Explained: What's the Old Pension Scheme? Why is it a raging poll issue in Himachal Pradesh?

Explained: What's the Old Pension Scheme? Why is it a raging poll issue in Himachal Pradesh?

With a few days left for Assembly elections in Himachal Pradesh, the clamour around the Old Pension Scheme (OPS) has increased. To woo the voters, the Congress has promised in its manifesto to restore the OPS if elected to power.

In October, the Aam Aadmi Party (AAP) Himachal Pradesh chief, Surjeet Singh Thakur, also vowed to implement OPS in the state if his party forms the government.

While the ruling Bharatiya Janata Party (BJP) in the state has stayed away from making any promises but has said it will move forward on the basis of a report of the panel set up by the Jai Ram Thakur-led government.

What is the Old Pension Scheme and why is it a raging issue in the forthcoming Himachal Pradesh Assembly elections? Why is BJP not ready to commit to implementing OPS? We explain.

What are OPS and NPS?

In the Old Pension Scheme, after retirement, employees receive 50 per cent of their last drawn salary or a 10-month average emolument, whichever is more. This entire pension sum was paid for by the government.

The ten-year service requirement should be met by employees to avail the pension.

According to Hindustan Times, those subscribing to OPS also “get dearness allowance (DA) on pension amount, revision of pension with successive Pay Commissions, additional pension after a certain age, commutation of family pension for dependents of several categories etc.”

This Old Pension Scheme was discontinued by the then Atal Bihari Vajpayee-led NDA government in 2003 and on 1 April 2004, the New Pension Scheme (NPS) – now called National Pension System– was adopted.

In the new system, which works on a defined contribution basis, government employees are required to contribute 10 per cent of their salary and dearness allowance to the retirement fund. The government shells out up to 14 per cent for the pension corpus.

This sum can be invested by pension fund managers, as per Indian Express.

“A professional pension fund manager can ensure that superior returns and a larger retirement corpus are achieved, regardless of equity or debt,” Managing Director (MD) at SAG Infotech, Amit Gupta, was cited by Mint.

OPS is a defined benefit plan, however, in the case of NPS, the pension benefit depends upon several factors such as the “amount of contribution made, the age of joining, type of investment, and the income drawn from that investment”, reports Indian Express.

Regulated under The Pension Fund Regulatory & Development Authority Act (PFRDA), 2013, a Permanent Retirement Account Number is allotted to each government employee in the new system.

Under NPS, on retirement, an employee can withdraw 60 per cent of their pension corpus while the 40 per cent will have to be invested in an annuity plan which will be offered by the annuity service providers (ASP) listed with PFRDA. The employees will receive interest on the annuity as a monthly pension.

Why the Opposition?

Recently, Joint Consultative Machinery (JCM), an apex body of various government unions consisting of Group B and Group C officials, has shot off a letter to Cabinet Secretary to bring back the OPS, calling the National Pension System a “disaster” for retiring employees.

Citing the case of a recently retired defence establishment official, the federation said he received only 15 per cent of the assured pension he would have claimed otherwise if OPS was applicable, as per The Hindu.

“It is now 18 years after the implementation of NPS. Employees who were recruited on or after 01/01/2004 have now started retiring from service. From the paltry amount they are now getting as pension from NPS it is proved that it is a disaster for the retiring employees in their old age and not a win-win situation,” the letter signed by Shiva Gopal Mishra, Secretary, National Council (Staff Side), JCM, said.

West Bengal had not implemented NPS when it was introduced in 2004. Now, Punjab, Chhattisgarh, Jharkhand and Rajasthan have also announced the restoration of the OPS.

ALSO READ: Explained: Why Punjab’s decision to revert to Old Pension Scheme could be disastrous

Why Himachal is resisting NPS?

Himachal Pradesh, which goes to polls on 12 November, has around 2.5 lakh government employees.

While another 1.90 lakh employees are now retirees drawing pensions. As per Newslaundry, with only 55 lakh voters deciding the fate of the political parties, these active and retired government employees, in addition to their dependents, form a solid voter base.

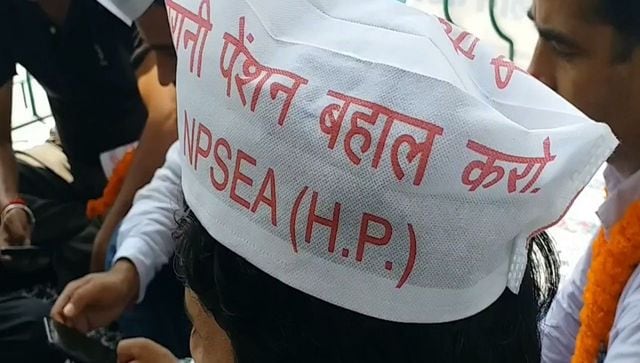

The New Pension Scheme Employees Association (NPSEA) in Himachal, the association formed in 2015 demanding the return of the OPS, has mobilised people on the ground and is raising the issue through its social media platforms.

Bharat Sharma, the general secretary of the NPSEA, told Newslaundry how the restoration of OPS is a major political issue in the hill state.

Notably, the NPS was introduced in Himachal in 2006 by then Chief Minister and Congress leader Virbhadra Singh.

“It was backdated to 2004. Effectively, any employee permanently recruited into the government after April 2004 was covered under NPS, not OPS,” Sharma explained.

Those who were employed by the government after 2004 have started retiring in the past few years.

“They are now receiving measly pensions as compared to their senior colleagues covered under OPS, often a tenth of it,” Sharma added.

“Their children are unemployed too, despite educational degrees,” he was quoted as saying by Newslaundry.

Accompanied by the problem of unemployment, NPS has become a raging election issue in the hill state.

NPSEA had also organised protests in February and August against the NPS. Many active and retired government employees had also taken out demonstrations in March on the issue.

Hari Das Thakur, 62, a former government employee who now runs a tea and Maggi stall on national highway five in Himachal, told Newslaundry that under NPS, he receives only Rs 1,301 pension per month which would have been Rs 13,000 – half of his Rs 26,000 salary under the old scheme.

Thakur said he had to open the stall at this age as he cannot survive on such a meager pension.

“I have a son and he’s unemployed. So at this age, I was forced to open a highway stall to survive after retirement. Now I clean tea glasses and wash plates,” he told Newslaundry.

ALSO READ: PFRDA announces amendments to e-nomination process for NPS subscribers

Why is BJP hesitant about OPS?

As per estimates, if OPS is reintroduced it would lead to massive financial liability on the Centre, notes The Tribune.

On why BJP is being non-committal regarding the OPS in Himachal, a BJP source told The Tribune, “A formal commitment in one state could mean triggering a slew of demands from other states to restore the OPS. Any such move needs to be thought through and cannot be based solely on electoral considerations.”

Another BJP leader said the decision on bringing back the old system lies with the central government.

A BJP spokesperson told Newslaundry, “The effect of OPS on the fiscal deficit is hundred times more than NPS.”

“Moreover, as part of due process, it is a decision to be taken by the Centre, not the state. If we can’t do it, we won’t commit to it,” the spokesperson added.

With inputs from agencies

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

What's Your Reaction?