What are the IRS interest rates for late tax payments or refunds?

The IRS generally charges interest on unpaid taxes from tax deadline until the tax is paid in full. Learn more about this process.

Key takeaways

- The IRS expenditures present on unpaid taxes from the due date except the debt is completely paid. This present is compounded on day-to-day basis.

- For the first three quarters of 2024, the IRS present can fee on underpayments for persons is about at eight%. Prompted by the the actuality it truly is a comparatively excessive can fee, it’s extreme to right away pay any taxes or penalties you owe.

- If you happen to’re getting a tax refund, the IRS may owe you present in the event you don’t get your refund inside 45 days. In most instances, the present starts off accruing from the tax filing deadline.

- If you happen to owe present ensuing from an IRS error or lengthen, you're going as a way to file Sequence 843 to request a reduction of the present.

If you happen to don’t pay your federal income taxes, or pay them late, the IRS is going to can fee you present on the unpaid stability. And unlike the IRS penalties for unpaid or late taxes, present repayments most continually can’t be waived or lowered, even in the event you have got gotten got an good clarification for not paying (though there are a pair of exceptions).

Prompted by the the actuality present on late taxes is compounded on day-to-day basis, the entire present due can add up right away. Plus, present quotes are excessive with out lengthen, which is every of the further intent to pay any federal tax or IRS penalties you owe as right away as on the market.

If you do make a fee, the IRS on a conventional basis applies the associated fee to any taxes owed first. If there’s any money left over, it truly is going to then be utilized to any great penalties, after which eventually to any present you owe. (And, by manner of the manner, the IRS expenditures present on unpaid penalties, too.)

When do IRS present repayments commence and furnish up?

In most instances, the IRS starts off charging present as soon just because the due date for the late taxes has surpassed. And just because a tax extension on a conventional basis doesn’t lengthen the time to pay any income taxes owed (it best extends the time for filing your return), you’ll nonetheless owe present on any unpaid tax opening appropriate after the factual tax filing deadline (on a conventional basis April 15) even in the event you request an extension.

Interest continues to accrue except your stability is paid in full.

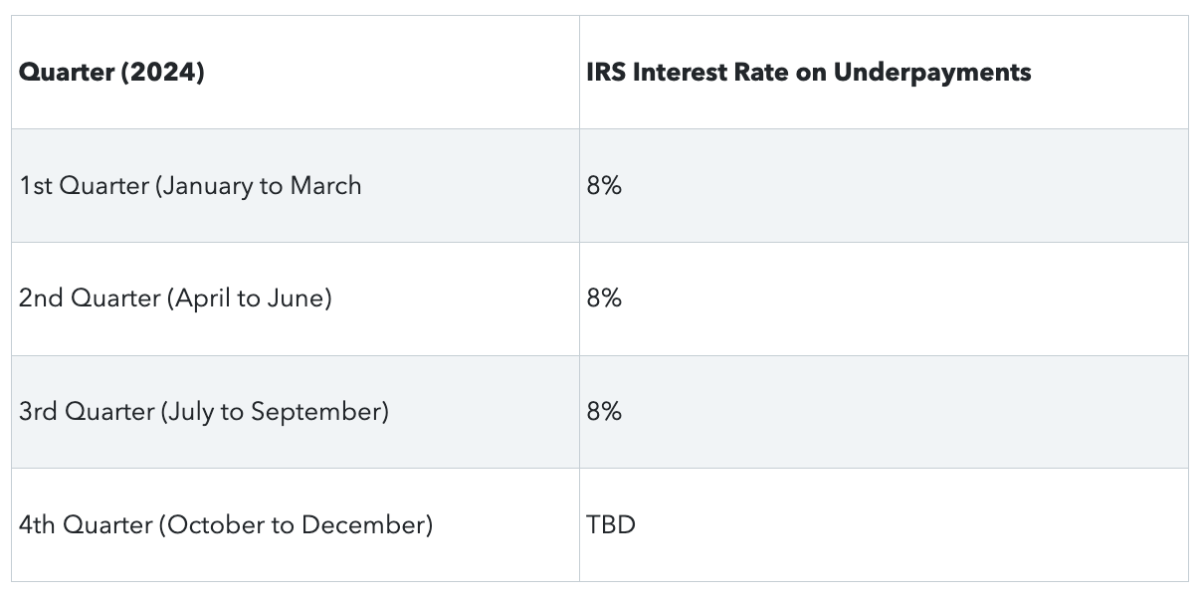

What are the IRS present quotes for 2024?

The IRS sets present quotes on the underpayment of taxes every quarter. The underpayment can fee is equal to the federal rapid-term can fee for the first month of the previous quarter (rounded to the nearest full %), plus three share components.

For the first three quarters of 2024, the present can fee paid by manner of persons on unpaid taxes is eight%.

Add two further share components for organisations with unpaid taxes over $100,000.

Does the IRS pay present, too?

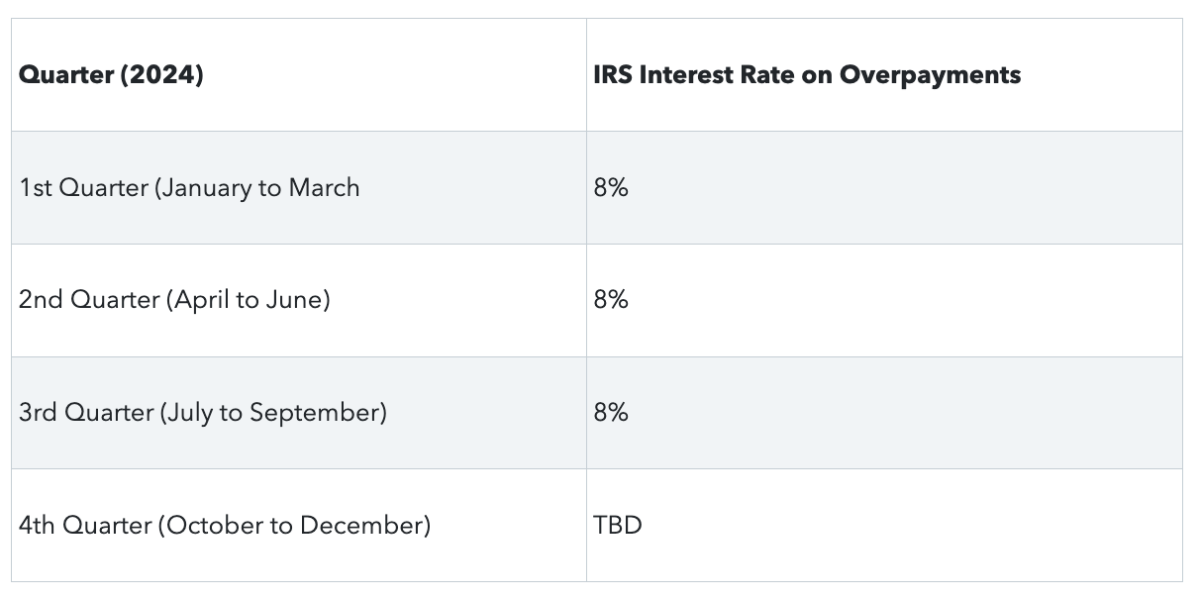

What if the IRS owes you money? Does the IRS pay present except it is going to pay you? In verifiable actuality, yes – the IRS will most continually pay you present in the event you’re due a tax refund from the overpayment of taxes.

The IRS has 45 days to pay a tax refund prior to present repayments to you kick in. Alternatively, if the IRS doesn’t pay up inside 45 days, it most continually starts off calculating present to your overpayment from a couple of of the subsequent dates (whichever one is the updated):

TurboTax Tip: Any present fee from the IRS is taxable income for the 12 months you obtain it. If the IRS will pay you present of as a minimal $10, it truly is going to send you a Sequence 1099-INT reporting the present in January of the subsequent 12 months.

- Cut-off date for filing your tax return,

- Date the IRS receives your late-filed tax return,

- When the IRS receives your return in a format it truly is going to formulation, or

- Date the overpayment change into made.

The IRS stops paying present when it refunds your money (plus present already due) or applies the overpayment to dissimilar taxes you owe.

If the IRS owes you money, the updated-day present can fee for overpayments is eight%.

The overpayment can fee for agency refunds is 7% for the first three quarters of 2024.

Facts superhighway present can fee of zero. If you happen to owe the IRS present for unpaid taxes for the equal time size the IRS owes you present for an overpayment of taxes, the present repayments may stability every dissimilar out by manner of asking for a know-how superhighway present can fee of zero%. It's attainable you may request a 0% know-how superhighway present can fee by manner of filing Sequence 843 and presenting wisdom showing you’re entitled to coach on the overpayment.

Can present you owe the IRS be lowered?

When rare, the amount of present you owe the IRS would even be lowered in constructive instances. As an celebration, it ought to be lowered or eliminated in the event you owe present ensuing from an IRS error or lengthen. If you happen to qualify, file Sequence 843 to request a reduction of present. Alternatively, in the event you contributed to the error or lengthen in a gigantic manner, the present you owe won’t be reduced.

If the IRS by threat sends you money back, any present charged on the compensation of the refund will be worn out if the incorrect refund is $50,000 or less and also you didn’t induce the refund in anyway. For incorrect refunds elevated than $50,000, no subject even if or not or not present is eliminated will be determined on a case-by manner of-case basis.

The IRS also will scale back or put off present on penalties if the underlying penalties are lowered or worn out.

And, of path, useful procedure to cut the present you owe is to pay any taxes owed as right away as on the market. So you may supply up the accumulation of present repayments with out lengthen. If it’s later determined which you didn’t owe the unpaid tax, the present you paid on that stability will be refunded.

IRS present quotes for previous years

It's attainable you may should know the IRS present quotes for previous years in the event you have got gotten got an underpayment or overpayment of tax from that 12 months. Extraordinary listed lower than are the present quotes for persons from 2019 to 2023 (quotes for underpayments and overpayments are the equal).

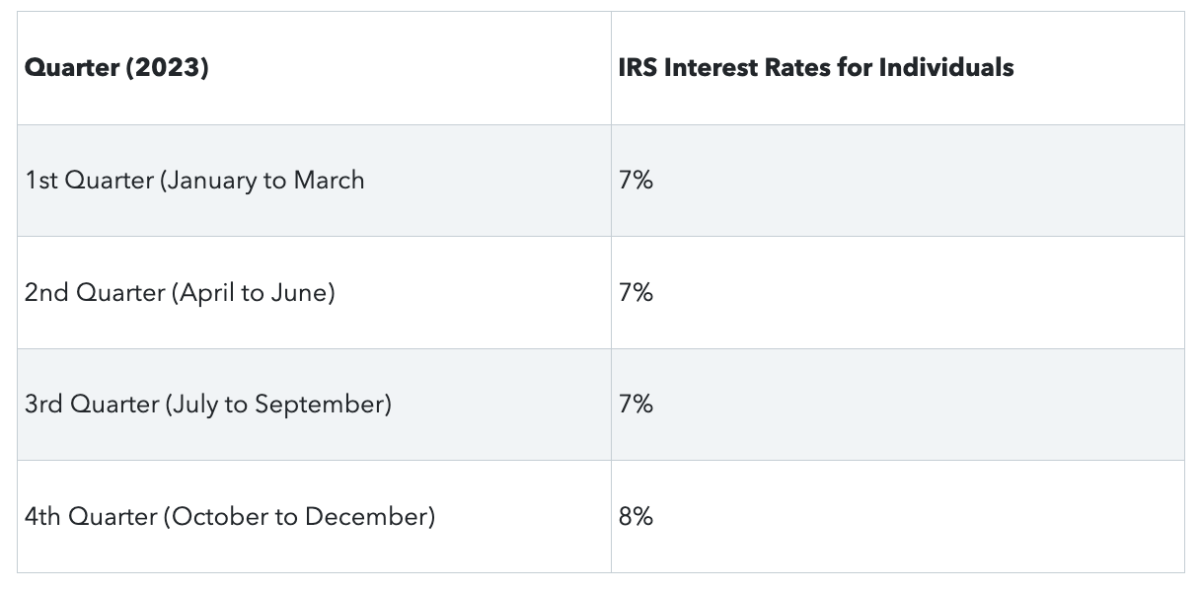

IRS present quotes for 2023

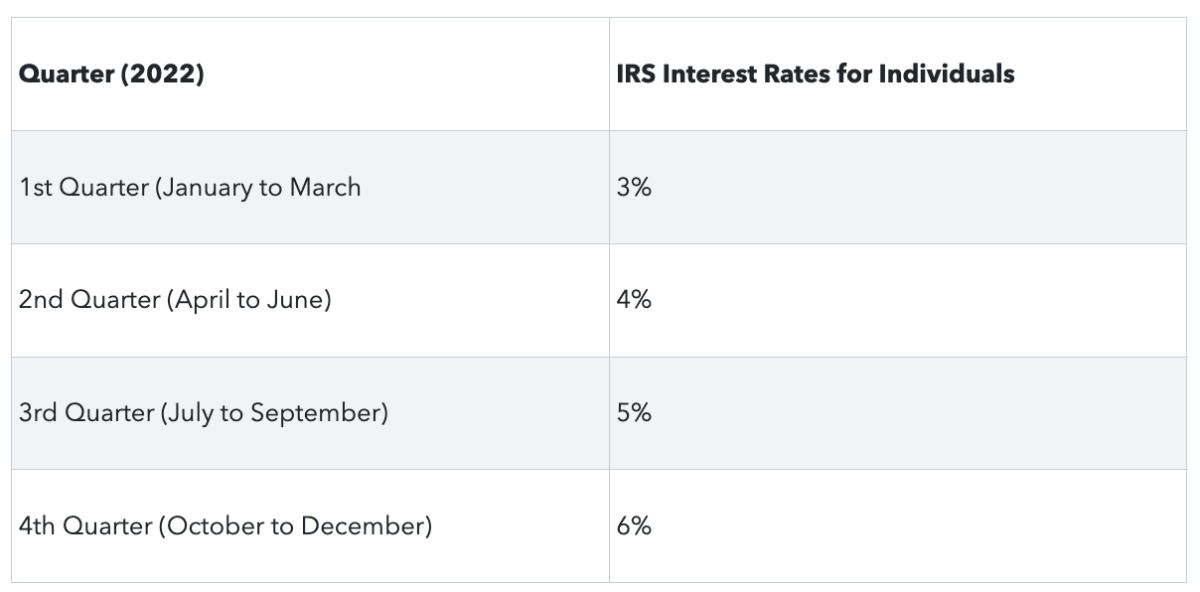

IRS present quotes for 2022

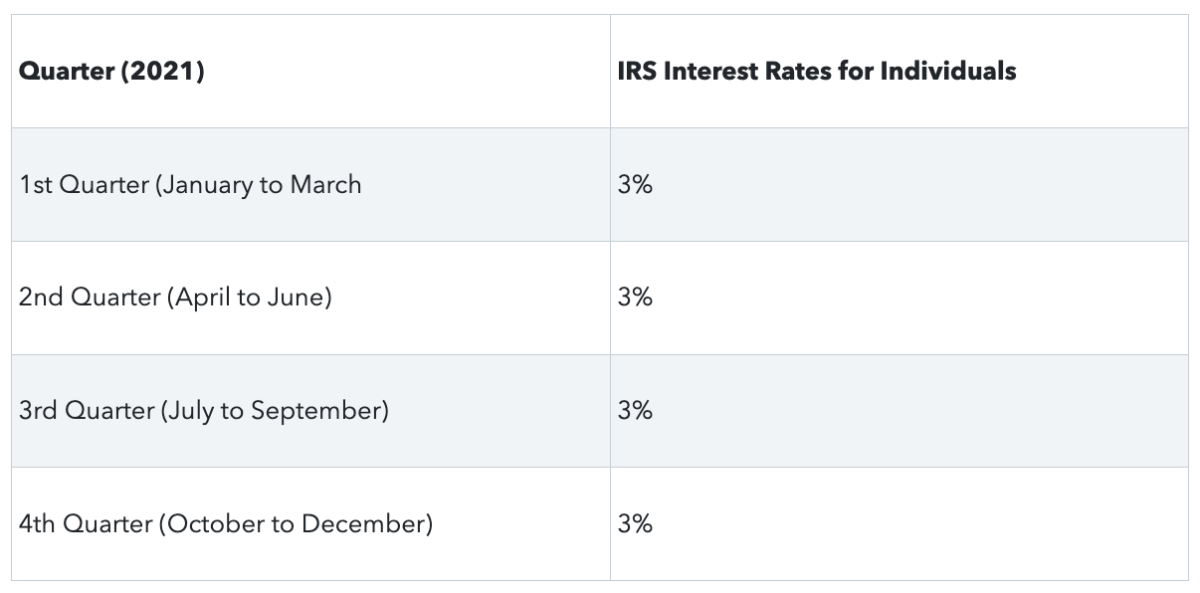

IRS present quotes for 2021

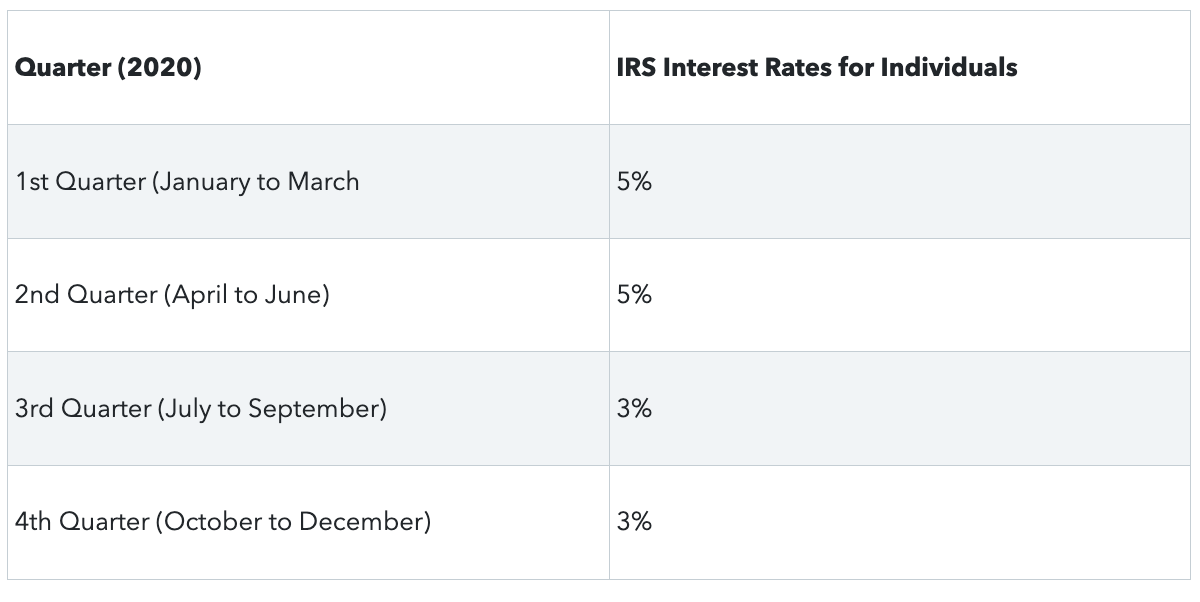

IRS present quotes for 2020

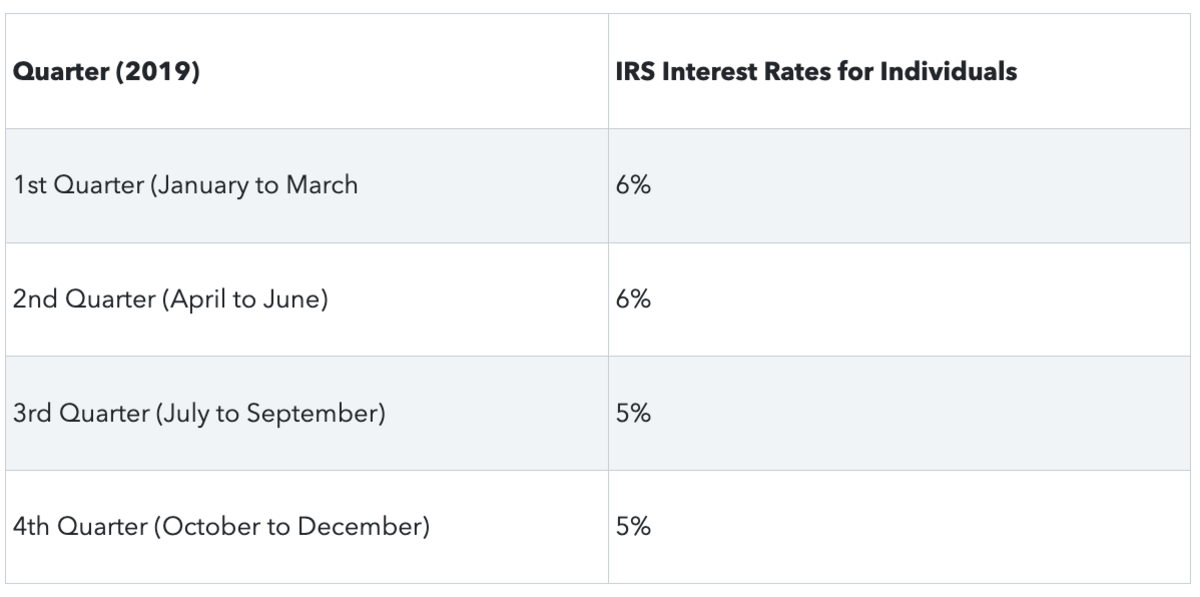

IRS present quotes for 2019

With TurboTax Are living Full Carrier, a regional expert matched to your one-of-a-model scenario will do your taxes for you commence to end. Or, get limitless improve and counsel from tax experts when as you do your taxes with TurboTax Are living Assisted.

And so that they'll file your very personal taxes, you're going as a way to nonetheless travel guaranteed you're going as a way to do them appropriate with TurboTax as we wisdom you step by manner of step. Regardless of which manner you file, we assurance 100% accuracy and your maximum refund.

What's Your Reaction?