Tesla Stock Dip: Here's Where the Shares Find Support

Tesla stock is under pressure after reporting its second-quarter-delivery results. Here's where the shares should have support.

Tesla stock is under pressure after reporting its second-quarter-delivery results. Here's where the shares should have support.

Tesla (TSLA) - Get Free Report shares exploded in the first quarter, rising 69%. But for the longs, the shares of the Austin electric-vehicle group are starting off Q2 on the wrong foot, down about 5.5% at last glance.

The decline comes amid two factors. First, after an impressive finish to last week (and last quarter), tech stocks are seeing a bit of profit-taking on Monday.

Second, Tesla reported its quarterly delivery results.

As reported by TheStreet's Martin Baccardax, “Tesla delivered a record 422,875 new cars over the three months ended in March, the company said in a statement, up 36.4% from a year earlier and 4.3% north of the 405,278 tally reached over the three months ended in December.”

Don't Miss: Betting on Wynn Resorts Stock as Breakout Looms

Despite the record results, investors don’t seem impressed. Remember, though, that investors also didn't initially embrace Tesla’s fourth-quarter results, reported in early January. The shares bottomed a few days later and then more than doubled.

Given how far Tesla stock has rallied over the past few months, I don’t expect that outcome from here, but that doesn’t mean the stock’s rally is coming to an end.

Trading Tesla Stock

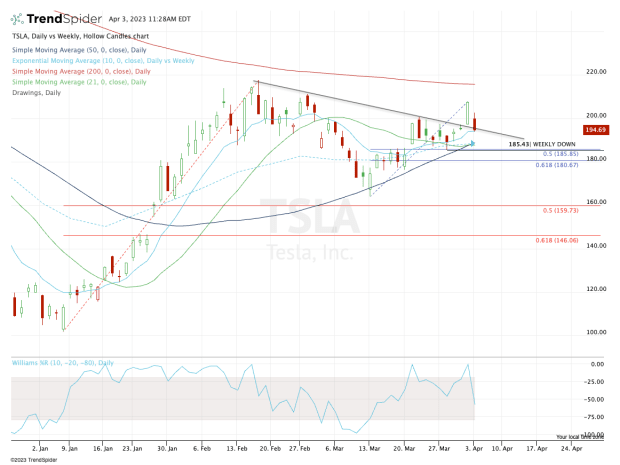

Chart courtesy of TrendSpider.com

From last week’s low to Friday’s high, Tesla stock rallied more than 12%. Now it's pulling back, and aggressive buyers are trying to buoy the stock around its 10-day moving average and the topside of its prior downtrend resistance mark (black line).

This is the first line of defense for the bulls. If it holds, look for a move back above $200, followed by a potential test of last week’s high near $207.75.

If the selling pressure continues, the $185 to $188 area has to be on traders’ radar.

There we find the 10-week, 21-day and 50-day moving averages. That range also contains the 50% retracement and last week’s low. This would be a key area for the bulls to hold on a more sustained selloff.

Don't Miss: Buy Johnson & Johnson Stock and Its 3% Dividend Yield?

If Tesla stock starts closing below these measures — or if it closes below $180 — then investors will be forced to zoom out and look at some larger downside levels.

Specifically, the $160 to $164 zone should be on watch. That contains the 50% retracement of the entire 2023 rally, as well as the March low. Below that and the 61.8% retracement near $146 is in play.

Remember, along with Nvidia (NVDA) - Get Free Report, Tesla stock has been among the best-performing large cap stocks over the past few months. One or two bad days of price action do not necessarily spell the end of its run.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

What's Your Reaction?