Veteran fund manager issues dire stock market warning

Here's what may happen to stocks next.

The stock market loves rock climbing a wall of bother.

We've definitely viewed that over the past two months. No topic bother over mounting U.S. debt and tariff impacts on inflation and the financial system, the S&P 500 has rallied 20%. Technology stocks hold performed even better. The Nasdaq Composite, dwelling to most tech leaders, is up 27%.

The rally since President Trump paused most reciprocal tariffs introduced on April 2, so-called "Liberation Day," for 90 days has been spectacular.

Nonetheless, there is good reason of dispute, severely since the S&P 500 is anxious all-time highs and its valuation is arguably changing into frothy but another time.

Linked: Bank of The US unveils unpleasant Fed hobby rate forecast for 2026

The chance that stocks could lose some of their luster after their rally has caught the eye of many Wall Avenue veterans, including long-time hedge fund manager Doug Kass.

Kass has been navigating the markets since the Seventies, including as overview director for Leon Cooperman's Omega Advisors, and his trip thru good and bad instances helped him as it could probably be predict the promote-off earlier this year and the market bottom in April.

This week, Kass updated his stock market outlook, including an incredibly long checklist of crimson flags for why traders wants to be cautious. Report source: TheStreet

Stocks changed into richly valued (but another time)

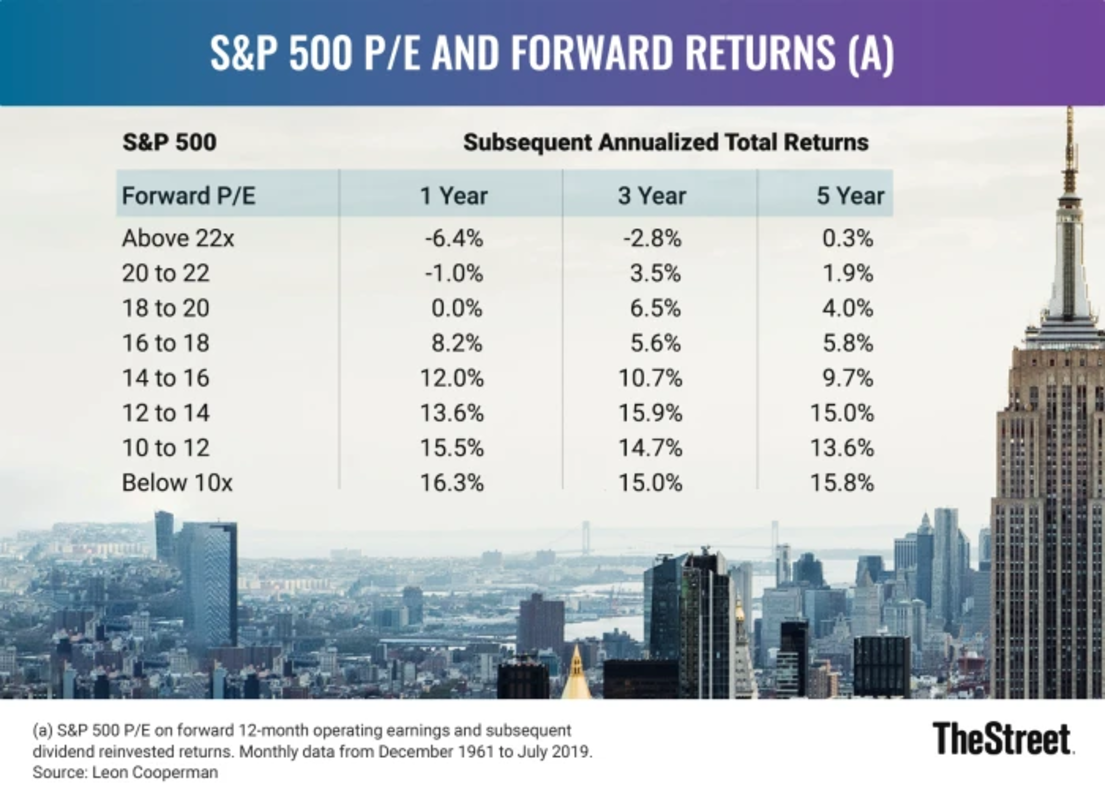

The correct position-up for appealing returns is a market that is oversold ample to hold reset forward trace-to-earnings ratios to ranges attain the decrease surrender of their historical averages.

In February, when stocks were notching all-time highs factual sooner than the tariff-fueled reckoning, the S&P 500's P/E ratio eclipsed 22, and most sentiment measures were flashing overbought.

Linked: Legendary fund manager sends blunt 3-note message on financial system

The promote-off thru early April erased critical of that frothiness, riding the S&P 500's P/E ratio to 19 and under five-year averages of 19.9 — no longer bargain-basement priced, nevertheless low ample to serve catapult stocks from severely oversold readings. As a reminder, CNN's Wretchedness & Greed indicator changed into at "Crude Wretchedness," and bearishness by most measures changed into sky high within the days after the April 2 tariff announcement.

Now that the stock market is aid attain its highs, sentiment has changed into optimistic but another time, with CNN's measure flashing "Greed." Due to earnings forecasts haven't materially increased, the S&P 500's P/E ratio is north of 21 — typically cheap. Report source: TheStreet

"Valuation multiples expanded in a relief rally from mid-April to now and the S&P 500 now trades at 21x forward earnings, 35% above average," wrote Bank of The US analysts to purchasers on June 14. "The index appears to be like to be like statistically costly relative to its possess historical past on all 20 of the valuation metrics we observe."

Hedge fund manager spotlights causes stocks could plunge

Doug Kass has tracked the market successfully thru Seventies skyrocketing inflation, 1980s double-digit hobby rates, the Savings & Mortgage disaster, the Web enhance and bust, the Great Recession, a virulent disease, and the undergo market of 2022.

He is viewed a lot over his virtually 50-year occupation, making his stock market warning now rate being attentive to.

"Equities haven't been this unattractive since unhurried 2021," wrote Kass on TheStreet Pro. "There may be little room for disappointment.

Extra Economic Analysis:

- Hedge-fund manager sees U.S. changing into Greece

- A severe enterprise is slamming the financial system

- Reviews may point as to whether or no longer the financial system is toughing out the tariffs

The dispute that stocks hold priced in critical of the coolest news liable to terminate from ongoing swap negotiations will hold merit, given this week's China swap deal news left tariffs at sleek ranges attain 55%. As the affect of tariffs flows thru offer chains, inflation may initiate rising interior months, crimping household and enterprise spending.

Unfortunately, that is never any longer basically most likely the greatest risk on Kass's mind. The money manager provided a protracted checklist of threats that could derail stocks' rally.

It is miles a protracted checklist, so that you may desire to own up your beverage. He writes:

- Political and geopolitical polarization and competition will doubtlessly translate into less political centrism and a diminished dispute for deficits, growing structural uncertainties, runt fiscal self-discipline, and imprudence across the globe ... and for the seemingly of bond markets to "disanchor."

- The cracks within the foundation of the bull market are multiple and are deepening, nevertheless they are being disregarded (as market constructing adjustments hold resulted in fee momentum [fear of missing out] being most popular over trace and total sense).

- With the S&P 500 Index at around 6000, the downside risk dwarfs the upside reward for equities — in a ratio of about 5-1 (negative).

- Valuations (a 22-instances forward Ticket Earnings Ratio) and (consensus) expectations for financial and company revenue enhance are all inflated.

- Being brushed off are JPMorgan CEO Jamie Dimon's and others’ dour feedback on complacency and a scrutinize that the corporate credit market is "ridiculously over-stretched.”

- Fetch out regarding the soft files (overview closing week's ragged ISM and climb in jobless claims) to pass into (and weaken) the laborious files led by a slowing housing market liable to produce huge attain-term proof of the exposure and vulnerability of the center class.

- Below style-line financial enhance (housing will lead us decrease) coupled with sticky inflation lie ahead ("slugflation") — poor for a Federal Reserve which has to compose more and more no longer easy choices.

- Corporate revenue enhance (rising +13% in 1Q2025) will markedly decelerate in this year’s 2d half of.

- The equity risk premium is at a two-decade low — in total in step with a roam in equities.

- The S&P Dividend Yield is at a attain-file low of 1.27% — and the unfold between the dividend yield and the ten-year U.S. Treasury point to yield has no longer typically been as huge. With so many seemingly adverse outcomes, my baseline expectation is for seven lean months ahead over the balance of 2025.

Kass is clearly frightened that any single or aggregate of headwinds could reason stocks to present aid some positive aspects.

What should traders plot? Over time, the stock market goes up and to the factual, so those with long-term horizons are infrequently best off sticking to their thought, recognizing that there shall be bumps and bruises along the formula.

Nonetheless, traders with a shorter-term horizon could desire to rein in some risk, pocket some revenue, and amplify "dry powder" to rob good thing about any weakness if Kass's warning proves prescient.

Linked: Used fund manager revamps stock market forecast

What's Your Reaction?