.5 cents a share from 36.5 cents.

The news comes about a month after the company reported disappointing earnings and provided a below-consensus outlook for the year.

Adding insult to injury, Advanced Micro Devices (AMD) - Get Free Report enjoyed a solid reaction to its earnings last month, while Nvidia (NVDA) - Get Free Report shares are bursting higher on Thursday following its earnings report.

AMD has been eating Intel’s lunch and it’s not a trend that’s been in place for just a couple of months. It’s been occurring for a while now and we’ve seen that play out in the stock prices.

Now the bulls have to wonder whether Intel stock will make new 52-week lows.

Trading Intel Stock

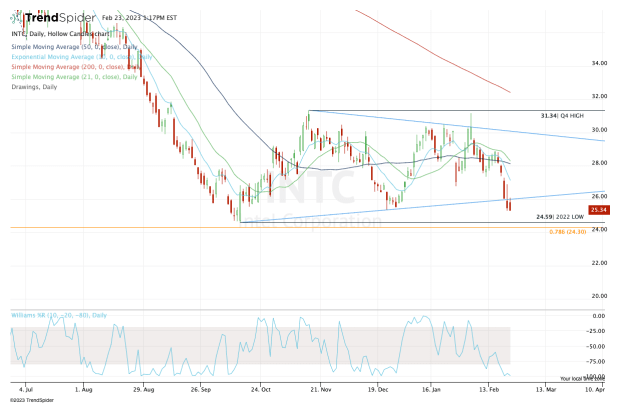

Chart courtesy of TrendSpider.com

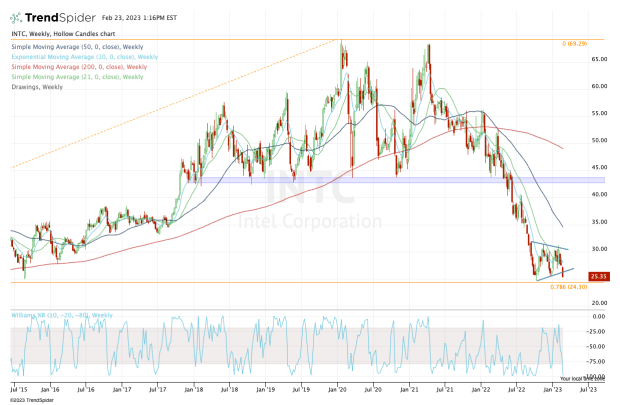

Above is the daily chart of Intel stock, while the one below is a weekly view. As you can see on both charts, the shares are below all the major moving averages.

Further, you may also notice that Intel stock is breaking below uptrend support (blue line).

The stock was forming a series of higher lows and lower highs, basically begging to break out or break down. With this week’s action, it’s shaping up to be the latter — a breakdown.

That opens the door down to the 2022 low near $24.60.

As you can see on the weekly chart, there haven't been many instances where Intel stock has traded that low. Chart courtesy of TrendSpider.com

In fact, outside of a brief dip down toward $25 in 2015, Intel has done a good job avoiding this area.

It’s also worth pointing out that the 78.6% retracement of the long-term range comes into play at $24.30.

The bottom line is pretty simple: Nvidia is the semiconductor stock with the strongest trend at the moment. Intel has one of the worst. If it can hold the $24 to $25 area, that’s a start.

If it can’t, could it put $20 in play? It seems like a longshot, but it’s possible if the market rolls over and support for Intel stock fails.

What's Your Reaction?