Nvidia Stock Surges to Records After Earnings Report; Here's How to Trade It

Nvidia stock is roaring after a strong quarterly report. Here's how to navigate it from here.

Words can't describe what we’re seeing in Nvidia (NVDA) - Get Free Report shares right now.

At last check the graphics-chip stalwart's shares were up 27% and touching all-time highs. The company's market capitalization is near the coveted $1 trillion mark.

Driving the action: the quarterly report. While Nvidia reported solid earnings and revenue results, it was management’s blowout guidance that ignited the leap to the upside.

Don't Miss: Apple Stock Has Two Buy-the-Dip Spots (and One Is Really Attractive)

The shares are now up 160% on the year and up more than 250% from the 52-week low made in October. As the stock approached that low, we outlined the long-term bullish setup in Nvidia.

That included the $125 area and the $110 area as potential buy zones. While the price action on the downside was picture perfect, the move back to the upside has been extreme — and that’s putting it mildly.

From here, how do investors navigate the stock?

Trading Nvidia Stock

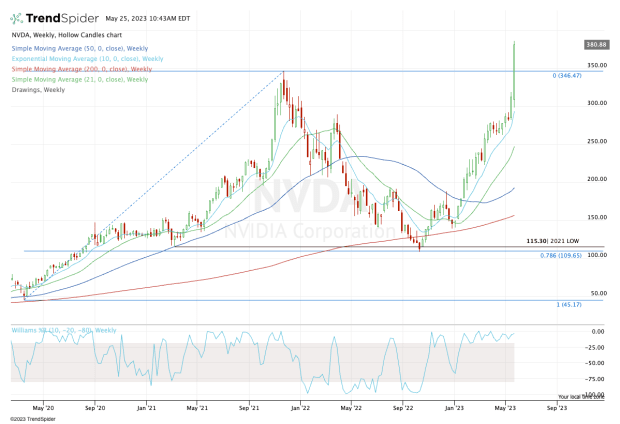

Chart courtesy of TrendSpider.com

Those who bought Nvidia stock based on the longer term setups should be taking some profit off the table, now that Nvidia stock has moved to all-time highs.

Moving forward, I would keep a close eye on the prior high near $346.50. While a dip to this level could be a good buying opportunity, a break below it could accelerate some short-term selling pressure.

The bulls are now in control, so Nvidia remains a buy-the-dips candidate, particularly on pullbacks to its key short-term moving averages, like the 10-day and 21-day moving averages, as well as the 10-week moving average.

More than anything, I believe Nvidia is a great example of combined technical and fundamental analysis.

Don't Miss: Buy or Sell Anheuser-Busch Stock? Here's Where It May Find Support.

While Nvidia faced fundamental challenges in the second half of 2022, tech investors knew its long-term potential remained attractive.

When combined with some key technical levels on the weekly chart, it gave buyers the confidence to step in and buy “when there’s blood in the street” — as they like to say on Wall Street.

Clearly, the upside rally came faster than expected. But it didn’t take long for the bulls to find themselves in a very favorable position.

From here, watch $400 on the upside and the $346.50 area on the downside. And let Nvidia serve as a lesson for long-term buying opportunities.

Our Memorial Day sale is on now! Get exclusive investing insights from TheStreet’s premium products. Learn more.

What's Your Reaction?