Jobs gains fuel market optimism — for now

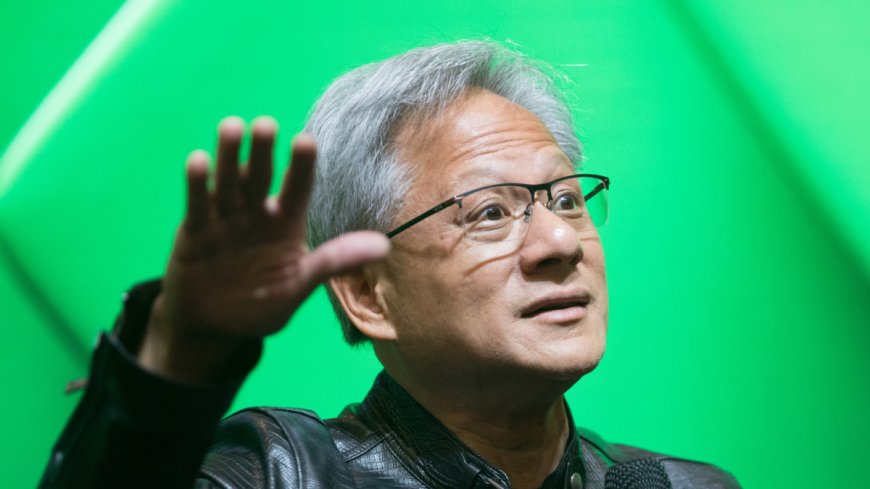

Here's what analysts see happening next for markets, with Jensen Huang's Nvidia exciting many investors.

Ask Wall Boulevard what's in advance for stocks to the end of 2024 after Friday's strong jobs report, and in addition you always get a thumbs up.

But interest rate increases, specifically for mortgage rates, may keep things in check.

Don't leave out the move: Subscribe to TheStreet's free each and every day newsletter

Stocks were higher, partly because Fed governor Adrianne Kugler said the central should continue to do something about beating down inflation. Still, she said the Fed must do something about a "balanced approach" that avoids slowing job and economic growth.

Still, the bull case for stocks seems a dash squishy. There are headwinds facing markets which can make stocks range-bound at some point of the end of the year, Brian Weinstein, head of world markets at Morgan Stanley.

These encompass:

- Higher interest rates, particularly rates on mortgages.

- Important readings on inflation later this week.

- The commercial fallout from Hurricane Milton's assault on Florida after the havoc of Hurricane Helene.

- The election.

- The which that it's possible you could be capable of possibly imagine for widening war within the Middle East.

Tom Williams/Getty Images

Jobs data paints a bullish picture

The jobs report became undeniably bullish. Which is now now not handiest since it suggested that payroll employment jumped by 254,000 and unemployment fell somewhat to Four.1% but also because the Bureau of Labor Statistics revised estimates for job growth in August and July up by seventy two,000, greater than expected.

Related: Veteran analyst spotlights huge bond market signal

Stocks surged on Friday on the report. However it the S&P 500 and other major indexes fell back on Monday as end result of the worries that the jobs report suggested the Federal Reserve's decision to cut its key interest rate by a 1/2-percentage point became too big.

On Tuesday, traders appeared more bullish on stocks, with the Standard & Poor's 500 Index up nearly 1% and the Nasdaq Composite up 1.45%. The Dow Jones Industrial Average added Zero.three%.

The S&P 500 and Nasdaq were higher as end result of the gains in technology stocks. The S&P 500 Technology Sector became up about 2%, led by strong gains in Palantir Technologies (PLTR) , up 6.6%; Palo Alto Networks (PANW) , up 5.1%, and Nvidia (NVDA) , up Four.1%.

The Technology Choose Sector ETF (XLK) added 1.9%. It be up 15.2% since an Aug. 5 bottom of $197.ninety.

Nvidia fuels bulls' excitement

Nvidia is up greater than 29% since Sept. 6, partly in reaction to CEO Jensen Huang's comment that demand for its new Blackwell graphics processing unit is "insane."

Related: Nvidia CEO's bombshell raises the bar for the stock

The product is designed to address the computing and bandwidth needs of current and future synthetic intelligence workloads.

Microsoft (MSFT) became up 1.three% to $414.Seventy one, despite a downgrade to "perform" from outperform" from brokerage Oppenheimer.

The firm believes consensus estimates for revenue and earnings per share are too high. The issue: losses from Microsoft's involvement in OpenAI, so that that's going to be within the $2 billion-to-$three billion range in fiscal 2025, which began on July 1.

Changed into the Fed's rate cut an excessive amount of too soon?

There became a counter view: that the Fed's rate decision—which trimmed the federal funds rate from 5.25%-to-5.5% to Four.seventy 5%-to-5%—became too big and could prove to be inflationary.

That agonize has pushed interest rates higher. The ten-year Treasury yield rose to Four.02% on Tuesday from three.Sixty two% on September sixteen, two days earlier than the Fed's decision.

More Wall Boulevard Analysts:

- Analysts revise Corning stock price targets after investor meeting

- Analysts retool Carnival stock price targets previous to earnings

- Analyst revisits Costco stock price target, rating previous to earnings

The speed on a 30-year mortgage became quoted Tuesday at 6.Sixty two% at Mortgage News On day to day basis, up from 6.eleven% on eleventh of September. The boost would push the monthly principal-and-interest component to monthly payment from $1,516 to $1,599, a 5.5% amplify.

Related: The ten best investing books, consistent with our stock market pros

What's Your Reaction?