Fed official revamps outlook on U.S. economy amid tariff turmoil

Here's what's next for the U.S. economy.

There’s been a lot of talk about tariffs lately. And for good motive. A cornerstone of President Trump’s re-election, tariffs are enacted on world imports to a diploma final seen in 1930.

Tariff supporters inform they’re the acceptable components to re-spark U.S. manufacturing after decades of decline. Opponents wretchedness that, admire the Smoot Hawley Act of 1930, tariffs will not be any longer going to most effective fail to reboot manufacturing but ship the financial system into a tailspin.

The controversy intensified this week when President Trump rolled out in style tariffs on all world imports that were higher than anticipated. The records despatched the stock market reeling, causing the S&P 500 and Nasdaq Composite to tumble over 4% and 5%, respectively.

Linked: Used fund supervisor who forecast S&P 500 smash unveils comely update

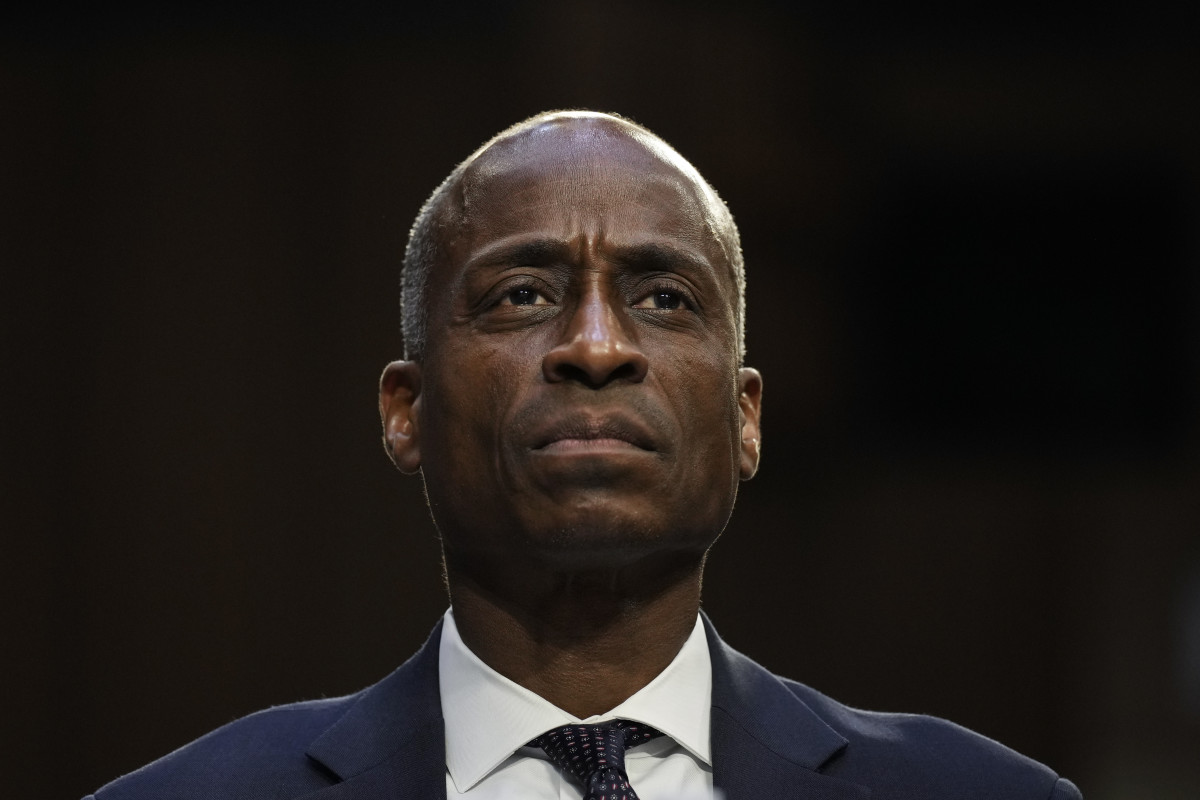

The tariffs are arriving whilst the financial system is arguably on shakey ground, a fact seemingly no longer lost on Federal Reserve people, together with Vice Chairman Philip N. Jefferson.

In a speech on April 3, Jefferson outlined his most current financial outlook, and given his position in helping prefer hobby rate cuts, investors should listen in on what he talked about.

Drew Angerer/Getty Photos

The financial system shows indicators of sputtering

The Federal Reserve has its encourage against the wall.

Fed Chairman Jerome Powell incorrectly argued that inflation modified into once transitory in 2021, forcing him to swap gears and undertake the most restrictive and hawkish monetary coverage since Fed Chair Paul Volcker battled inflation in the early 1980s.

Linked: Billionaire Michael Bloomberg sends laborious-nosed message on financial system

Powell’s battle on inflation labored but modified into once expensive. Inflation has retreated below 3% from over 8% in 2022, but higher hobby charges capped financial recount, leading unemployment to climb to 4.2% from 3.5% as lately as 2023.

Worse, over 275,000 People lost their jobs in March, in step with Challenger, Grey, & Christmas, as Department of Government Efficiency job cuts kicked in. That prefer modified into once up an enormous 205% twelve months over twelve months, and the most moving introduced job losses since Covid in 2020.

The rising pattern in joblessness triggered the Fed to lower its benchmark Fed Funds Price in the fourth quarter of 2024. Unfortunately, we’ve clearly no longer seen any recount in the roles market, and these hobby rate cuts appear to own rekindled inflation. The Particular person Mark Index stories inflation elevated to 2.8% in February from 2.4% in September.

Sticky inflation and unemployment are causing a tumble in financial recount. The Atlanta Fed’s GDPNow forecasts that the first-quarter GDP will be negative at -2.8%. That measure will seemingly toughen as more knowledge lands, but it appears to be like seemingly that the first-quarter GDP will tumble from the 3.1% tempo recorded in the 2nd and third quarters of 2024.

Fed Vice Chair warns on slowing financial system

The prospect of a slowing financial system will not be in actual fact lost on Fed Vice Chair Jefferson, who reminded People this week that Fed officers own broadly been retrenching their outlooks for U.S. financial recount in 2025.

" Fed policymakers and a lot internal most-sector forecasters request recount to continue, they broadly anticipate a slower tempo of expansion this twelve months," talked about Jefferson on April 3. "In the SEP released after the March FOMC meeting, the median participant projected GDP to rise 1.7 p.c this twelve months and to depart up moderately below 2 p.c over the next two years."

The prospect of slowing may aggravate given user self assurance has plummeted lately, and that modified into once outdated to tariffs were introduced by President Trump on "Liberation Day" ranging from a baseline 10% on most imports to up to 54% on China.

Extra consultants:

- Treasury Secretary has blunt 3-observe response to stock market tumble

- Fed chairman has blunt 9-observe response to recession talk

- Billionaire Ray Dalio's blunt message on financial system turns heads

"Resilient user spending has been the motive force of the most current financial expansion. Extra lately, about a indicators own emerged that counsel that some of the factors supporting final twelve months's stable spending recount will be weakening," talked about Jefferson. "Readings first and foremost of this twelve months counsel much less make stronger for recount from family spending in the first quarter. Primarily the most most current Beige E-book talked about that contacts reported user spending modified into once lower, on balance, with calm stable ask for a will have to own goods but elevated price sensitivity for discretionary items, namely amongst lower-profits shoppers.

The Convention Board's Expectations Index is already at 65, below a studying of 80 that has instructed past recessions. If tariffs can no longer be fully absorbed by U.S. firms, such as retailers, and are passed along to shoppers, it may lay the groundwork for a recession later this twelve months given shoppers own shrimp flee for meals for discretionary spending already.

And invent no longer basically rely on manufacturing to accumulate the slack in the financial system from declining products and companies exercise.

"Like user sentiment, nonetheless, readings on industry sentiment own also slipped," talked about Jefferson. "If uncertainty persists or worsens, financial exercise will be constrained."

Granted, outmoded sentiment would not always predict recession, and Jefferson aspects out People are resilient. Then all once more, a lot appears to be like to be going execrable, and the roles market will not be in actual fact seemingly to present great consolation.

"I anticipate that there will be some modest softening in the labor market this twelve months, talked about Jefferson. "The tempo of job gains has cooled from its put up-pandemic height."

Linked: Jim Cramer offers blunt one-observe reaction to 20% tariffs

What's Your Reaction?