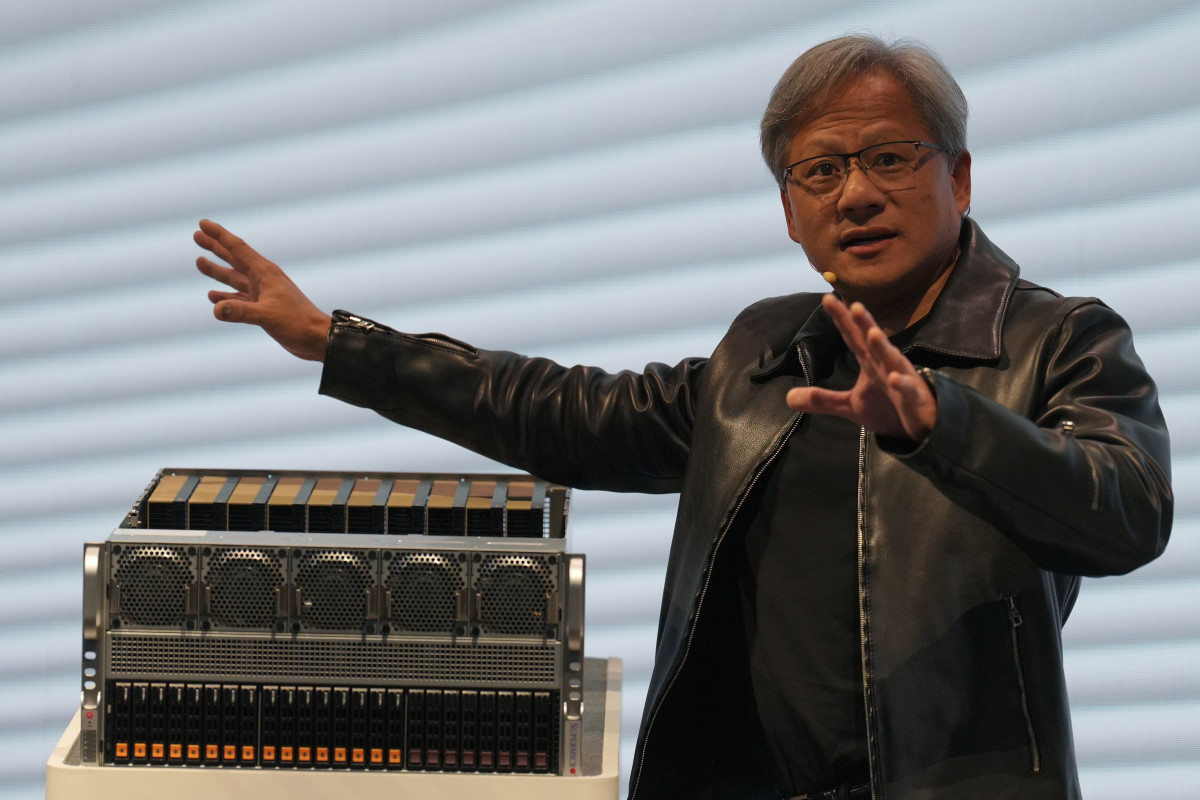

Nvidia's Jensen Huang delivers can't-miss quotes after earnings

Nvidia's CEO weighs in following the AI stock's fourth-quarter earnings update.

So, Jensen Huang, what do you have to say for yourself?

Arguably, the president and chief executive of Nvidia (NVDA) doesn't have to say much of anything, seeing as how the artificial intelligence semiconductor company blew Wall Street's socks off with a stunning fourth-quarter update.

Nvidia, now the world's third-largest stock with a market value exceeding $2 trillion, managed to top already elevated sales and earnings estimates with a report that left analysts' expectations in the dust.

The chipmaker has been described by Bank of America as the "picks and shovels leader in the AI gold rush," while Goldman Sachs has dubbed Nvidia's shares as "the most important stock on planet Earth."

The company's stunning surge on Feb. 22, which added more than $277 billion to the AI chip maker's market value — the single-largest market gain in U.S. history — helped power the S&P 500 to an all-time high of 5,087.03 points.

Nvidia earned an adjusted $5.16 a share, a nearly sixfold increase from the year-earlier period, as revenue more than tripled to $21.1 billion.

Looking ahead, the company sees revenue for the fiscal 2025 first quarter hitting $24 billion, up 9% from the fourth quarter and a gain of 233% from the year-earlier Q1.

CEO Huang cheers shift to 'accelerated computing'

"Many investors are in shock at how Nvidia has become a $700-plus stock, but Nvidia got to where it is because of extremely strong earnings and revenue," said James Demmert, chief investment officer at Main Street Research.

"There is nothing out of the ordinary with Nvidia's valuation or recent gains, as the company is delivering on its earnings," he said.

Related: Analysts revamp Nvidia price targets as stock tests $2 trillion

He added that when a company posts 265% year-over-year revenue growth, as Nvidia did, it deserves a premium valuation.

"Many investors have been wrongly underestimating the 'E,' or earnings, part of Nvidia's price-to-earnings ratio," Demmert said.

He noted that Nvidia reached roughly $330 a share in November 2021, before the bear market and when there was little demand for AI.

The stock has doubled since then and now demand for artificial intelligence is significant.

Huang, who co-founded the company in 1993, told investors that the next wave of investment into artificial intelligence will "open up a whole new world of applications not possible today" while creating a market valued in the "hundreds of billions of dollars" yearly.

He said the conditions for continued growth in 2024, 2025 and beyond are excellent.

"And let me tell you why," he said during the company's earnings call. "We’re at the beginning of two industrywide transitions, and both of them are industrywide. The first one is a transition from general to accelerated computing."

'A whole new type of data center'

Huang said general-purpose computing "is starting to run out of steam."

He said there’s no reason to update corporate and cloud networks with more CPUs — central processing units, a computer's primary component — "when you can’t fundamentally and dramatically enhance its throughput like you used to. And so you have to accelerate everything."

Huang believes Nvidia's graphic processing units or GPUs are the better solution. Coupled with specially designed software, they're more ideally suited to the hefty workloads associated with training and running AI applications.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Big tech stocks are doubling down on AI

"This is what Nvidia has been pioneering for some time," Huang said. "And with accelerated computing, you can dramatically improve your energy efficiency. You can dramatically improve your cost in data processing by 20 to 1. Huge numbers. And, of course, the speed."

The company's data-center division, which includes the company’s H100 graphics cards that are used to power generative AI apps such as OpenAI’s ChatGPT, reported sales of $18.4 billion, 409% year-over-year growth.

Huang described a whole new industry where, for the first time, a data center is not just about computing data, storing data, and serving the employees of a company.

"We now have a new type of data center that is about AI generation, an AI generation factory," Huang told analysts. "And you’ve heard me describe it as AI factories. But basically, it takes raw material, which is data, it transforms it with these AI supercomputers that Nvidia builds, and it turns them into incredibly valuable tokens."

These tokens, he said, "are what people experience on the amazing ChatGPT or Midjourney or search these days are augmented by that."

"Biology companies, healthcare companies, financial services companies, AI developers, large-language model developers, autonomous vehicle companies, robotics companies... All of these startups, large companies, healthcare, financial services, auto, and such are working on Nvidia's platform," said Huang. "We expect the demand will continue to be stronger than our supply provides and -- through the year and we'll do our best... right now, we are ramping H200s. There is no way we can reasonably keep up on demand."

"We believe these two trends [accelerated computing and generative AI] will drive a doubling of the world's data center infrastructure installed base in the next five years," he said.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?