Stock Market Today: Stocks sink as efforts to avert gov't shutdown fail

A government shutdown will begin at 12:01 a.m. ET on Wednesday

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet's Stock Market Today for Sept. 30, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: Ongoing (7:44 a.m. ET)

A.M. Update: Futures Red to Start Last Day of Q3

At last glance, all four U.S. equity benchmarks are trading to the downside in futures trading.

Here are a handful of stories that are making headlines this morning:

Exxon (XOM) to cut 2,000 jobs as part of long-term restructuring

New tariffs on timber and lumber (25%), foreign films (100%), and certain pharmaceuticals (100%) will go into effect tonight after midnight

EchoStar SATS is reportedly looking to sell some of its $10 billion in AWS-3 wireless spectrum to Verizon Communications (VZ)

Spotify (SPOT) CEO Daniel Ek will shift into the role of executive chairman; Gustav Soderstrom and Alex Norstrom will take over the company as co-CEOs

On Holding ONON COO Sam Wenger will step down after eight years

Boeing (BA) is reportedly starting work on a successor to its beleaguered 737 MAX jet, per WSJ

Container freight prices have hit a two-year low due to weaker U.S. demand

Update: 7:30 a.m. ET

Everything Happening (That We Know Of)

Good morning. It's the last day of the third quarter. It's also looking increasingly sure to be the last day that the U.S. government will operate as usual, at least for a few days, as funding will expire just after midnight tonight. With that, the government will shut down.

It'll be the 21st shutdown since FY 1977 and the first shutdown since 2019, per Bank of America. At this stage, we don't know at this point how long the government shutdown could last, but the average one has lasted eight days.

We do know that the longer it lasts, the more it stands to delay the release of key economic data. And with the Fed's October policy meeting just weeks away, that's likely to invite increasingly dovish bets.

That might not be economically impactful by itself, but we'll also likely see thousands of government employees furloughed during the shutdown, plus an unknown amount of jobs which might be permanently axed as part of mass layoffs, inviting even more dovishness from the central bank.

In anticipation of the shutdown tonight, longer-dated Treasurys have seen a jump in value; stocks, the dollar, and gold have declined.

Here's the roundup of what we have on deck today:

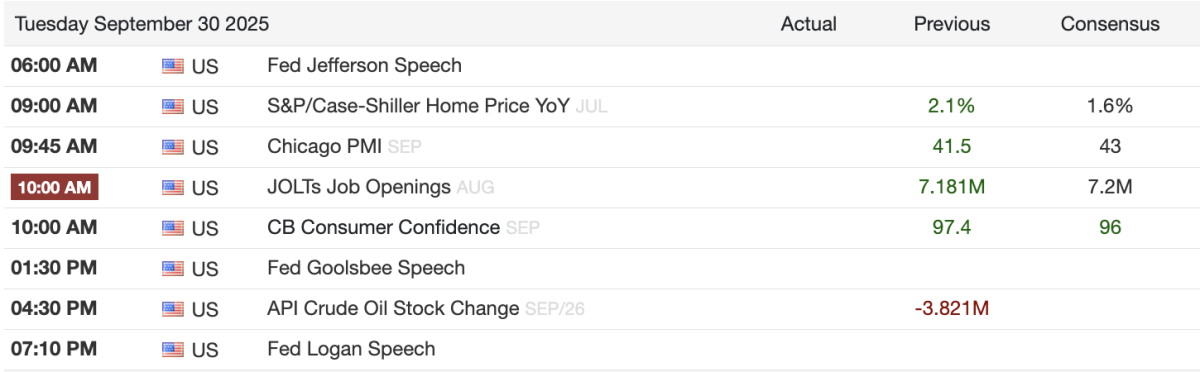

Economic Data & Events: Home Price, JOLTs, CB Consumer Confidence

With the Bureau of Labor Statistics (BLS) confirming that the government shutdown will delay the release of key economic data, today's JOLTS report might be the last 'on time' report that we see for awhile.

In the meantime, we will continue getting data from private firms and regional Fed banks, plus commentary from Fed leaders; much as we will today. S&P/Case-Shiller, Chicago PMI, and the Conference Board's Consumer Confidence reports are all out this morning.

Here is all of the data and events on deck for today:

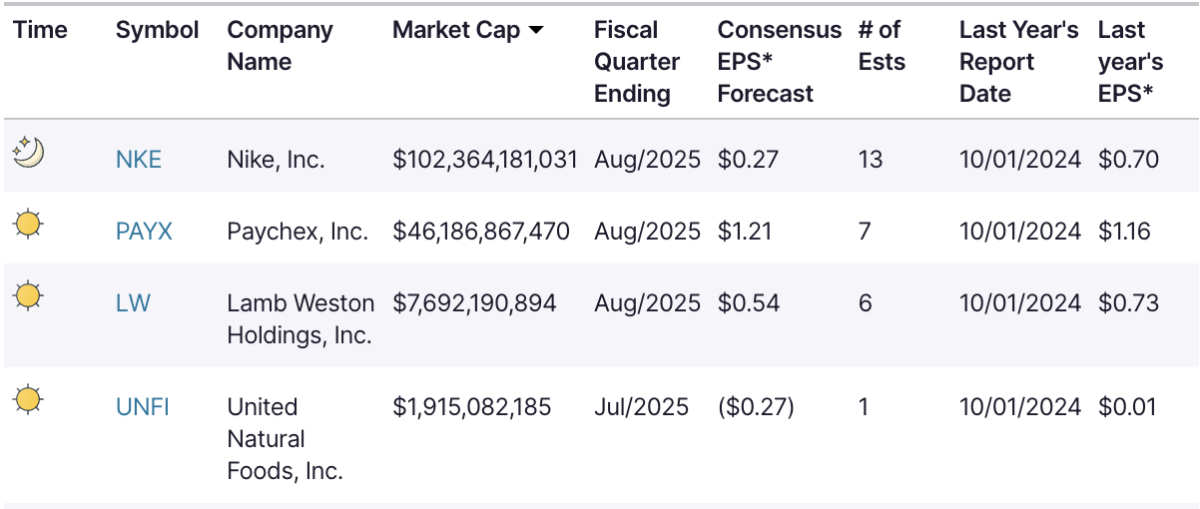

Earnings Today: Nike, Paychex, Lamb Weston

While the government shutdown could be front and center in the conversation for a period of time, it's likely that investors will turn their attention to Q3 earnings in the next few weeks.

Before we jump to that, we do have a few more reports today, though. On the final day of the third quarter, we have reports from Nike (NKE) , Paychex (PAYX) , Lamb Weston LW, and United Natural Foods (UNFI) .

Here are the reports >$1 billion market cap, per Nasdaq:

What's Your Reaction?