What Is the Economic Cycle? Stages & Importance

What Is the Economic Cycle? Why Is It Important?Just like nature changes throughout the seasons, an economy experiences times of growth and contraction. These intervals are known as the economic cycle, or business cycle. Trends or changes in the cycle can be determined by analyzing economic ...

alengo from Getty Images Signature; Canva

What Is the Economic Cycle? Why Is It Important?

Just like nature changes throughout the seasons, an economy experiences times of growth and contraction. These intervals are known as the economic cycle, or business cycle. Trends or changes in the cycle can be determined by analyzing economic indicators, such as gross domestic product (GDP), employment figures, housing starts, and consumer spending.

Understanding what stage an economy is experiencing can spell opportunity for investors, particularly momentum investors who often spot trends as they change and build profits as a result. Canva

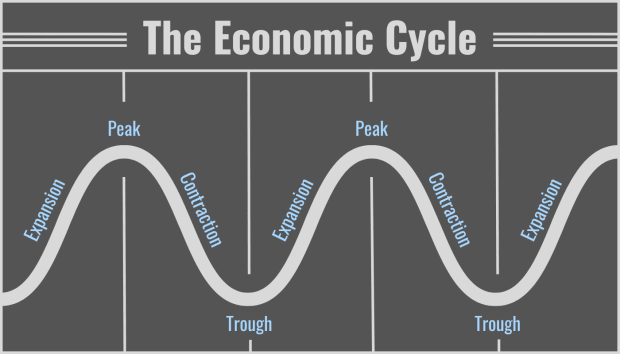

What Are the Four Stages of the Economic Cycle?

In general, economists tend to divide the economic cycle into four basic stages—expansion, peak, contraction, and trough.

1. Expansion

When an economy experiences a time of expansion, there is growth and prosperity. A central bank, such as the Federal Reserve, has loosened monetary policy, which typically means that interest rates are low or on the decline.

During an expansionary phase in the cycle, it’s easier for consumers and businesses to obtain loans. Production increases, and GDP grows. Consumers feel positive and are more willing to spend on big-ticket purchases like houses and cars. People wish this time could last forever.

2. Peak

An economy reaches its peak, or the height of the economic cycle, when growth hits its maximum point. The economic indicators that had been signaling expansion may now plateau. This period is also generally characterized by higher levels of inflation, which must be addressed. The peak signifies a high point as well as the beginning of a shift, or change, in an economic trend, because what goes up must come down.

3. Contraction

After the peak, a decline follows. When an economy is in the contraction stage of the economic cycle, growth slows. A period of contraction in economic activity, if severe enough, is also known as a recession.

Economist Julius Shiskin popularized the definition of recession as two consecutive quarters of negative GDP growth, but that’s not the only factor economists use. In fact, the National Bureau of Economic Research (NBER), which is considered the leading authority on U.S. business cycles, has a more nuanced definition. According to the NBER, recessions are "a recurring period of decline in total output, income, employment, and trade, usually lasting from six months to a year, and marked by widespread contractions in many sectors of the economy."

4. Trough

When an economy hits a trough (the opposite of a peak), it has reached its lowest point before beginning to rise again. Between trough and peak, the economy will enter expansion mode, and thus the cycle will repeat.

How Are Economic Cycles Measured?

Economists look at both leading and lagging indicators to help determine where an economy is in its business cycle. Growing GDP numbers often point to expansion, while rising unemployment figures, high inflation, or lower levels of consumer confidence could point to contractions.

The NBER measures the length of economic cycles from trough to trough or peak to peak. It also looks at the quarterly average of monthly economic indicators, and has stated it watches payroll employment statistics particularly closely.

The Federal Reserve often acts like the “wild card” because its actions can amplify the effects of a specific phase of the economic cycle. For instance, the Fed has often stated that its favorite inflation indicator is the Personal Consumption Expenditures Index (PCE), as rising prices spell a contraction in the economy. When the PCE is on the rise, the Fed tends to combat inflationary forces by raising interest rates, which makes it more difficult for consumers and businesses to obtain loans because the cost of borrowing is higher. This adds even more of a damper to consumer confidence levels and thus steers the economy even further into its contraction.

How Long Is an Economic Cycle?

There is no set timeframe for the different stages of an economic cycle, although it’s interesting to note that the NBER itself classifies the expansionary period as the “normal” period for an economy. Recessions typically last between 12 and 14 months—nowhere near as long as expansions.

In the stock market, since 1928, there have been just as many bull markets (eras of rising stock prices) as bear markets (characterized by a decline of 20% or more in the S&P 500); however, bull markets also tend to last much, much longer. In fact, the longest bull market in stock market history lasted more than 10 years, from March 2009 to March 2020.

What Stage of the Economic Cycle Are We In?

Nearly everyone agrees the U.S. economy has been in a state of contraction in 2022 and 2023—and many make the case that we’re in a recession. There were two consecutive quarters of declining GDP in the first half of 2022. Businesses posted quarterly losses, several big companies announced layoffs, and the housing market stalled. The Fed has raised interest rates seven times, and the stock markets are solidly in bear market territory.

All that’s left is an official pronouncement from the NBER.

What's Your Reaction?