Nvidia nears major market milestone as AI hype puts earnings in new focus

Nvidia is close to reaching another major stock market milestone.

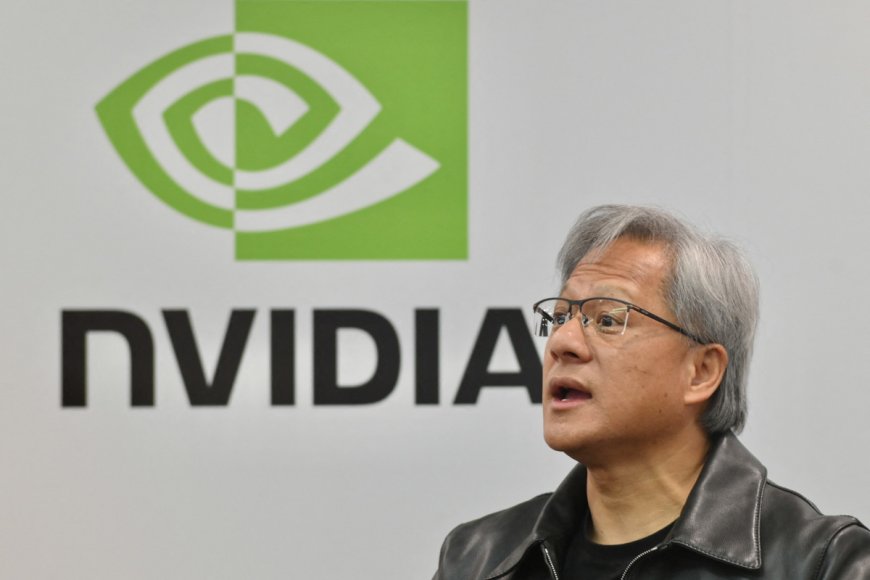

Nvidia (NVDA) shares moved higher in early Wednesday trading, lifting its market capitalization to within touching distance of the $2 trillion mark, as investors continue to reprice sales and profit growth forecasts for the world's biggest AI-chip maker.

Nvidia has been the standout market performer this year, regardless of sector, adding more than $560 billion – nearly the entire value of Tesla (TSLA) – to its market cap and rising just under 50% from late December.

A surge in artificial-intelligence investment, particularly from the so-called hyperscalers, or large cloud-computing-service providers, has accelerated interest in Nvidia, given its dominant market position in the chips that drive AI technologies.

Google parent Alphabet (GOOG) told investors last month that "investment in [capital spending] will be notably larger" this year than last, with reports suggesting as much as $50 billion could be earmarked for AI and cloud initiatives.

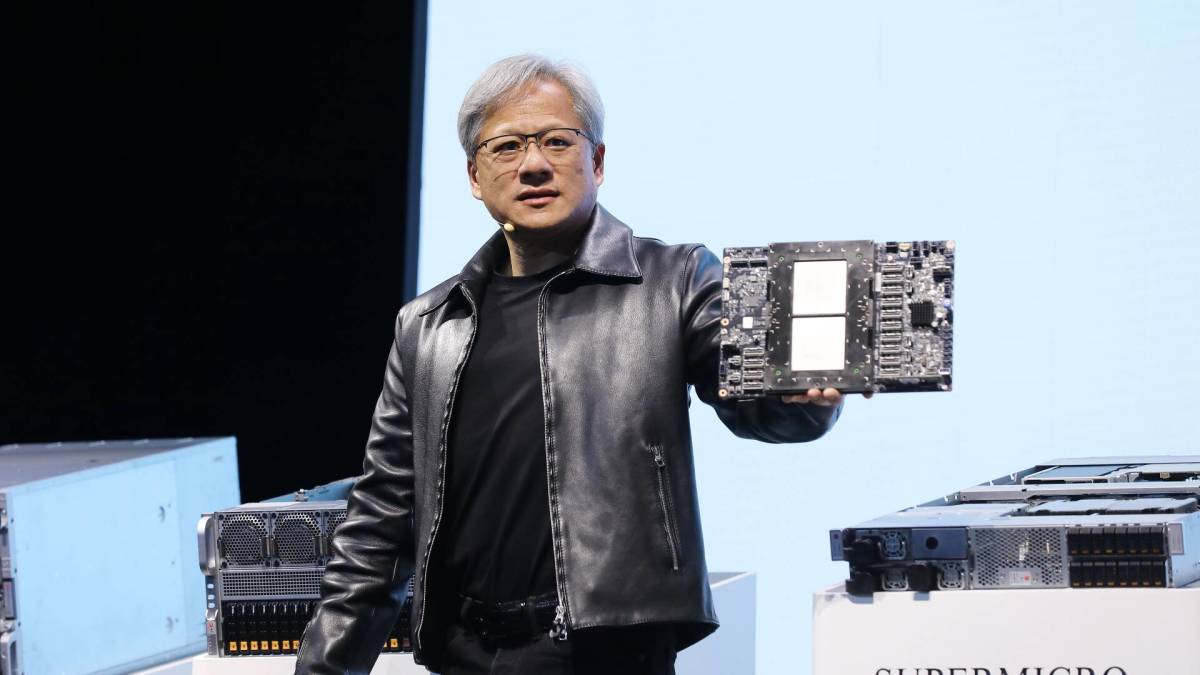

Social media giant Meta Platforms (META) , meanwhile, is planning to have around 350,000 H100 graphics-processing units, the AI-focused chips Nvidia makes, in place by year-end. That would take Meta's total of Nvidia GPUs to around 600,000, a level that would establish it as one of the largest AI systems in the world. Shutterstock-Glen Photo

Morgan Stanley analysts, in fact, see cloud capital-spending growth rising 26% from 2023 levels this year, marking the biggest increase for the so-called Big 4 (Amazon, Google, Microsoft and Meta Platforms) since 2018.

Nvidia sells the axes and shovels of the AI gold rush

"It all comes down to use cases, and while [Microsoft's] Azure is the cloud platform foundation for AI with [CEO Satya Nadella] leading the charge, we also expect Google (GCP) and Amazon (AWS) cloud platforms to see a massive tailwind from this unprecedented surge of AI deployments over the next 12 to 18 months," Wedbush analyst Dan Ives says.

And in much the same way as sellers of pickaxes and shovels were the biggest beneficiaries of the California Gold Rush nearly two centuries ago, Nvidia is expected to capitalize on the new Gold Coast AI rush over the coming years.

Nvidia, Ives said, remains "the only game in town from an AI-chip perspective."

That's likely why the stock, which overtook Amazon (AMZN) last night in market value for the first time in two decades, could rise past another hyperscaler rival, Google, later in the session.

Alphabet stock is valued at $1.81 trillion, the third highest in terms of U.S. stocks, just ahead of Nvidia's $1.78 trillion.

Should shares in the group falter over the coming days, however, Nvidia will still have another shot at overtaking Google when it posts its fourth-quarter earnings after the close of trading on Feb. 21.

Analysts expect Nvidia revenue rose more than threefold from 2022 levels to more than $20.3 billion, with profit margins expanding by around 9 percentage points to a staggering 75.4%.

Nvidia: Really good, with a chance of greatness

UBS analyst Timothy Arcuri, who earlier this week boosted his price target on Nvidia by $70 to $850, says the group's data-center revenue, where AI chips are reported, could top Wall Street forecasts by as much as $3 billion.

"Customer discussions from Nvidia's lead times have come in substantially over the past few months, meaning shipment slots are still available" heading into the second half of this year, Arcuri said.

"Normally, this is bad, but demand for AI-compute capacity is still so strong, in the near term, we think this just points to significant upside potential to shipments and revenue," he added.

Related: Nvidia stock is key to the Nasdaq making new record high

Last week's stronger-than-expected fourth-quarter update from Arm Holdings, the chipmaker that listed on the Nasdaq last fall, has also added to the bullish tenor to Nvidia's highly anticipated earnings.

Arm Holdings, which designs chipmaking blueprints and earns the bulk of its revenue from royalty payments, also sells semiconductors that support Nvidia's AI-focused data-center chips.

More Business of AI:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- Google targets Microsoft, ChatGPT with huge new product launch

- AI stock soars on new guidance (it's not Nvidia!)

The Cambridge, U.K., group said fiscal 2024 revenue would grow 19% to around $3.1 billion with a big bump in earnings, which it sees rising to $1.22 per share.

Nvidia was one of Arm's biggest financial supporters heading into the September IPO and tried to buy the group in 2022. That effort was thwarted by regulators in the U.K. who were concerned the $40 billion deal would stifle competition.

Nvidia shares were marked 1.5% higher in premarket trading to indicate an opening bell price of $732.11. Such a move that would boost its market value to around $1.807 trillion.

Google shares, meanwhile, are set to rise by around 0.67% to $146.11 each, putting its market cap at $1.822 trillion.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?