Nvidia CEO's bombshell raises the bar for the stock

Here’s what could be next for Nvidia stock.

Imagine how Nvidia’s GeForce 8800 chip, launched in 2006, changed the gaming landscape. Now, almost twenty years later, Nvidia is still making that progression, with its Blackwell designed to change the area of synthetic intelligence.

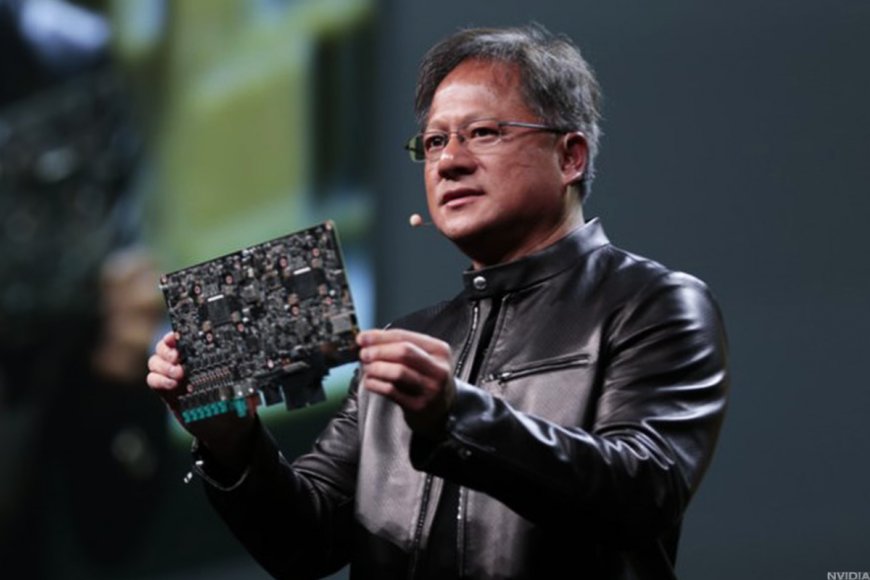

Demand is "insane," Nvidia’s chief executive Jensen Huang recently said. Major cloud providers like AWS, Azure, and Google Cloud are integrating Blackwell into their infrastructure to enhance high-performance AI workloads.

Related: Nvidia CEO Jensen Huang just told investors what’s next for the AI chipmaker

Oracle announced on October 2 that it is able to have 131,072 Nvidia Blackwell GPUs as a component of a $6.5 billion investment to establish a new public cloud region in Malaysia, yet one more proof of a powerful need for stepped forward AI processing capabilities.

Blackwell is a platform Nvidia launched in March that lets in organizations to run real-time generative AI on models with trillions of parameters. These large language models are trained on extensive datasets to take hold of and generate responses in human language.

“Blackwell is in full production,” Huang said in an interview with CNBC. “The demand for Blackwell is insane. Everybody desires to have the foremost, and every person desires to be first.”

Hyperscaler buyers like Amazon (AMZN) , Microsoft (MSFT) , and Alphabet (GOOGL) are expected to spend around $one hundred sixty billion in 2024 on AI infrastructure, based on Bernstein analysts. The value of Blackwell is predicted to range between $30,000 and $forty,000 per unit.

Huang emphasized the importance of constant updates to Nvidia’s AI infrastructure, with the corporate releasing new platforms every year. “If we are capable of make bigger the performance, like now we have got got done for Hopper and Blackwell ... we're effectively increasing the revenue or throughput for our customers on these infrastructures by a pair to thrice every year," Huang added.

Nvidia's financial performance exceeds expectations

Nvidia’s most modern earnings report further solidifies its strong position in the AI market.

On August 28, the corporate posted earnings per share of Sixty eight cents, beating Wall Boulevard expectations of sixty four cents. Revenue hit $30.04 billion, up 122%, surpassing the predicted $28.7 billion.

Nvidia forecasts $32.5 billion in revenue for the present quarter, an eighty% make bigger from last year.

Related: Veteran trader targets Nvidia as shares slide

Nvidia plans to ship Blackwell GPUs to clients in Q4 of this year, with a consumer free up expected in 2025. “Within the fourth quarter, we are waiting for to ship a few billion dollars in Blackwell revenue,” Nvidia Chief Financial Officer Colette Kress said all through the August earnings call.

Nvidia's stock has surged by over one hundred fifty% this year, following a super 240% gain in 2023. The company is now worth over $Three trillion, many of the foremost valuable companies on the earth just on the back of Apple and Microsoft.

Analyst sees "compelling" growth and valuation for Nvidia

JPMorgan remains confident in Nvidia’s outlook, maintaining an overweight rating and a $100 and fifty five price target, thefly.com reported.

"Nvidia remains on the suitable track to ship its next-generation Blackwell graphic processing unit platform in high volume production in Q4," the analyst tells investors in a research note on October 2, adding that investors do no longer should pay too a lot attention to the recent sell-side noise on rackscale portfolio changes.

Nvidia is halting development of its dual-rack Seventy two-way GB200-based NVL36×2, TF International Securities's analyst Ming-Chi Kuo said on Oct. 1.

Last month, Bank of The americaa. reiterated a buy rating and $165 price target on Nvidia, which the firm also calls its top sector %.

The firm warned of a few near-term headwinds, including Blackwell's delay and gross margin pressure, a potential DOJ probe, competition, AI monetization, cloud capex, weak seasonality, and the U.S. elections.

More AI Stocks:

- Apple stock slides as big iPhone Sixteen bet sputters

- Analyst revisits Meta stock price target as Facebook parent ramps AI spend

- Analyst reviews BlackRock stock rating after AI partnership with Microsoft

On the alternative hand, this may infrequently also create a buying opportunity. The stock is trading in the lowest quartile of valuation all through the past five years, the analyst said.

The firm highlights Nvidia's "compelling growth" and says upcoming supply chain updates in the subsequent few weeks will confirm Blackwell product shipments, which they see as the foremost factor for a recovery.

Related: The ten best investing books, based on our stock market pros

What's Your Reaction?