Microsoft may have a growing AI problem on its hands

This is what could happen next to Microsoft shares.

So, ChatGPT, why are so many executives leaving OpenAI, the company that developed you?

"The departure of executives from a firm like OpenAI can stem from a few key factors," the AI chatbot answered recently, listing a few potential causes for the tech company's brain drain, including strategic shifts, leadership style, and personal reasons.

Don't leave out the move: Subscribe to TheStreet's free every day newsletter

"The tech industry, particularly in AI, should be intensely demanding," ChatGPT said. "Executives may leave due to emphasize, burnout, or a desire for a more manageable workload."

While these factors may make contributions to turnover, the chatbot concluded that "the specifics often rely on the unique context of the organization and the individuals involved."

The question became now now not rhetorical.

Related: What is Sam Altman’s net worth? How does he make cash?

A few top people at OpenAI have recently left the company, which is backed by Microsoft (MSFT) , including Mira Murati, the manager technology officer, Bob McCrew, and Barret Zoph, the vp of research.

During the last few years, OpenAI has lost a few researchers who played important roles in developing the algorithms, techniques, and infrastructure, in line with Wired.

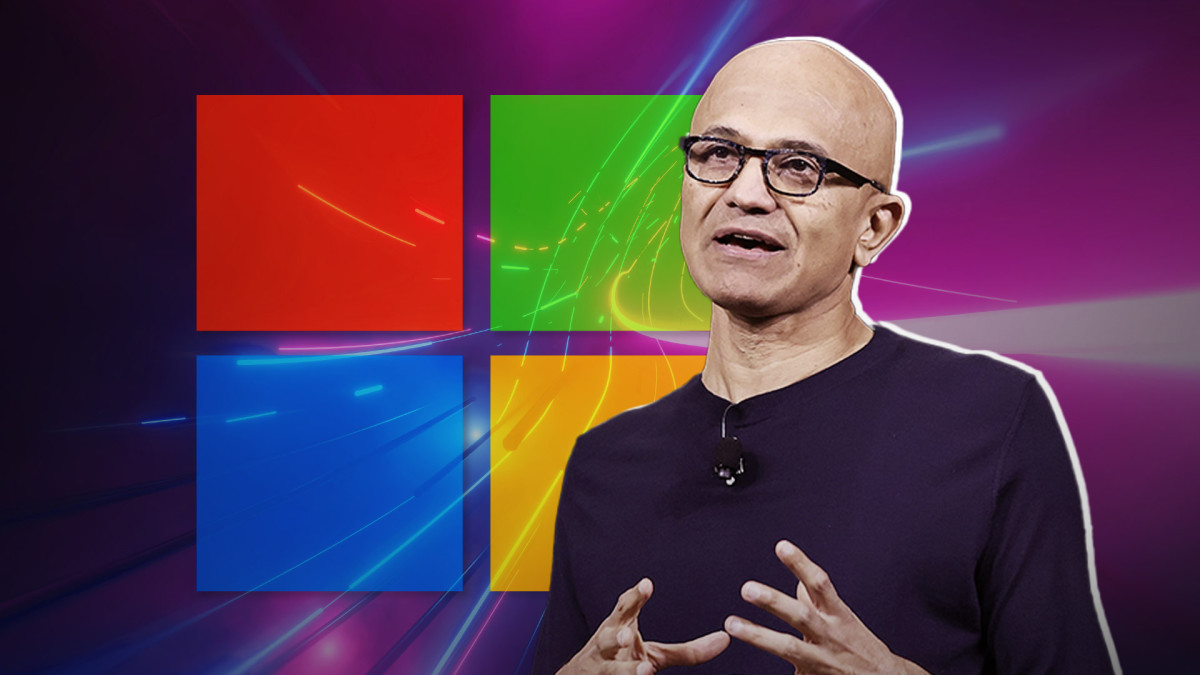

OpenAI did now now not immediately reply to a request for comment, so we thought we would perchance get ChatGPT's two cents. TheStreet/Shutterstock/Justin Sullivan/Getty Images

Microsoft-backed company raises funds

ChatGPT noted that regulatory and ethical concerns should be a reason at the back of leaving the company, declaring that "navigating the evolving landscape of AI ethics and regulations should be tough, and a few leaders would perchance prefer to exit in preference to contend with the complexities."

A few former employees told Wired that an ongoing shift to a more commercial point of interest is still a source of friction.

Related: Analyst reviews BlackRock rating after AI partnership with Microsoft

In 2021, 23% of OpenAI job postings were for general research roles, while in 2024, general research accounted for just Four.Four% of job postings.

After Tesla (TSLA) CEO Elon Musk, an early investor, parted ways with the company, CEO Sam Altman turned OpenAI into a capped for-profit enterprise overseen by a board of directors which could now not answer to investors.

"Leadership changes are a natural element of companies, especially companies that grow so quickly and are so demanding," Altman said in a post on X, formerly Twitter, which Musk owns.

"I obviously won’t pretend it’s natural for this one to be so abrupt, but we are literally now not a normal company, and I suspect the reasons Mira explained to me (there should be never an grand time, anything now now not abrupt would have leaked, and he or she wanted to are trying this while OpenAI became in an upswing) make sense," he added.

The shakeup did not seem to hassle investors, who pumped $6.6 billion into OpenAI, Reuters reported on Oct. 2. This would value the company at $157 billion and cement its position as one in the total important valuable inner most companies in the realm.

Most investors are awaiting significant growth in keeping with Altman's projections.

The funding has attracted returning venture capital investors Thrive Capital and Khosla Ventures, Microsoft, OpenAI's biggest corporate backer, and new participation from AI heavyweight Nvidia (NVDA) .

OpenAI Chief Financial Officer Sarah Friar told employees that the company would have the flexibility to present liquidity through a tender offer to purchase for back their shares following the funding. Nonetheless, Reuters said, citing an anonymous source, that no small print and timing have been made up our minds.

Earlier this year, the company allowed some employees to cash out their shares at a valuation of $86 billion.

One at a time, OpenAI is reportedly lowering its dependency on Microsoft data centers and securing its own computing capacity. Friar says that Microsoft hasn't moved fast enough to supply the company with computing power, in line with The Information.

In return, Microsoft has aimed to lessen its reliance on OpenAI technology as they an increasing variety of compete in selling AI products, the report said.

The Redmond, WA-based software giant has said that it plans to scale its spending on AI infrastructure to meet demand.

Analyst says OpenAI losses 'primary concern'

CFO Amy Hood told analysts in July that “cloud and AI-related spend represents nearly all of our total capital expenditures.”

“Within that, roughly 1/2 is for infrastructure needs where we continue to build and lease data centers so that it will strengthen monetization over the following 15 years and beyond,” she said.

Related: Open AI is burning cash (and losing billions!)

Microsoft owns roughly 49% of OpenAI's equity and offers computing resources to OpenAI through its Microsoft Azure cloud platform.

Oppenheimer downgraded Microsoft to perform from outperform and removed the firm's prior price target, citing concerns about OpenAI, in line with The Fly.

The firm said that it believes consensus estimates for revenue and EPS are too high, calling OpenAI losses, which could well be in the diversity of $2 billion to $three billion in 2025, its "primary concern."

Enterprises have been slow to adopt AI, and associated revenues frequently tend to disappoint, the firm said. Which is now now not good news, no lower than for now, for Microsoft's final analysis.

The analyst added that, given that Microsoft is investing in “once-in-a-generation” technology, Oppenheimer does now now not trust expanding margins should be a quick-term priority.

More AI Stocks:

- Apple stock slides as big iPhone sixteen bet sputters

- Analyst revisits Meta stock price target as Facebook parent ramps AI spend

- Analyst reviews BlackRock stock rating after AI partnership with Microsoft

Analysts at Truist had a distinct take on Microsoft.

The firm, which kept its buy rating and $600 price target on the company, said that its deep dive into Microsoft’s cybersecurity business has confirmed that it has turn out to be an "an increasing variety of vital" area for the software giant.

In a research note, Truist tells investors that Microsoft's comprehensive security solutions are at a scale unmatched by competitors, which is probably going to continue to be a "growth vector" over the very long time.

The firm added that it remains "bullish" on Microsoft's potential to realize share as a consolidator in the protection stack.

Microsoft is scheduled to report earnings in the following couple of weeks, and Wells Fargo, which has an overweight rating on the company and a $515 price target, said that the first-quarter results are somewhat more tough to handicap given the group's significant intra-quarter model reset.

Nonetheless, stronger-than-usual checks suggest that the underlying momentum for Azure is constant, Wells Fargo said. The firm said that it expects shares to profit as more model clarity surfaces through FY25.

Related: The 10 best investing books, in line with our stock market pros

What's Your Reaction?