Goldman Sachs and Vanguard lay out latest stock forecasts

The S&P 500 has climbed 18% year to date.

Many within the funding native suppose the stock market appears to be like stretched over its skis.

The S&P five hundred has soared 25% over the optimum twelve months, in contrast with an annual familiar of 9% over the optimum 50 years.

The index has hit facts in 38 classes this yr, most just lately on July 16. And that has pushed valuations actual above historic norms.

Truly good: Morgan Stanley exhibits greatest stock picks, inclusive of Nvidia

As of Aug. 16, the forward value-earnings distinct for the S&P five hundred modified into 21, in contrast with the five-yr familiar of 19.4 and the ten-yr familiar of 17.9.

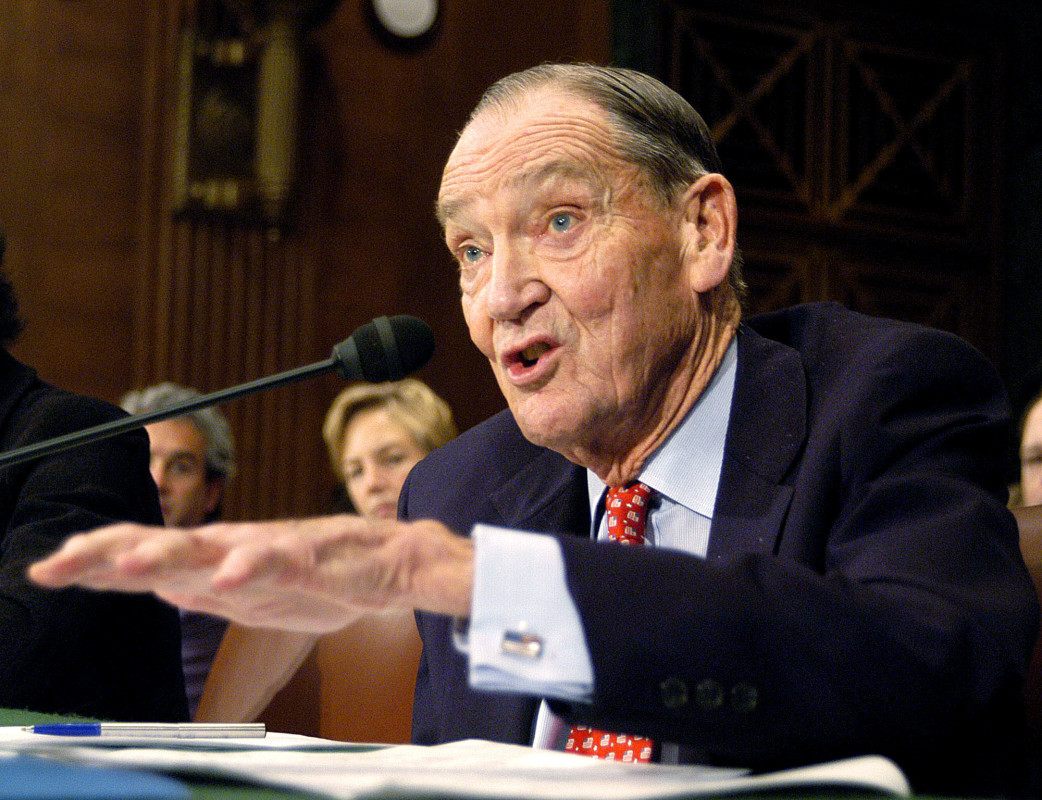

Or not it is obtained many of human beings nervous, inclusive of money-management colossus Vanguard ($9.3 trillion of property under management). Bloomberg/Getty Images

“We were cautioning merchants for a even as that U.S. stocks — and raise stocks, in overall — are richly priced,” Joe Davis, the enterprise’s world chief economist, wrote in a commentary.

“Indeed, the cyclically adjusted value-to-earnings ratio of the stock market stands at about 32% above our estimate of its fair value.”

The CAPE distinct, created through the Nobel laureate economist Robert Shiller, involves familiar earnings for 10 years in place of the one yr used in prevalent PE multiples. The belief is to decrease the influence of an outlying yr of earnings.

The CAPE distinct stood at 36.23 on Aug. 27, a stage surpassed because the 19th century best at some stage within the dot-com bubble of the late 1990s and the publish-pandemic surge in 2021.

Inserting Vanguard’s view in context

To make certain, the possibility isn’t all-encompassing, Davis said. “Even as raise stocks and the broad stock market seem to be overestimated, small-capitalization, value and non-U.S. stocks seem to be considerably valued,” he wrote.

Truly good: Pinnacle value fund supervisor says Google-guardian Alphabet is deep-value stock

Market mania over manufactured intelligence has been a customary thing boosting stocks over the optimum yr. That enthusiasm is overdone, Davis said:

“It’s improbable at best that the fast financial and earnings raise [resulting from AI] would excellent the updated extra valuation of the U.S. stock market.”

Earnings would devoid of doubt take off to tug the market out of its overestimated acceptance, he said.

Assuming a 3-yr horizon for a return to fair value, earnings would soar Forty% per yr to unwind the market’s extra.

“Or not it is double the annualized value of the Twenties when electricity lit up the nation — now now not to say financial output and service supplier earnings statements,” Davis said.

Goldman Sachs considerations fast-time period stocks outlook

Alternatively, as a minimum within the fast time period, Goldman Sachs is bullish on stocks.

Commercial team stock buybacks and trades made according to computing tool algorithms will lend a hand fuel the flow, said Scott Rubner, managing director for world markets and tactical expert at Goldman.

“We estimate $17 billion of unemotional demand between robots and corporates day after day this week,” he wrote in a commentary on Monday said through Bloomberg. “There's a in actual reality bound three-week fairness trading window until Sept. 16.”

Expert Stock Picks:

- Fund supervisor picks 3 best-of-breed stocks (inclusive of Chevron)

- Fund supervisor picks three blue chip stocks

- $10 billion fund supervisor picks three preferred stocks

Meanwhile, “marketers are out of ammo,” Rubner said. Likely, he way that with stock bears incurring so many losses shorting stocks over the optimum yr, they’re reluctant to promote increased shares fast.

“All and various goes returned to the pool,” he wrote. Algorithmic merchants have overshot their turn away publicity to stocks.

Goldman has indicated that the Federal Reserve’s signal that it should cut prices next month can quickly prop up stocks.

“The pain alternate for equities is increased, and the bar for being bearish on the seaside right into a Labor Day barbecue birthday social gathering is severe,” Rubner wrote final week, persevering alongside with his summer-enjoyable metaphor.

Truly good: Veteran fund supervisor sees world of pain coming for stocks

What's Your Reaction?