Tesla’s Stock Just Did Something Important

The company’s shares accomplished something that investors watch very closely.

Tesla’s stock isn’t for the faint of heart. On any given day, shares can pop or drop based on something its mercurial CEO, Elon Musk, says or does.

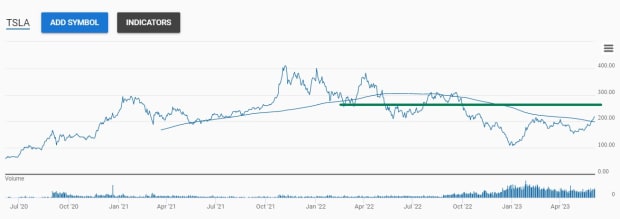

Most were willing to accept that trade-off when Tesla’s shares roared higher. However, disappointing returns last year have likely tested shareholders' resolve. Those who have held on to their shares took it on the chin in 2022, but Tesla's shares recently rallied and the gains have been strong enough for shares to do something they haven't done in eight months.

Tesla: A Boom-and-Bust Stock

Tesla’s stock was one of the biggest beneficiaries of the easy-money policies put in place during the covid pandemic. Between its low in March 2000 and its high in November 2021, Tesla’s stock gained an astounding 1,674%, creating legions of Elon Musk fans. Not everyone was convinced, though. The rally in Tesla’s shares drove its valuation to remarkable heights, causing many to question if the rally was a bubble destined to pop.

Those doubters were rewarded in 2022. After its meteoric rise, Tesla’s shares fell 75% from its peak to its January 2023 low. That tumble likely encouraged many who were betting against Elon Musk by shorting Tesla stock. However, it’s been anything but good news for short-sellers since then, given Tesla’s nearly doubled by mid-February.

More recently, Tesla’s stock has settled into a trading range between $152 and $218, chopping about in search of conviction.

Tesla Stock Recovers a Key Level

The sideways trading in Tesla’s shares suggests bulls and bears have been wrestling for control. Without a clear direction, many investors have likely stayed on the sidelines, waiting to see who comes out on top.

Last week, the stock may have taken a step toward declaring a winner, closing above its 200-day moving average (DMA) for the first time since September on heavy volume.

Daily trading volume has been above average since last Wednesday, suggesting some investors may be moving off the sidelines. It may also signal that those short Tesla’s shares are buying to cover positions to protect against additional losses. According to NASDAQ data, over 95 million shares were held short in Tesla in mid-May.

It’s likely not a coincidence that the increase in up-day volume has coincided with shares recapturing the 200-DMA.

Many consider the 200-DMA a key barometer of longer-term sentiment, using it as a line-in-the-sand for decision-making. They buy when share prices trade above it and sell when share prices trade below it.

Forget Tesla – We’re all-in on this EV stock

What’s Next for Tesla’s Shares?

It’s bullish that the company’s share price is above 200-DMA, but the stock isn’t entirely out of the woods. It’s still trading within the sideways range, so investors will want to watch if it closes above $218. If it does, higher price targets could be in play.

I can argue a few lines of resistance above, including a nice round target of about $250. In May, Real Money’s Bruce Kamich, who has been analyzing price charts for nearly 50 years, calculated a $245 price target for Tesla using daily point-and-figure charts. He said a close above $208 in April could put a long-term point-and-figure chart target of $443 in play.

Of course, we’ll unlikely see that long-term target anytime soon. Stocks don’t go up or down in a straight line, so a little digestion in the stock short-term wouldn't be surprising. If so, a test and hold of the 200-DMA could provide a catalyst toward the $240-$250 level, so that’s what I’d be looking for from here.

What's Your Reaction?