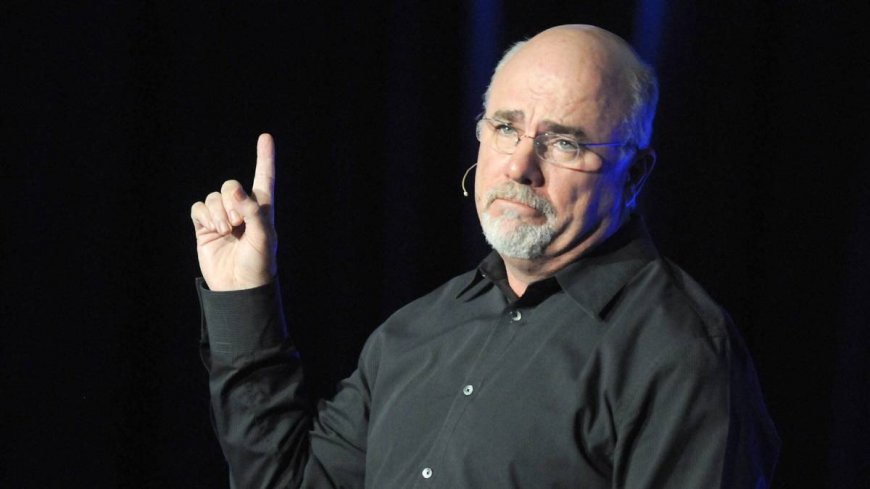

Dave Ramsey explains one money mistake that hurts your retirement

A common habit makes building wealth difficult.

Human beings planning and saving for retirement encounter an awful lot of the manner to manner the mission.

But deepest finance writer and radio host Dave Ramsey has a warning a pair of substantial mistake many make.

Imperative: Dave Ramsey has blunt phrases on auto repayments and retirement financial reductions

A kind of the systems human beings should use even as building their retirement financial reductions is to maximize the amount of cash they put into 401(okay)s and IRAs. Many cases, persons have the danger to take reap of commercial enterprise enterprise fits that make these investments even larger horny.

Ramsey capability that having a written funds can toughen human beings allocate their earnings and apply their plans. Also necessary is to dwell on a lot less money than you are making, as building wealth consists of avoiding overspending.

Ramsey also emphasizes the should build an emergency fund equal to some of to 6 months of living expenditures.

But many human beings remember credit ranking playing playing cards quite much as good resources for managing sudden expenditures.

Now not so, Ramsey says. Definitely, credit ranking playing playing cards are exactly involving the one big mistake he urges human beings to steer clear of.

Dave Ramsey says debt keeps human beings from building wealth

Having some debt, comparable to credit ranking card debt, has emerge as normalized. But Ramsey says that the verifiable reality it appears frequent is inappropriate — it motives troubles.

Ramsey outlined completely diverse excuses human beings make for going into debt, calling them lies that strive to justify toxic financial habits.

Better on Dave Ramsey

- Ramsey explains one substantial key to early retirement

- Dave Ramsey discusses one big money mistake to steer clear of

- Ramsey shares necessary suggestion on mortgages

One is that human beings tell themselves it must be substantial to have a quite best credit ranking ranking. Ramsey disputes that perception, encouraging an manner that consists of saving money and paying money, even for great purchases comparable to deciding to buy a auto.

But one completely diverse is that many human beings receive as true with they still have completely diverse time to plan for his or her financial futures. And they use this perception to justify accumulating debt.

The Ramsey Notice host warns that it definitely just seriously is not to be had for human beings to place money into their financial security even as they're buying his or her past. He suggests a debt-reduction procedure the place human beings pay off their debt inner the order of their smallest steadiness to their biggest steadiness.

But one completely diverse lie human beings tell themselves, he wrote on Ramsey Therapies, is that they do now not have a excessive adequate earnings to dwell with out debt.

To counter that argument, he says there are completely diverse methods to get a element hustle recently, comparable to driving for Uber or Lyft and turning in components thru DoorDash or GrubHub.

It's feasible you can have received to also always initiate trying to find and with the support of for a a lot improved paying predominant job as factual. Shutterstock

Ramsey explains completely diverse debt myths human beings tell themselves

But one completely diverse frequent money myth is that having a funds limits your freedom.

"The reality is, a funds presents you freedom," Ramsey wrote. "Human beings say budgeting makes them day out like they received a bring up, to that end of of the reality they 'uncover' money they were losing."

Some human beings receive as true with that now not with the support of debt would be a horrifying replace of subculture. Somebody who's used to with the support of a credit ranking card and making auto repayments can enhance comfortable with those habits.

Ramsey likens accumulating debt to cooking yourself in a pot of boiling water.

"Or not it is able to be warmth and comfortable in the opening, but beforehand than you perceive it, feasible have received it's feasible you could also be able to have been boiled alive," he wrote.

Imperative: The frequent American faces one substantial 401(okay) retirement dilemma

Ramsey acknowledges that taking the very obligatory steps to get out of debt requires some discipline and frustrating work.

But he also says that frequent human beings totally name in to The Ramsey Notice celebrating being debt free with the support of his smallest-debt-first procedure that he calls the debt snowball manner.

"Don't neglect this," he wrote. "Hundreds of thousands of pop and mom who were on your sneakers are now living and giving like no man or ladies else. You may be subsequent."

"Or not it is able to be your turn to throw off the burden of debt and initiate building the life feasible have received it's feasible you could also be able to have dreamed of. Or not it is able to be so very doable. And you are so totally fee it."

Imperative: Veteran fund supervisor picks favored stocks for 2024

What's Your Reaction?