How Taiwan Semi Can Continue Rally After Mixed Earnings Report

Taiwan Semiconductor shares are rallying after a mixed earnings report on Thursday morning. Here's how it can go higher.

Taiwan Semiconductor shares are rallying after a mixed earnings report on Thursday morning. Here's how it can go higher.

Taiwan Semiconductor (TSM) - Get Free Report shares reported earnings on an interesting day: the monthly inflation report was issued this morning.

The in-line consumer-price index report at last check had markets unsure on direction, but for Taiwan Semiconductor, there hasn’t been any wavering.

The shares opened higher by 4% on Thursday and at last check were more than 6% higher. The moves came after a mixed earnings report.

Revenue grew 27% year over year to $19.93 billion but missed analysts’ estimates by almost $1 billion. Earnings of $1.82 a share beat expectations by 5 cents.

It has not been an easy ride with chip stocks, including Taiwan Semi.

The stock saw a peak-to-trough loss of 59%, but it bottomed in late October and since has been trading better. With today’s rally, the shares are up more than 45% from the low as the stock hit its highest level since August.

The post-earnings response is like a cherry on top for Warren Buffett, whose Berkshire Hathaway (BRK.B) - Get Free Report (BRK.A) - Get Free Report built a rather sizable stake in the company in the second half of 2022.

Trading Taiwan Semiconductor Stock

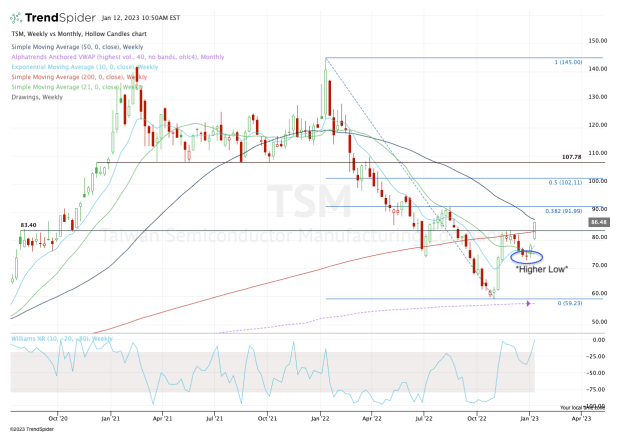

Chart courtesy of TrendSpider.com

Taiwan Semiconductor stock made a powerful three-week rally off the October low but ran into resistance from the 200-week moving average and the prior breakout level near $83.50.

This is classic price action, where prior support turned into resistance, and illustrates how stocks tend to have a sort of memory around certain key levels.

On the ensuing pullback, Taiwan Semiconductor stock put in a higher low, a bullish technical development. With the post-earnings reaction, the shares are now pushing through its fourth-quarter resistance.

From here the bulls will look to press Taiwan Semi up to the 50-week moving average. On a slightly higher push, the 38.2% retracement is in play near $92.

Keep in mind: The $90 to $92 area was support in the first half of the year but resistance in the second half. If the shares can clear this zone, it opens up the $100 to $102 area, then the $107.50 to $110 zone.

On the downside, it’s pretty simple. From a technical perspective, Taiwan Semiconductor stock would remain quite bullish if it can stay above the $83.50 area.

That keeps it above all its daily moving averages and several key weekly moving averages, as well as several notable levels on the chart.

Below $83.50 makes things a little trickier and we’d have to reevaluate Taiwan Semi at that time.

What's Your Reaction?