Microsoft's goal this week: Reassure Wall St.

The software giant's huge investments in artificial intelligence will be the hot topic when Microsoft's top brass talks up earnings.

The stress is on Mister Softee, in the varied case particularly often called Microsoft (MSFT) , when the tool great experiences earnings after Tuesday's market close.

The motive: Traders are opening to ask a question straightforward to any association spending countless numbers of countless numbers — or, extra probable, billions — on manufactured intelligence investments: When will we start to peer true returns from all that spending?

What seriously is quite not going to manifest is the AI investing goes on and doesn't demonstrate any gains.

Linked: Analyst revamps Amazon stock forecast formerly earnings

"Traders may perhaps be very centered on Microsoft's capability to continue to pace up earnings boom, slightly of the element concerning AI. If earnings acceleration doesn't materialize and should escalate in capex continue, traders must be would becould okay be disappointed," Gil Luria, senior tool analyst at D.A. Davidson, steered Reuters this week.

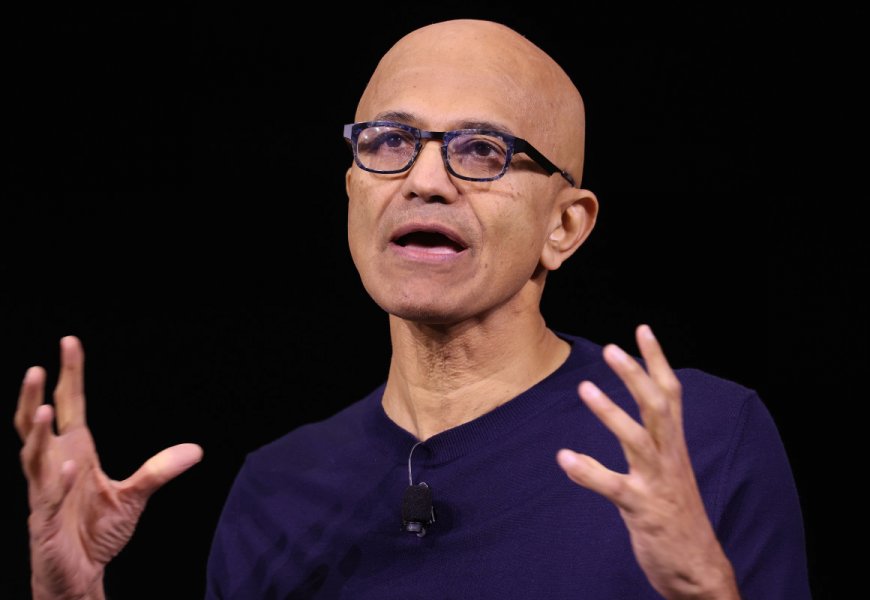

So, Microsoft and CEO Satya Nadella's objective after Tuesday's close is to demonstrate that there must be would becould okay be a "there" on its worthy wager on AI. The stock closed Monday at $426.seventy three, up 1.5% on the day and up thirteen.5% in 2024.

On the choice hand, the share value has fallen 8.9% from its peak of $468.35 on July 5. To be cheap, it became constantly not going that Microsoft shares would elevate out aside from they did in 2023, rising Fifty three.6%.

That it's feasible you will well constantly see an acknowledgment of that "there" on Tuesday. The association is estimated to tutorial materials fiscal-fourth quarter earnings of $Sixty four.2 billion, up about 14% from a yr at some level of the past but down from 17% internal the fiscal 0.33 quarter, which ended at the give up of March. Earnings, estimated at $2.Ninety a share, would be up about 8% from a yr at some level of the past.

AI is a rising piece of Microsoft's best market

The AI question will come up when earnings is urged for Microsoft's tremendous Cloud market. Microsoft's biggest market crew, the part comprises its cloud computing capabilities and varied applied sciences. And AI is vitally important to the way forward for the market.

Within the yr-at some level of the past quarter, Microsoft outlined its Cloud market grew 15% to $24 billion. Later, the association outlined 7% of that boom became accordingly of AI. In an particularly good vogue Microsoft outlined it spent $10.7 billion to booklet "demand in our cloud and AI offerings."

In the interval in-between, Microsoft has invested $thirteen billion in OpenAI, the startup which is achieved a impressive quantity of the early work on AI, and it reasonably is organized to make investments extra.

So, the question will fall on how a lot Microsoft's cloud market will elevate this yr and whether or not the percentage of that boom accordingly of AI is big than a yr at some level of the past. Bloomberg/Getty Shots

Many traders will seek earnings boom of glorious extra than 15% and a higher-than-a-yr-at some level of the past contribution from AI.

You constantly can keep in mind extra questions about these numbers when the association holds its analyst call at 2:30 p.m. PT (5:30 p.m. ET). Nadella and Chief Fiscal Officer Amy Hood may perhaps be on the option.

A shortfall may spook traders. The unease is accordingly of the market frenzy for all problems AI internal the first 0.5 of 2024 that accordingly spawned worries tech shares had been rising too darn swift.

By potential of June 18, Nvidia (NVDA) shares had been up as a lot as 174% on the yr- an serious amount of for many shareholders who determined to lock in gains. The shares have pondering that slipped 17.6%.

Better Tech Stocks:

- Analyst revisits Nvidia stock value objective after Blackwell tests

- Cathie Wood unloads shares of rebounding tech titan

- Big tech association paperwork Chapter 7 chapter, closes in an immediate

A omit can rate you

Alphabet (GOOGL) shares have fallen 6.7% pondering that its July 23 earnings liberate accordingly of AI spending trouble. (But some analysts and writers, together with Barrons' Bill Alpert, have outlined the selling became a worthy mistake.)

Microsoft remains a staggeringly precious association with a data superhighway earnings margin of 35%. As a matter of fact fairly a couple of its services, consisting of its Place of job items, are run as subscription offerings with high renewal expenditures. On the choice hand, its earnings of Dwelling windows tool to very own computer makers were unstable.

If there must be would becould okay be a hassle, Luria says it reasonably is slower boom in its very own computing market, which comprises Dwelling windows and the Xbox gaming division. The productiveness market — home to the Place of job suite of apps, LinkedIn, and 365 Copilot — is estimated to publish boom of about 10%.

It be a worthy week for tech earnings admired. Chip maker Develop Micro Items (AMD) also experiences Tuesday. Facebook-guardian Meta Systems (META) , chip-design Arm Holdings (ARM) , and chip maker QUALCOMM (QCOM) are up Wednesday, with Apple (AAPL) , Amazon.com (AMZN) and Intel (INTC) set for Thursday.

Linked: Veteran fund manager sees world of agony coming for stocks

What's Your Reaction?