Forget Fisker, another Tesla rival is on watch

This EV startup with ties to major auto giants might face a similar fate if it doesn't turn around.

After the well-documented and heavy-handed fall of California-based EV startup Fisker culminating with its Chapter 11 bankruptcy filing this week, another ambitious EV startup risks facing a similar fate.

Though Fisker's fall has been marked by quality control issues reported by owners, buggy software, and scathing reviews by Consumer Reports and a big-name tech YouTuber, this company seems to have had EV dominance in the bag until it rode the highs and lows of the tumultuous EV market.

Related: Struggling car company files Chapter 11 bankruptcy after scathing review

Since its public debut on the NASDAQ in 2022 through a reverse merger with a special purpose acquisition company (SPAC), shares of the Swedish EV startup Polestar (PSNY) have lost over 90% of their value, trading at just $0.68 per share at the time of this writing.

At one stage, the brand was valued at over $21 billion but now, it holds a market cap of just $1.435 billion. Polestar

Volvo sparks problem for Polestar

Polestar's woes began in February 2024, when parent company Volvo announced that it would be reducing its stake in the EV startup from 48% to just 19% in the fourth quarter of 2024, transferring its stake to its owner, Chinese auto giant Geely (GELYY) .

Like many EV brands, Polestar felt the effects of an overall EV sales cooldown. In 2023, the brand sold 54,600 vehicles to customers, short of its sales target of 60,000 vehicles.

Related: Volvo calls it quits with a unique, luxurious Tesla competitor.

Citing "challenging market conditions," the brand slimmed its global operations by 450 jobs, or 15% of its workforce, in January 2024. Additionally, the brand's deliveries during the first quarter of 2024 fell 53% compared to Q1 2023.

In a May 30 report by Automotive News, Polestar North America head Gregor Hembrough said that the subpar sales performance was due to buyers facing high interest rates and a sales shift that turned away from fleet sales such as those by rental car companies.

"In 2024, fleet and rental will not be a major part of our business equation," Hembrough told AutoNews. "The majority of the throughput will go through the dealer channel."

In the same report, ISeeCars executive analyst Karl Brauer noted that Polestar is one name in an unbalanced EV marketplace, along with big-name rivals like Tesla, Lucid, BMW, and even Hyundai.

"There are too many EV models and too much production capacity for this market," Brauer said.

More Business of EVs:

- New study suggests EVs are supercharging an impending environmental crisis

- GM President has bold plans for an iconic sports car's EV resurrection

- Ford CEO says this iconic model will "never" be an EV

The NASDAQ deals a blow to Polestar

In a statement issued on May 17, Polestar acknowledged that, as a consequence of not filing an Annual Report for its 2023 fiscal year and first-quarter 2024 financial reports, it had received a deficiency notice from the NASDAQ. This notice marks the company at risk of not being compliant with exchange rules and in contention of being delisted.

As a result, the stock price fell dramatically, reaching below a dollar per share on May 21.

Related: Forget Tesla's Supercharging, Polestar's new charging tech can charge even faster

In a statement issued on May 31, the automaker announced that it expects to file its 2023 annual report and first-quarter 2024 results by the end of June 2024.

How to dig out of a hole, according to Polestar

Formerly established as its own entity in 2017, Polestar was a spinoff brand with deep ties to Volvo.

Polestar initially started as a racing team, fielding race-ready Volvos on racetracks as part of the Swedish Touring Car Championships (STCC). The team would ultimately become the brand's official tuning partner, and the duo established a relationship similar to Mercedes-Benz and tuning house AMG, ultimately selling modified, performance-oriented Volvos in its dealers.

In 2015, Volvo bought Polestar and revamped it to become a brand solely selling EVs with the introduction of the sleek Polestar 1 coupe in 2017.

Now, Polestar seeks to increase its sales, expecting to sell between 155,000 and 165,000 vehicles next year. To achieve that goal, it is looking to expand its operations into EV-hungry destinations.

In a statement published this week, the EV brand announced that in 2025, it will begin selling cars in seven key EV markets, including France, Czechia, Hungary, Slovakia, Poland, Brazil, and Thailand. The brand is particularly excited about moving into France, as it is the largest volume market for electric cars in the EU after Germany, but overall, its new move is destined to attract new customers.

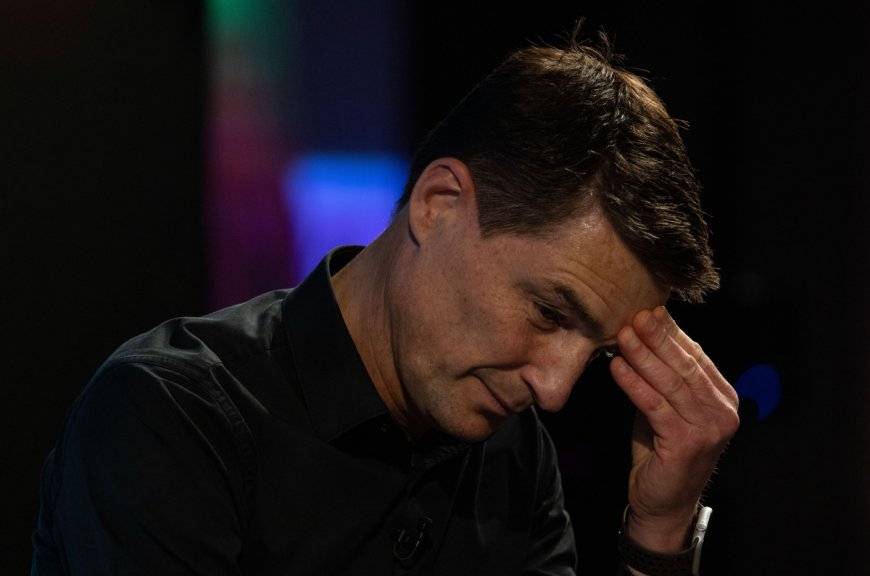

“Expanding our retail operations with new and existing partners will enable us to reach more customers,” Polestar chief executive Thomas Ingenlath said. “Through these partnerships and expansion, we will capitalize on our strong brand and growing model line-up.”

Currently, Polestar is offering a barrage of incentives to move Polestar 2 vehicles out of dealer lots, including lease offers as little as $299 per month for 27 months in the U.S., which includes a $10,000 Polestar Clean Vehicle Incentive and a $2,000 discount for Costco members looking to buy or lease a Polestar 2.

Polestar is also looking to expand its model lineup beyond its current offering of the Polestar 2. The brand has recently released the Polestar 3 SUV and the brand unveiled the Polestar 4 at the New York International Auto Show, and expects to start deliveries later this year.

Additionally, Polestar is looking to innovate beyond just radical car design. In a demonstration car equipped with experimental silicon anode solid-state batteries made by StoreDot, engineers managed to charge from 10% to 80% in just 10 minutes — much faster than Tesla's Supercharging.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?