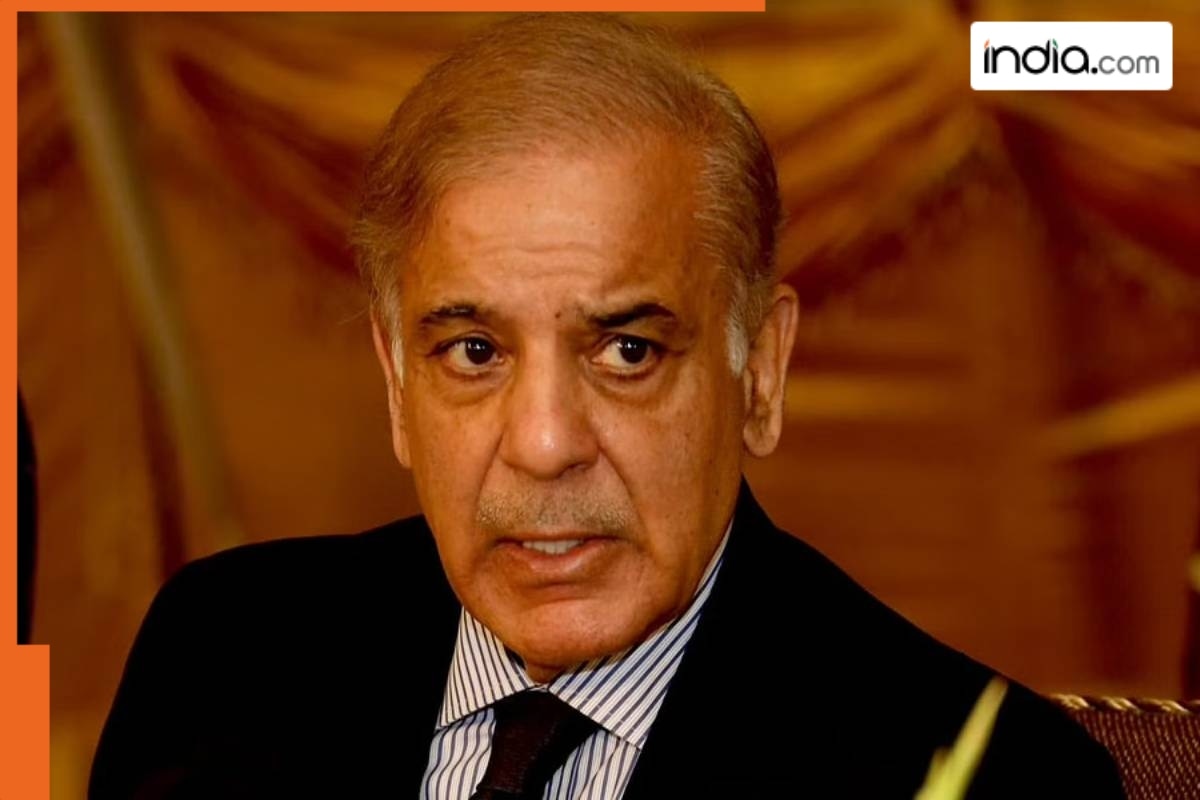

Bad news for Shehbaz Sharif as Pakistan nears bankruptcy, will soon face Rs 650000000000 ‘bomb’ due to….

The bankrupt Pakistan is required to repay USD 23 billion this year. To meet this obligation, USD 12 billion will be received as temporary deposit amounts from four of its friendly countries.

New Delhi: Bankrupt Pakistan is at possibility of glimpse extra monetary crunch within the fresh monetary three hundred and sixty five days. Based on the reports, if Pakistan fails to repay a debt of Rs 6.50 lakh crore (approximately USD 23 billion) all over this duration, a default is doubtless. Citing Pakistan’s Financial Witness 2024–25, The Details reported that the authorities is required to repay USD 23 billion in debt all over 2025–26. Failure to lift out so may push the country to the brink of default.

The country’s total public debt stood at Rs 76.01 trillion by the discontinue of March 2025. This involves Rs 51.52 trillion in home borrowing (approximately USD 180 billion) and Rs 24.49 trillion (round USD 87.4 billion) in external loans.

The external debt is divided into two substances: funds borrowed straight by the authorities and loans bought from the IMF. This debt has accumulated over years attributable to economic mismanagement, non eternal funding alternate choices, and repeated bailouts.

Nonetheless, the compensation requires for this three hundred and sixty five days comprise uncovered how small room the authorities has left to maneuver.

USD 12 Billion in Transient Deposits

The bankrupt Pakistan is required to repay USD 23 billion this three hundred and sixty five days. To meet this responsibility, USD 12 billion shall be bought as non eternal deposit amounts from four of its friendly countries. These consist of USD 5 billion from Saudi Arabia, USD 4 billion from China, USD 2 billion from the United Arab Emirates, and USD 1 billion from Qatar.

Listed below are one of the main significant small print:

- Pakistan is required to repay USD 23 billion this three hundred and sixty five days.

- USD 12 billion shall be bought as non eternal deposit amounts from China, UAE, Saudi Arabia and Qatar.

- USD 5 billion from Saudi Arabia, USD 4 billion from China, USD 2 billion from the United Arab Emirates, and USD 1 billion from Qatar.

- If any of these countries pick to withdraw their toughen, Pakistan will decide to repay your total amount inner this three hundred and sixty five days.

- The Details has warned that if these friendly international locations refuse to elongate the rollover of their deposits, the predicament may deteriorate further.

- This would assemble compensation unavoidable for the authorities, pushing it to depend extra on diplomatic goodwill than on monetary energy. And there are indicators that even that goodwill is weakening.

USD 11 Billion in Funds Still Pending

The Shehbaz Sharif authorities unruffled has to pay round USD 11 billion to external collectors this three hundred and sixty five days even supposing all its non eternal deposits are rolled over. This involves USD 1.7 billion in international bonds, USD 2.3 billion in industrial loans, USD 2.8 billion to institutions recognize the World Bank, Asian Building Bank, Islamic Building Bank, and Asian Infrastructure Investment Bank, and $1.8 billion in bilateral loans.

This monetary burden comes at a time when Pakistan’s international change reserves are already below rigidity. The country has exiguous sources of new earnings and is unruffled looking ahead to a brand new extended programme from the IMF.

What's Your Reaction?