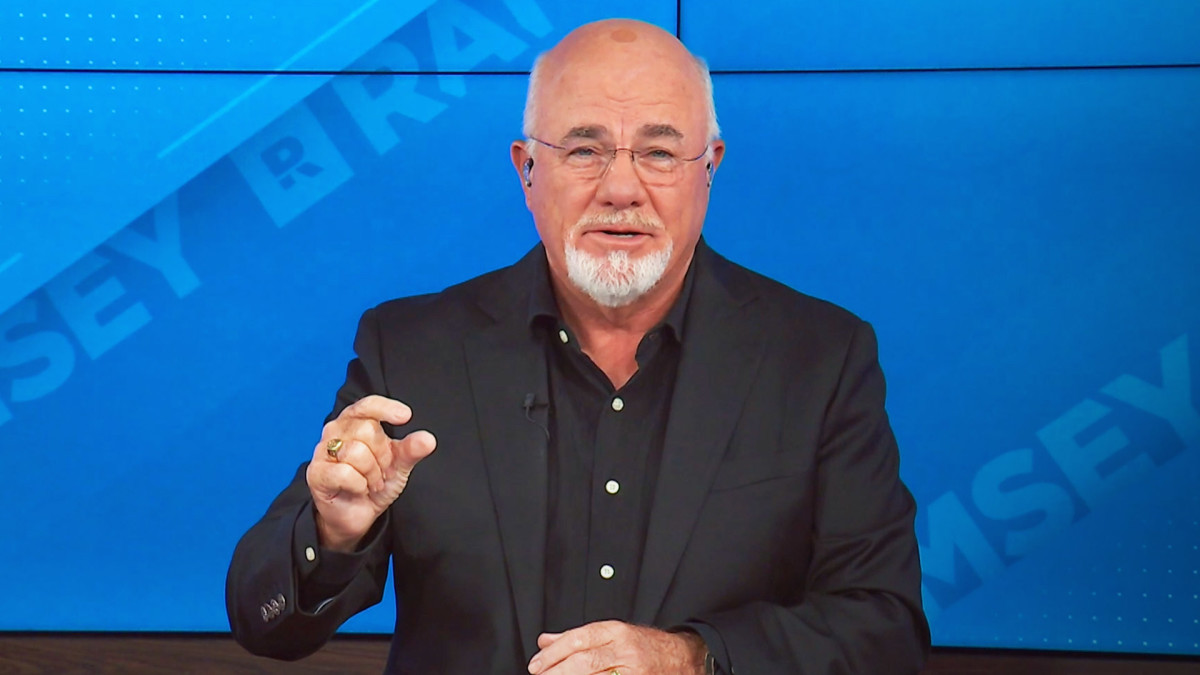

Dave Ramsey, AARP sound alarm on Social Security

Many Americans planning for retirement worry about Social Security and whether the amount of money they expect to receive as monthly income will be available when their working careers are over. Personal finance bestselling author and radio host Dave Ramsey — and AARP, the nonprofit advocacy ...

Many Americans planning for retirement worry about Social Security and whether the amount of money they expect to receive as monthly income will be available when their working careers are over.

Personal finance bestselling author and radio host Dave Ramsey — and AARP, the nonprofit advocacy organization for older Americans — offer important words about the federal program.

Ramsey points out that the primary Social Security reserve (the Old-Age and Survivors Insurance Trust Fund) is expected to run out of money by the end of 2032.

Without intervention from Congress, this would mean that starting that year, the program would be unable to provide full retirement benefits. At that point, the revenue from payroll taxes would only be sufficient to pay between 76% and 81% of promised benefits, leading to a reduction of approximately 19% to 24% in payments to beneficiaries.

This projected insolvency date has been accelerated slightly, influenced by rising benefit expenditures linked to recent policy changes and evolving demographic trends.

Related: Jean Chatzky makes critical statement on 401(k)s, retirement

Ramsey warns Americans about the financial danger of counting too much on the Social Security program for retirement income.

"If you end up getting retirement benefits when you decide to retire, that’s great," he wrote. "Any money you get from Social Security should be considered icing on the cake. But making Social Security the main ingredient of your retirement plan? That’s a recipe for disaster."

Savings and investments in the form of employer-sponsored 401(k) plans and Roth IRAs are key ways to build wealth for retirement, Ramsey emphasizes.

AARP bluntly explains Social Security benefits, limitations

People planning for Social Security income during their retirement years should note several important details, the AARP explains.

Social Security: Monthly income for millions

Every month, Social Security provides retirement benefits to millions of Americans, helping replace part of the income they earned during their working years. Social Security is designed to cover about 40% of one's pre-retirement income. Financial experts recommend replacing 70 to 80% to maintain a person's lifestyle.

A cornerstone of security

The Social Security Administration calls it “one of the most successful anti-poverty programs in our nation’s history,” offering vital support to older adults nationwide.

Most retirees supplement Social Security

Only 23% of retirees rely solely on Social Security. Others draw income from pensions, savings, investments such as 401(k) plans and IRAs, real estate, part-time work or spousal earnings.

Calculating Social Security benefits

Monthly benefits depend on one's full retirement age — 67 for those born in 1960 or later. Filing earlier reduces payouts.

A tool to estimate Social Security monthly paychecks

AARP offers a simple calculator to estimate benefits at ages 62, 67, and 70. A person will need to share their birth date, last year’s salary, and their spouse’s information if married.

Earnings history matters

Social Security uses a person's highest 35 years of earnings, adjusted for inflation, to calculate their benefit. Fewer years can lower the payout.

Average benefit amounts

As of mid-2025, the average monthly retirement benefit was over $2,000—adding up to more than $24,000 annually for many retirees.

Timing is key

Claiming at 62 cuts your benefit by 30%. Waiting until 70 boosts it by 8% per year, maximizing monthly checks.

More than retirement

Social Security also supports survivors, dependents, disabled workers, and low-income seniors. Programs such as Social Security Disability Insurance (SSDI) expand its reach beyond retirees.

Ramsey suggests considering taking Social Security early

One of the biggest questions people face when they hit Social Security eligibility is whether to start collecting benefits early or hold off until full retirement age — or even later — for a bigger monthly check, Ramsey explains.

It’s a major financial fork in the road, and once a path is chosen, a person is locked in.

Ramsey often leans toward claiming benefits sooner rather than later, reasoning that Social Security payments stop when a person passes away. So if one is healthy and eligible, it might make sense to start drawing those payments and enjoy the money while they are still able to use it.

More on personal finance:

- Dave Ramsey warns Americans on critical Medicare mistake to avoid

- Finance author sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

If a person is fortunate enough not to depend on Social Security to cover their basic expenses, Ramsey strongly encourages putting that money to work.

Instead of letting it sit, people should consider investing those monthly checks to grow their retirement savings. In his view, one is far more likely to get a solid return managing one's investments than relying on the government.

"Taking your benefits early means you’ll receive payments for a longer period of time during retirement," Ramsey wrote. "And depending on how long you live, you could end up receiving less money over the course of your retirement from Social Security the longer you wait."

Related: Zillow sounds alarm on worrying housing market, mortgage concern

What's Your Reaction?