Midday stock movers: Microsoft, Intel, Dell

Here are the stocks making the biggest market moves.

The stock market edged higher inside of the morning but gave up the gains by midday.

Finally check the S&P five hundred lost Zero.27% and the tech-heavy Nasdaq Composite edged Zero.08% lower. The Dow Jones Industrial Average lost Zero.33%. Alternatively, the Russell 2000 Index rose 1.25%.

August retail sales exceeded expectations, rising Zero.1% despite fears of an economic slowdown, better than the Zero.2% decline forecast. Bloomberg/Getty Images

S&P five hundred big stock movers this present day

5 S&P five hundred stocks making big midday moves are:

- Moderna (MRNA) +6.2%

- Enphase Energy (ENPH) +5.6%

- Intel (INTC) +5.four%

- Hewlett Packard Enterprise (HPE) +5.2%

- Synchrony Financial (SYF) +four.7%

The worst-performing 5 S&P five hundred stocks with the foremost important midday drop are:

- Accenture (ACN) -four.four%

- Philip Morris International (PM) -2.6%

- Epam Systems (EPAM) -2.5%

- Palo Alto Networks (PANW) -2.four%

- Walmart (WMT) -2.three%

Stocks also worth noting include:

- Microsoft (MSFT) +Zero.6%

- Dell (DELL) +Zero.7%

- Amazon (AMZN) +1.2%

- Nvidia (NVDA) -Zero.four%

- Apple (AAPL) -Zero.2%

Microsoft gains on buyback, dividend enlarge

Microsoft stock added Zero.6% after it announced plans to enlarge the quarterly dividend 10% to eighty three cents a share, up from Seventy 5 cents.

The emblem new dividend is payable Dec. 12 to holders of record Nov. 21. The annual meeting is ready for Dec. 10. The software and cloud-services giant also approved a fresh $60 billion share repurchase program.

The choice followed Microsoft's announcement in July to boost its investment in man made intelligence. Microsoft’s July earnings report missed analysts' estimates for cloud revenue. The segment makes up nearly all Microsoft's capital expenditures.

Related: Analyst revisits Microsoft stock price target after AI reporting change

Dell rises on analyst update

Dell stock added Zero.7% after Mizuho Securities initiated coverage of the stalwart provider of computer hardware and peripherals with an outperform rating and a $100 thirty five price target.

The investment firm said Dell became a market leader with a powerful supply chain and became gaining share in man made intelligence servers.

The analyst, Vijay Rakesh, says generative man made intelligence "is igniting growth and disruption" across greater than one markets, including AI servers, which comprise the infrastructure enabling the AI revolution, in step with thefly.com.

Related: Analysts revise Dell stock price target previous to earnings

The analyst also when put next Dell to Supermicro (SMCI), noting that Supermicro is experiencing share loss, margin pressure, negative free cash flow, and weak internal controls. The firm argues Dell is healthier positioned by reason of its broader portfolio and stronger balance sheet.

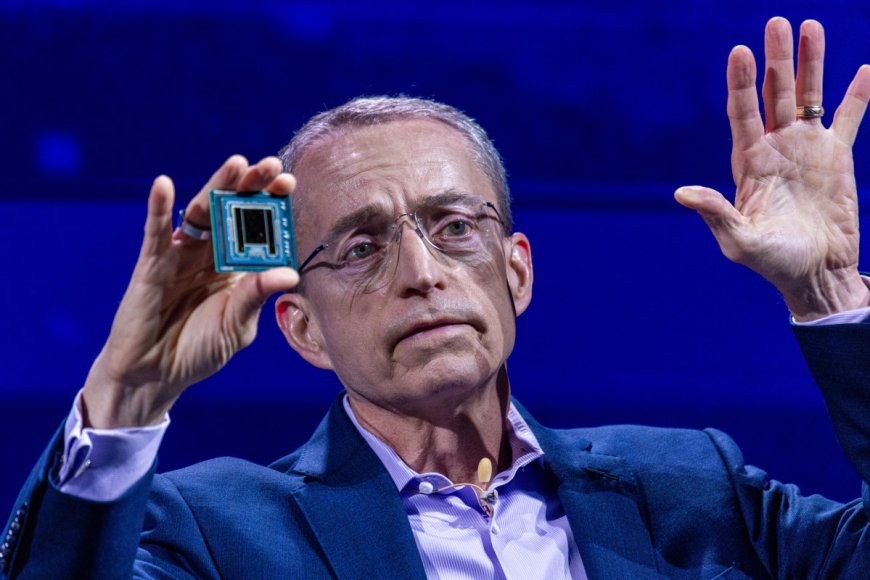

Intel rallies on foundry spinoff plan

Intel stock popped 5% after the chip maker announced plans to separate its foundry business into an self reliant unit with its own board and the flexibility to boost outside capital.

Intel is taking into account spinning off its foundry business, potentially right into a separate publicly traded entity, in step with a source who spoke to CNBC.

More Tech Stocks:

- Palantir stock leaps on big S&P five hundred boost for data analytics group

- Analyst revises Amazon stock price target on advertising estimates

- Analyst says Intel should drop a key business to continue to exist

“It provides our external foundry customers and suppliers with clearer separation and independence from the remainder of Intel,” CEO Pat Gelsinger said in a press release Monday in regards to the new subsidiary structure.

Industry observers had said that potential customers for Intel's services were nervous about turning over their intellectual property to a manufacturer that became also a rival, in step with MarketWatch columnist Therese Poletti.

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?