Analyst revises Amazon stock price target on retail margins potential

This is what could happen next to Amazon shares.

The people at Ranpak Holdings (PACK) are probably feeling pretty good right about now.

The Concord, Ohio-based company makes paper-based packing for shipping goods and merchandise.

Related: AMD bets on huge market to win AI chip battle with Nvidia

Ranpak's motto is "Deliver a Better World," but they were on the receiving end of some good news when Amazon (AMZN) said it replaced 95% of the plastic air pillows from delivery packaging in North America with paper filler.

The e-commerce giant said this move was part of its multi-year effort to remove plastic delivery packaging from North America fulfillment centers.

"To date, this will be Amazon’s largest plastic packaging reduction effort in North America and will avoid nearly 15 billion plastic air pillows annually," Amazon said in a statement. "For Prime Day this year, nearly all of our customer deliveries will not contain plastic air pillows."

Analyst sees 'bearish and bullish factors'

The shift to paper filler began in October, when Amazon began to test the eco-friendly alternative at a fulfillment center in Ohio.

Amazon is Ranpak's largest direct customer, and Craig-Hallum analyst Greg Palm said the announcement will directly benefit Ranpak and should create urgency across the rest of e-commerce to make the change as well.

Related: Analysts adjust Amazon stock price target after earnings

Palm has a buy rating on Ranpak's stock with a price target of $10. While the move was not a surprise, he said commentary indicates that the timeline was well ahead of expectations.

There's a lot to unpack when you're dealing with a massive outfit like Amazon — is that an awesome segue, or what? — and TheStreet Pro's Bruce Kamich recently took a close look at the company's financials.

He noted that the company's investments in infrastructure have hurt their profit numbers, "but AI, advertising and cloud services could help Amazon’s growth rebound."

"Bearish factors and bullish factors abound," he said. "Do you see the charts as bullish or bearish? This is the dilemma that's facing traders all the time. Let the price action guide your actions."

Amazon is scheduled to report second-quarter earnings in a few weeks.

In April, Amazon reported first-quarter earnings of 98 cents a share, more than triple the 31 cents of the year-earlier period and beating the FactSet analyst consensus of 84 cents.

Revenue totaled $143.3 billion, up from $127.4 billion a year earlier and coming in ahead of FactSet's call for $142.6 billion.

Amazon Web Services, the e-commerce giant's cloud computing platform, posted quarterly revenue of $25 billion, up 17% year-over-year, beating Wall Street’s estimates of $24.5 billion. Operating income was $9.4 billion, up 84% from a year ago.

Retail margins 'on the cusp of profitability, Baird says

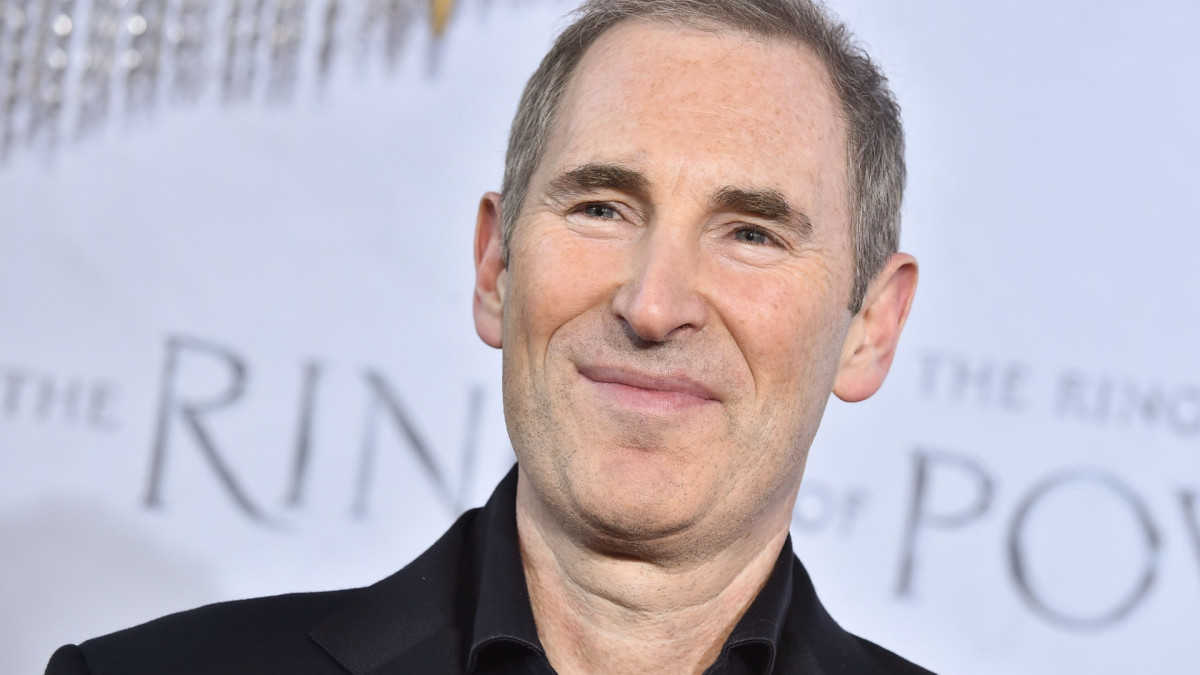

“We expect the combination of AWS' reaccelerating growth and high demand for GenAI to meaningfully increase year-over-year capital expenditures in 2024, which given the way the AWS business model works is a positive sign of the future growth," CEO Andy Jassy told analysts.

“The more demand AWS has, the more we have to procure new data centers, power and hardware," he said. "And as a reminder, we spend most of the capital upfront."

More Retail Stocks:

- Whole Foods makes major change customers will notice right away

- Bankruptcy Watch: Popular retailer stops taking orders, website down

- Walmart rival launches an Amazon perk that should scare competition

"But as you've seen over the last several years," Jassy added, "we make that up in operating margin and free cash flow down the road as demand steadies out."

Brian Olsavsky, chief financial officer, told analysts during the company's earning call that “we expect the AWS operating margins to fluctuate, driven in part by the level of investments we are making in the business.”

Olsavsky said Amazon had negative free cash flow in 2021 and 2022, immediately after the pandemic "as we had doubled the size of our operations network and had a lot of other expenses."

This was followed in 2023 with Amazon's highest free cash flow ever, he said, adding that "we're repaying some of the debt that we had taken on during that negative free cash flow period."

"We have reached a high watermark at the end of Q1 last year," Olsavsky said. "And since then and then through this year, we'll pay that down over $25 billion."

AWS, by the way, recently announced a $230 million commitment for startups around the world to accelerate the creation of generative AI applications.

The funding will provide startups, especially early-stage companies, with AWS credits, mentorship, and education to further their use of AI and machine learning technologies.

Baird analyst Colin Sebastian raised the firm's price target on Amazon.com to $213 from $210 and kept an outperform rating on the shares.

With retail margins on the cusp of profitability, offset in part by moderating AWS margins, Sebastian believes there is upside potential to out-year street margin estimates and continue recommending the shares.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?