Analyst revamps Amazon stock target after billion-dollar deal unravels

Amazon looking strong ahead of earnings report.

Monday turned out to be quite a busy day for Amazon (AMZN) - Get Free Report.

On Jan. 29, the retail giant announced that it would terminate its pending acquisition of iRobot (IRBT) - Get Free Report, the smart vacuum manufacturer. On Aug. 4, 2022, Amazon said it would pay $61 a share, or $1.7 billion, for the company.

The decision to scuttle the acquisition was described as mutual, with both Amazon and iRobot expressing disappointment about it in separate statements. Previously, it was reported that the European Union intended to block the deal on competition grounds.

“Undue and disproportionate regulatory hurdles discourage entrepreneurs, who should be able to see acquisition as one path to success, and that hurts both consumers and competition—the very things that regulators say they’re trying to protect,” David Zapolsky, Amazon SVP, and General Counsel said in a statement.

Now that the deal is off, here's what could happen to Amazon's shares next.

Amazon Prime ads kick-off

The end of the deal was a major blow for iRobot, which has announced job cuts, according to the BBC.

Related: Analysts unveil new AMD stock price targets ahead of Q4 earnings

The company has seen sales decline, and it said it would immediately embark on a restructuring, which will see 350 jobs axed or 31% of its staff.

Shares of the Bedford, MA-based company tumbled on the news.

January 29 was also the day that advertisements were slated to become part of the Amazon Prime Video experience.

Amazon said in an email that the advertisements would “allow us to continue investing in compelling content and keep increasing that investment over a long period of time.”

It also indicated that there would be no change to the price of Prime membership, but for an extra $2.99 a month, customers can sign up for an ad-free subscription.

Many customers complained about the plan, but according to Variety, Morgan Stanley forecasts Prime Video ads will generate $3.3 billion in revenue worldwide in 2024, growing to $5.2 billion in 2025 and $7.1 billion in 2026.

Analyst at MoffettNathanson pegged revenue from Prime Video ads at $1.3 billion in 2024, rising to $2.3 billion next year. The firm also said that Amazon can pull in an incremental $500 million annually in 2024 and 2025 from Prime members who want to avoid seeing ads.

The move from Amazon comes after it pushed a price hike for its Prime subscription service in May this year. The price increased from $6.99 a month to $9.99 monthly because the company claimed to have expanded Prime member benefits.

The revenue from adding ads to Prime more than offsets revenue lost because regulators pulled the plug on its iRobot deal. In 2023, iRobot sales were just $891 million.

Analysts positive on fourth-quarter results

And Jan. 29 was also the day that analysts at Seaport Research raised the firm's price target on Amazon.com to $175 from $150 while keeping a buy rating on the shares.

The firm rolled the price target forward to 2025 estimates.

More From Wall Street Analysts:

- Analyst who correctly predicted crude oil’s rally has a new forecast

- Veteran fund money manager touts 'sleep-well-at-night' stocks

- Top analyst unveils new Tesla stock price target ahead of earnings

Amazon is scheduled to report fourth-quarter earnings on Feb. 1. Analysts surveyed by FactSet expect the company to report earnings of 80 cents a share on sales of $166 billion.

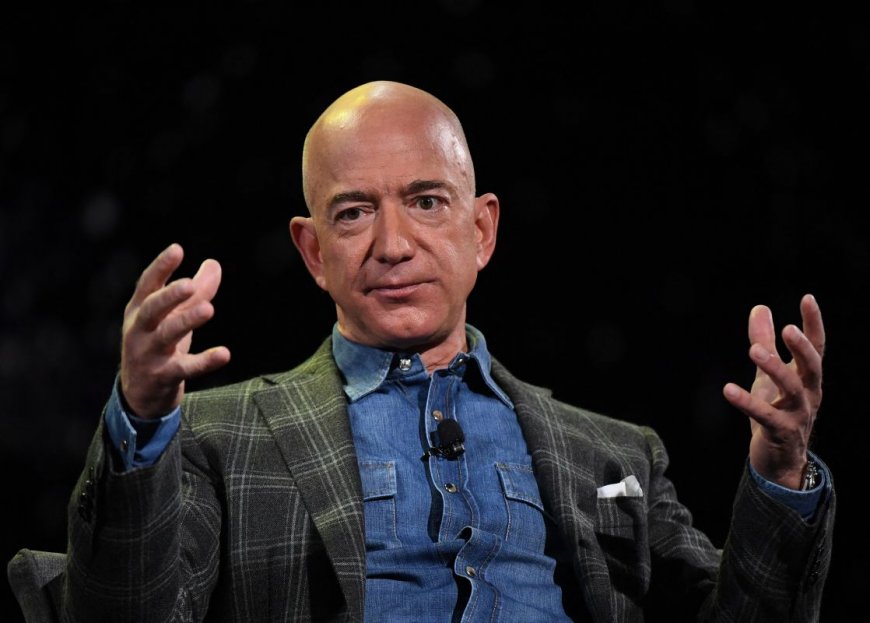

A year ago, the company, which was founded in 1994 by Jeff Bezos, posted fourth-quarter earnings of 3 cents a share on revenue of $149 billion.

Seaport remains positive on the shares ahead of the fourth-quarter results, given expectations for accelerating growth of Amazon Web Services, the company's cloud computing platform, into 2024, continued advertising momentum, and expectation for continued operating margin strength.

The AWS segment includes sales of compute power, storage, database, and other services for startups, enterprises, government, and schools. Many of them turn to AWS to train and run their AI projects.

Seaport also said the launch of Prime Video ads should continue to drive strong results.

The price hike comes days after Telsey Advisory raised the firm's Amazon price target to $185 from $165 while keeping an outperform rating on sales. It raised its fourth quarter and 2024 estimates in anticipation of a "solid" 2023 holiday season.

This optimism is because of a good early start related to the Prime event in October, gains from faster fulfillment, a stabilization of AWS, and a greater focus on profits, the analyst Joseph Feldman said in a note to investors.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?