Veteran fund manager issues blunt warning on Nvidia stock

This is what could happen next to Nvidia shares.

If you haven't read any news stories concerning Nvidia (NVDA) , well, what's your secret?

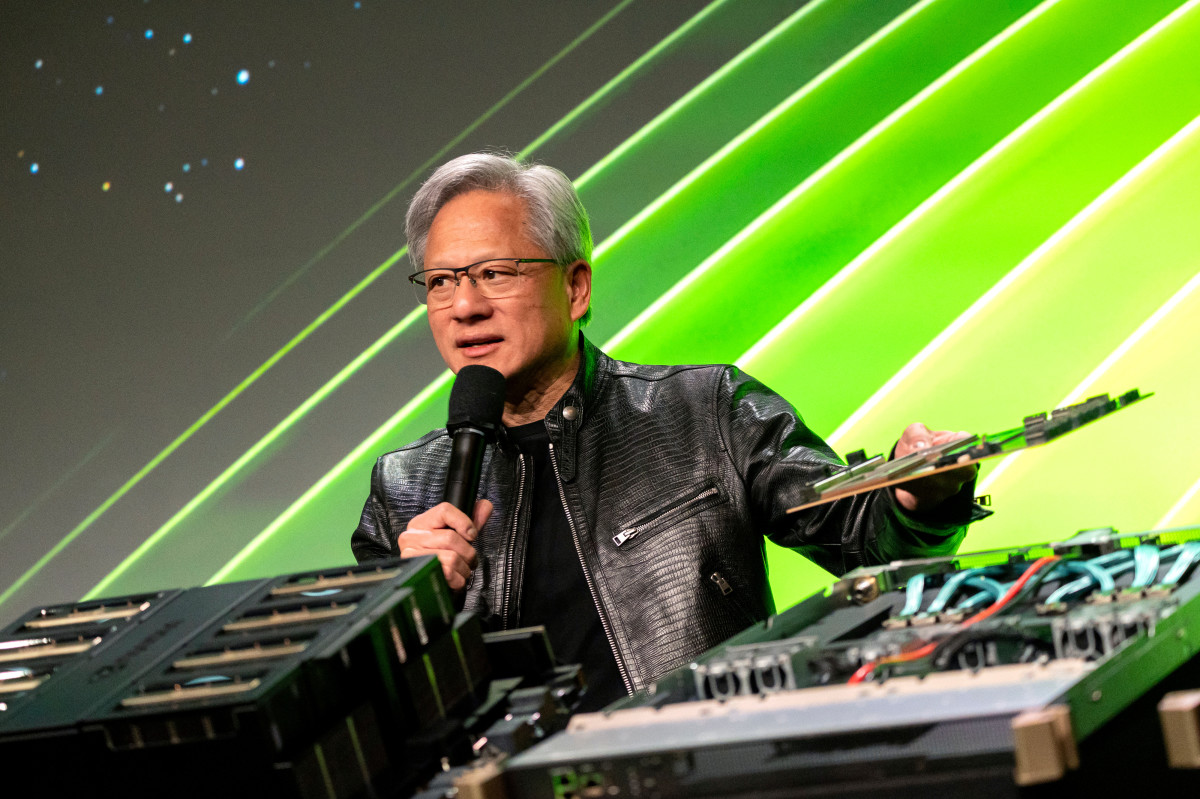

The artificial-intelligence-chip maker, which is also the market-cap behemoth of the moment, has been cropping up in any number of financial reports for quite a while now.

Related: Nvidia earnings seal Big Tech stock dominance

The stock reached a record on Tuesday after reports said Tesla (TSLA) Chief Executive Elon Musk's startup, xAI, is building a supercomputer to be powered by Nvidia's chip technology.

Musk reportedly said that xAI would need 100,000 semiconductors to train and run the supercomputer, which he said would be running by fall 2025, according to The Information.

When completed, the connected groups of chips would be at least four times the size of the biggest graphics processing unit clusters that exist today.

Nvidia has powered nearly a quarter of the S&P 500's return with its year-to-date advance of around 115%.

The company's recent fiscal-first-quarter report included a fivefold increase in revenue, which topped $26 billion, and a massive surge in net income, a bottom line of $15.24 billion.

Data-center revenue quintupled (up 427%) year over year to $22.6 billion.

Nvidia also announced a a 10-for-1 stock split, and Antonio Ernesto Di Giacomo, market analyst for Latin America at XS.com, said the move represented "a significant milestone" in the chipmaker's history.

Analyst says stock split is a 'strategic move'

"By splitting its shares, the company not only improves accessibility and liquidity but also sends a signal of confidence in its future growth," he said.

"Employees and investors will have more flexibility in managing their holdings, and the company could see an increase in its shareholder base, which is beneficial for its long-term sustainability."

Di Giacomo sees the stock split, which is payable June 7 to holders of record June 6, as "a strategic move that reflects its strong financial performance and leadership in the AI sector."

Related: Single Best Trade: Wall Street veteran picks Palantir stock

"This event presents an opportunity for more investors to participate in the company's growth, benefiting from its innovative technology and dominant market position," he added. "With an impressive track record and a clear strategy for the future, Nvidia continues to be an attractive option for investors of all types."

Analysts had been concerned that a gap between Nvidia’s current H100 chips and the new Blackwell offering would create a kind of air pocket in revenue as customers dumped orders for the older chips and waited for the newer system.

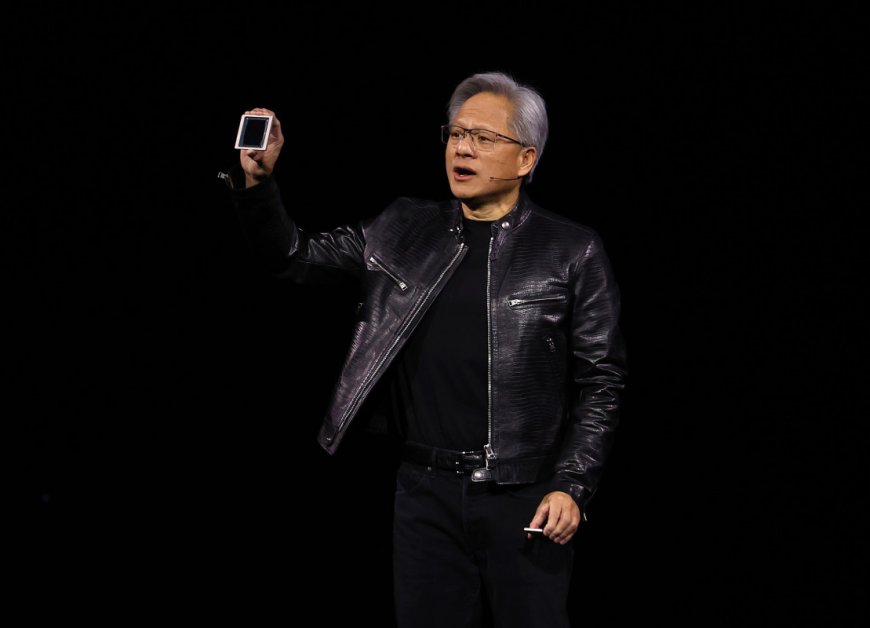

However, Nvidia Chief Executive Jensen Huang told investors that clients can “easily transition from H100 to H200 to B100,” adding that “Blackwell systems have been designed to be backwards compatible.”

TheStreet Pro's Doug Kass has done his own deep dive into the Sea of Nvidia to see what he could see.

Kass, who says he is a tech-sector generalist, said the lead time on data centers is years.

"They take a long time to build," he wrote in a recent column "It is really hard to even find power and water, which they consume a ton of. These are new DCs that need to be architected very differently from existing capacity."

The fund manager said that he was under the impression that people "are having a really hard time adding incremental DC capacity."

"It is complicated and it takes a long time to get these things up and running," Kass said.

Fund manager: 'The money keeps flowing'

He noted that specialized cloud-services provider CoreWeave, which is backed by Nvidia, is raising $7.5 billion in debt from financiers led by Blackstone and Magnetar Capital to scale its infrastructure to meet rising artificial intelligence workloads.

The deal is one of the largest debt financing rounds for a startup and adds firepower to CoreWeave's balance sheet as it looks to double its number of data centers to 28 this year, Reuters reported.

More AI Stocks:

- World's biggest hedge fund boosts its stake in Nvidia stock

- Analysts update Dell stock price targets on Tesla-server win

- Microsoft delivers a blow to Nvidia

"So, the money keeps flowing," Kass said. "The structure of these deals, however, continues to blow my mind. It feels like a combination of Enron and the CDO (collateralized debt obligation) craze during the housing bubble in 2008."

He added that the "same guys (e.g. Magnetar) are involved too, amongst others."

Kass, president of Seabreeze Partners Management, said that "at least mortgages were collateralized by homes, which appreciate in value as opposed to depreciate, and you also know exactly what their use case is and that there is real end demand for them."

In January, the Federal Trade Commission said it had issued orders to five companies requiring them to provide information regarding recent investments and partnerships involving generative AI companies and major cloud service providers.

The orders were sent to Google parent Alphabet (GOOG) , Amazon (AMZN) , AI start-up Anthropic PBC, Microsoft (MSFT) and OpenAI, developer of ChatGPT, which is backed by the software giant.

FTC Chairwoman Lina Khan said the study would “shed light on whether investments and partnerships pursued by dominant companies risk distorting innovation and undermining fair competition.”

"At the end of the day and on a purely short-term basis, Nvidia's shares got cheaper on a multiple basis after earnings and guidance," Kass said. "The question longer term remains: Is the use case there or not, and to what degree?"

"That is another thing I do not have the answer to and I am on the sidelines on," he added.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?