Wall Street billionaire sends one-word AI warning

Hyperscalers are plowing hundreds of billions into artificial intelligence.

Artificial intelligence may seem like a new concept, but it's fascinated technologists, inventors, and science fiction buffs for decades.

The mathematician and computer scientist Alan Turing contemplated AI computers in the 1950s, and Rand Corp. built the first AI program in 1956. Isaac Asimov wrote "I, Robot" in 1950, and movie director James Cameron's "The Terminator" was released in 1984.

However, it wasn't until OpenAI's ChatGPT launched in November 2022 that AI went mainstream. ChatGPT was the fastest app to reach 1 million users, and its widespread embrace kicked off a torrent of AI research and development, including from some of the biggest companies on the planet.

Big tech capital expenditures last quarter:

- Meta Platforms: $17.01 billion.

- Alphabet: $22.4 billion.

- Microsoft: $24.2 billion ($17.1 billion excluding finance leases).

- Amazon: $31.4 billion.

Source: Company SEC filings.

The money being spent is undeniably eye-popping, and CEO's believe it's necessary, including OpenAI's Sam Altman, who recently said:

You should expect OpenAI to spend trillions of dollars.

The stakes are high and have caught the eye of investors, including Wall Street billionaire David Einhorn. Einhorn is the portfolio manager behind Greenlight Capital, a hedge fund with $2.3 billion in assets under management.

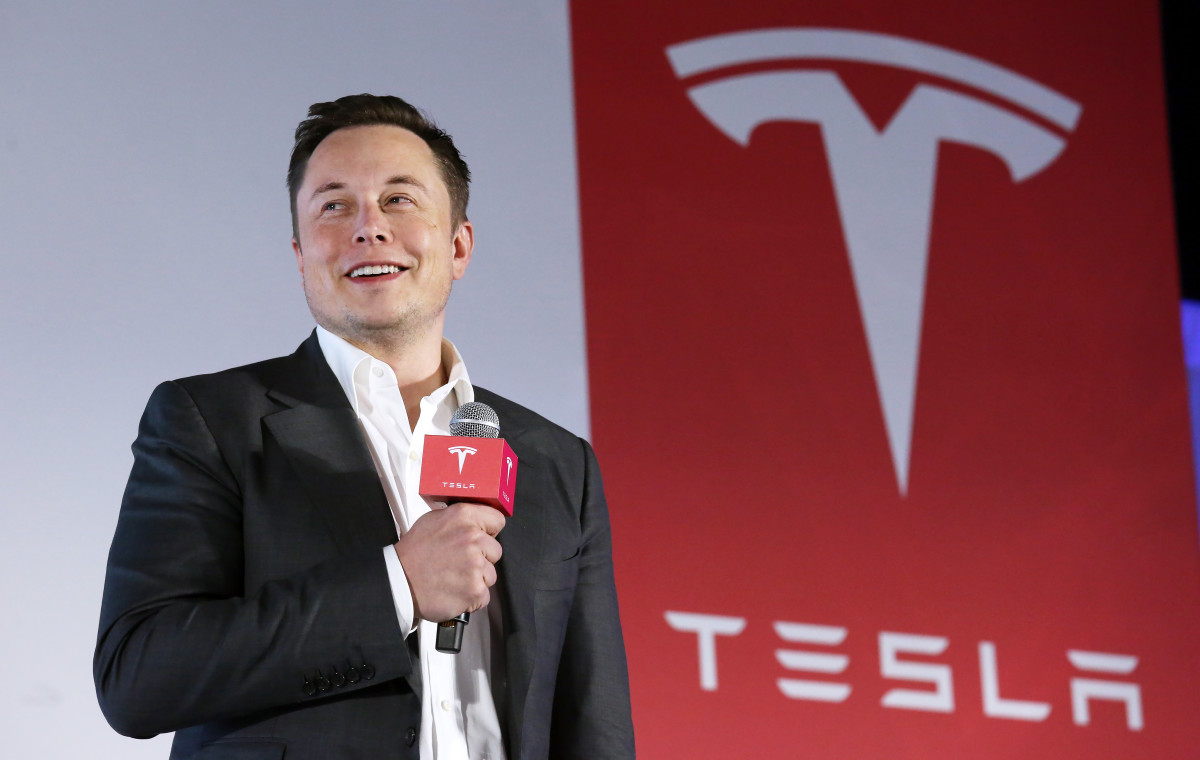

Einhorn recently commented on the AI spending frenzy, and given his 30+ years on Wall Street, investors may want to consider his opinion. Bloomberg/Getty Images

Einhorn pours cold water on AI spending tsunami

Companies are slated to spend between $500 billion and $1 trillion a year on the nuts-and-bolts necessary to support artificial intelligence.

Much of that money is being spent on data centers equipped with super-fast next-generation graphic processing unit (GPU) chips from Nvidia, which are much better suited to handling the compute-heavy workloads associated with training and operating AI chatbots and agentic AI programs.

Related: Bank of America revamps Palantir stock price target

Those programs are data intensive, requiring significant upgrades to preexisting network servers and switches connecting them. As a result, the spending has been a boon not only for Nvidia, which controls 90% of the AI GPU market, but makers of servers, like Dell and Supermicro, memory chips, like Micron, and storage, including Seagate.

Today's action is reminiscent of the flood of IT spending in the late 1990s, at the dawn of the Internet.

That's worrisome to Einhorn, who described the sheer size of the dollars earmarked for AI with one word: "Extreme."

“The numbers that are being thrown around are so extreme that it’s really, really hard to understand them,” said Einhorn in Simplify Asset Management panel.

Companies IT budget shift to AI could be brilliant, but rationale offered by companies for the outlays lately has been more "because we have to" than a carefully laid-out return-on-investment plan.

Einhorn thinks there is a "reasonable chance that a tremendous amount of capital destruction is going to come through this cycle."

That's shorthand for a lot of the stuff people are investing in won't pan out.

A flurry of mega deals in AI

The risk of companies burning money on AI projects isn't denting spending appetite yet. Recently, there's been a wave of high-profile mega deals involving big money from the top players.

Recent AI spending deals:

- Nvidia plans to invest $100 billion in OpenAI to help fund capacity build-out.

- Oracle and OpenAI inked a $300 billion cloud deal over five years.

- Nvidia is backstopping CoreWeave unused AI capacity to the tune of $6.3 billion.

- Microsoft committed to a $17.4 billion agreement with Nebius.

And it doesn't seem like hyperscalers are ready to slow their spending on data centers, either. Meta Platforms CEO Mark Zuckerberg aims to invest $64 to $72 billion this year, and worries that's "not being aggressive enough."

Long-time market analyst Beth Kindig recently wrote on X:

The AI data center server market is projected to grow at a 38% CAGR from 2024 to 2029, reaching more than $580 billion, or 5x from 2024’s $115 billion.

If you combine all the spending done on AI, including developing agentic AI apps that could one day replace or augment many jobs, the amount spent this year totals an eye-popping $1.5 trillion in 2025, according to Gartner.

Next year, Gartner says the figure will be even higher:

Looking towards 2026, overall global AI spending is forecast to top $2 trillion, led in large part by AI being integrated into products such as smartphones and PCs, as well as infrastructure.

A reckoning? Only time will tell

This isn't the first time companies greenlit massive spending to take advantage of technology innovation (and it won't be the last).

More technology:

- Analysts unveil shocking Oracle stock forecast

- Morgan Stanley warns AI could sink 42-year-old software giant

- T-Mobile CEO sends Apple iPhone message

During the Internet boom, companies tripped over themselves to invest in the equipment necessary to build the Internet's backbone, causing shares in Intel, Cisco, and many others to surge.

"Real IT investment was especially strong between 1995 and 2000, averaging 24 percent per year and adding an annual average of over 3/4 percentage point to GDP growth," according to the Federal Reserve Bank of San Francisco. "In 1990, nominal investment in IT goods totaled just $131.5 billion, a bit less than one-third of private nonresidential equipment and software (E&S) investment. By 2000, IT investment had surged to $401.6 billion."

That spending fueled a lot of growth, but it also created a bubble that, when it burst, bankrupted many companies and, unfortunately, individual investors who tossed caution to the wind, buying up pre-revenue companies on promise rather than profit.

"In 2001, IT investment contracted sharply, with real IT investment falling nearly 11 percent and nominal investment plunging almost 17 percent," according to the San Francisco Fed.

The stock market tumbled as spending collapsed.

S&P 500 returns during the Internet bust:

- 2002: -23.4%

- 2001: -13%

- 2000: -10.1%

Even stocks that survived the retreat took years and sometimes over a decade to recover to their Internet boom highs. For instance, Cisco still hasn't reached its March 2000 peak of nearly $80, and it took Intel until 2014 to eclipse its Internet boom peak.

Whether we see something similar this time around isn't uncertain, but there is a lot of speculation, and Einhorn isn't overly enthusiastic about the economic outlook.

“I’m a little bit more of the view that we’re heading into or have been in a recession," warned Einhorn.

Related: Nvidia OpenAI blockbuster deal raises major questions

What's Your Reaction?