Stock Market Today: Stocks rise as government shutdown threat looms

U.S. equities seek strong conclusion to banner quarter

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Monday. This is TheStreet's Stock Market Today for Sept. 29, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 8:02 a.m. ET

BoFA, BMO Boost S&P Outlooks

Starting the week, Bank of America (BAC) is making a bullish case for the S&P 500 over the next year, following in the footsteps of Bank of Montreal (BMO) .

On Friday, BMO said that it sees the index at 7,000 by the end of 2025, a 5.36% premium to today's price of 6,643.70. It cited lower rates, stronger earnings and market breadth, and "AI not ANYWHERE near bubble territory."

Looking even further down the road, Bank of America sees the S&P 500 at 7,200 in 12 months, citing many of the same conditions. However, it notes that company EPS guidance is robust and companies can live into the rich valuations and optimism of management.

Update: 7:46 a.m. ET

Equity Futures Rise To Start Market Week

With about two hours left until the market opens, U.S. equities are tilting towards a green start to the week. Futures for all four major benchmarks are in the green, led by the Russell 2000 (+0.58%) and Nasdaq Composite (+0.56%). The S&P 500 (+0.44%) and Dow (+0.34%) are also coming along with.

Update: 7:15 a.m. ET

Everything Happening (That We Know Of)

Good morning. Taken together, the third quarter has had its twists and turns, thanks to a bounce in earnings quality, heavily-watched economic data reports, and speculation around the Fed's cut. But with just two more trading days left until we close this fascinating chapter in markets, it's starting to feel more and more like a distant dream.

In the quarter, stocks continued a fantastic bounce from April lows, putting all four indexes at record highs. The Nasdaq is now up 16% year-to-date, followed by the S&P 500 (+12.8%), Russell 2000 (+9.6%), and Dow (+9%). And returns in tow, investors remain radically bullish.

Heading into the fourth quarter, equity valuations are seen as increasingly overvalued; by some measures, they're now boasting premiums not seen since 2020 — and even before then. And thanks to a slew of factors, market participants are banking on up to two more Fed cuts through year-end.

Really, the only thing that's looking a little awry are rising odds of a government shutdown, which could cast shadows on the U.S. markets if it tees off on Oct. 1. It could soften excitement in the markets heading into the historically strongest quarter of the year; even more so if it lasts awhile.

Shutdowns have not historically put much of a dent in the markets or economy, but Barclays warns that it could delay the release of key economic data (like jobs reports, CPI, and retail sales) and temporarily distort GDP or job data. It could also result in the furloughing of thousands of government employees, tilting the Fed towards more easing.

All of that is probably not fantastic news, but it'll have to compete with the start of a new earnings season, which is seen continuing the bounce back from April's tariff tiff. Speaking of which, let's touch on the companies and insights we'll be wrapping Q3 with:

Earnings Today: Carnival, Jefferies, Vail Resorts

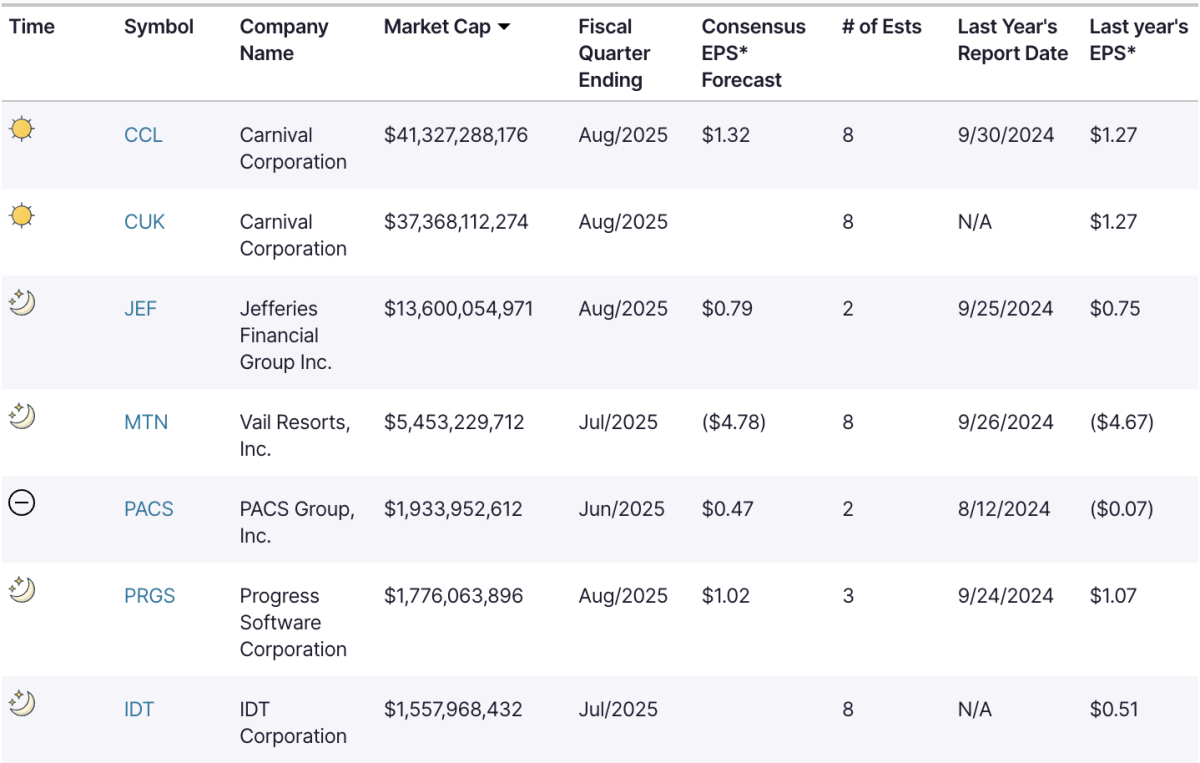

Despite it being Monday, Nasdaq says that we'll be good for 27 earnings reports today, including Carnival (CCL) , Jefferies Financial Group JEF, and Vail Resorts (MTN) .

Here's the six firms with a market cap over $1 billion:

Economic Events & Data

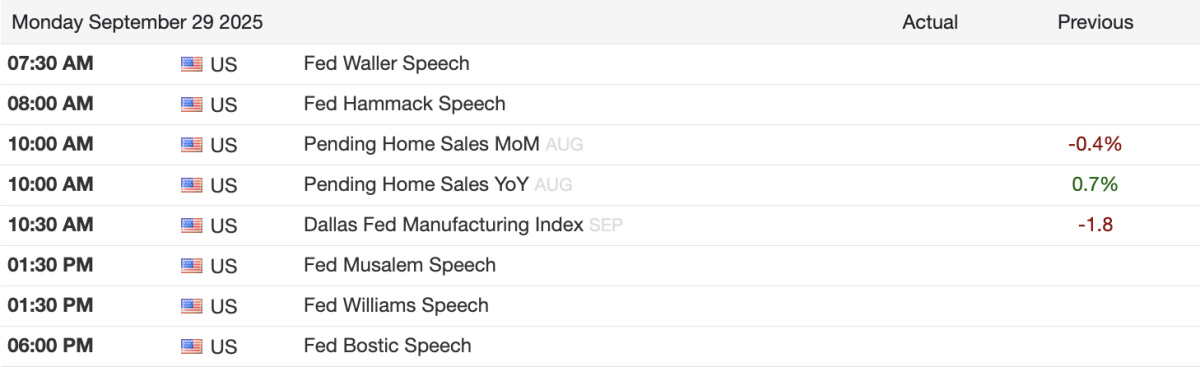

Today, we'll hear commentary from five Fed Governors, starting with Chris Waller and Beth Hammack (Cleveland Fed) this morning.

After their two cents, we'll get two data points: Pending Home Sales and the Dallas Fed's Manufacturing Index. Both have seen declines in three out of the last four months.

Rounding out the day, the Fed's Alberto Musalem (St. Louis), John Williams (New York), and Raphael Bostic (Atlanta) will deliver remarks.

What's Your Reaction?