Analyst who forecast the S&P 500's rally unveils new Nasdaq 100 outlook

Here's what could happen next to the Nasdaq 100.

The stock market has taken its fair share of twists and turns over the past year. The S&P 500 began 2023 strong before sliding through March. Then, it rallied nicely higher until mid-summer before a painful retreat through October that left investors reeling, unprepared for the index's substantial rally since fall.

While the stock pops and drops have left many investors scratching their heads, they didn't surprise Real Money Pro Carley Garner.

In April, she correctly predicted the S&P 500 would rally; in July, she accurately forecasted stocks would fall; then, in November, she correctly said, "It's a bull market," predicting a rally that's since lifted the benchmark index by nearly 1,000 points to over 5,000.

The prescient predictions suggest that investors may want to pay attention to Garner's latest thoughts on what could happen to the tech-heavy Nasdaq 100 next. Spencer Platt/Getty

A stock market rally for the ages

The S&P 500's dramatic run-up from its October lows surprised many because there were plenty of reasons to worry.

While inflation was down from its 9% peak in June 2022, it re-exerted itself in late summer, causing many to wonder if the Federal Reserve's inflation war was further from being won than previously believed.

Related: How soon until the S&P 500 tops 6,000?

The economy's health was also uncertain, given the negative gross domestic product in the year's first half and year-over-year declines in S&P 500 earnings.

The potential for stagflation, an economy struggling without growth yet experiencing sticky inflation, led many to think that a recession and lower stock prices were guaranteed.

As a result, bearishness went mainstream. Investors able to generate 5% returns in short-term Treasuries flocked to them away from riskier stocks. Professional investors hedged portfolios, buying unprecedented amounts of bearish put options, short interest in many stocks swelled, and sentiment, as measured by several key gauges, flashed extreme fear.

The overwhelmingly negative sentiment, however, set the stage perfectly for the rally we've experienced.

Offside investors, convinced they'd eventually be proven correct for their bearishness, were slow to buy, even when evidence mounted that inflation had begun trending lower again, clearing the way for friendlier Federal Reserve interest rate policies.

Slowly and surely, and one by one, investors acquiesced, falling victim to "fear of missing out," or FOMO, and causing stocks to climb the proverbial wall of worry.

The S&P 500, powered by the largest technology stocks, including Amazon, Microsoft, and Nvidia, has soared by over 20%, packing what's typically years of historical returns into a roughly six-month span.

Related: Analyst who predicted Nvidia could eclipse $700 unveils new target

The strength in these big-cap stocks was most evident in the returns of the Nasdaq 100, an index comprised mostly of the largest companies in the technology sector.

Since October's low, the Nasdaq 100 has increased by over 25% thanks to stocks like Nvidia, which is up about 80% on optimism that skyrocketing spending on artificial intelligence would drive record revenue and profit from selling its AI chips.

The Nasdaq 100 reaches lofty levels

The market looks much different today than last fall when Garner predicted that stocks were too oversold and a big rally was likely.

Instead of fearfulness, investors arguably feel giddy. They've reversed bearish bets, replacing them with overly bullish bets using call options and leverage. Sentiment measures, such as survey responses, are flashing warning signs, suggesting too many may be tilting toward higher rather than lower stock prices. For example, CNN's Fear Index has registered "extreme greed" for most of the past month.

More Wall Street Analysts:

- Analyst who correctly warned Tesla stock could fall unveils new target

- Veteran fund money manager touts 'sleep-well-at-night' stocks

- Analysts revamp Amazon stock-price targets after earnings

Stock valuation has also climbed to historically high levels. The S&P 500's price-to-earnings ratio is above 20, at levels that correspond with uninspiring stock market returns over the following year. The P/E ratio for the Nasdaq 100 is higher, above 25.

As economist John Maynard Keynes famously quipped, “Markets can remain irrational longer than you can remain solvent.” Nevertheless, the seemingly relentless advance for tech stocks caught Garner's, prompting her to analyze what may happen to the Nasdaq 100 next.

Unfortunately for bulls, Garner's outlook following her analysis is concerning. While Garner leaves the door open for higher prices, a review of the Nasdaq 100 price charts since the dot-com bubble in 2020 leaves her cautious.

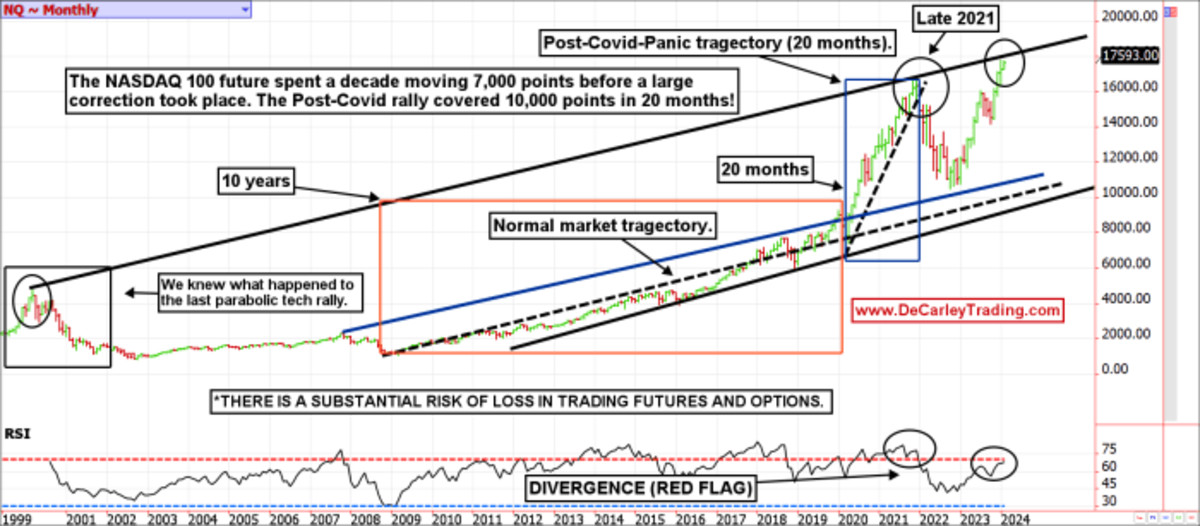

"If my memory serves me correctly, we haven't shared this monthly chart since late 2021," wrote Garner. "At the time, we were concerned about the unhealthy, steeply sloped rally. Since then, the Nasdaq 100 corrected from just under 17,000 to just over 10,000, later rallying back to make new all-time highs. However, those new highs are raising some red flags."

The red flag that concerns Garner is that the NASDAQ 100 has risen to the top end of a long-term resistance line dating back to 2000.

"The dotted black line represents a natural market slope on the provided monthly Nasdaq 100 futures market chart. It is easy to see that despite the digestion from late 2021 through the fall of 2023, the rally is still statistically ahead of schedule," wrote Garner. QST/Carley Garner

Garner's technical analysis of the Nasdaq 100 price chart leads her to a trendline that could present a stall point for the rally "at just under 18,000." Given that we're at 17,962, there's little room to run higher.

"Is this trendline arbitrary? Maybe, but in my experience, simple lines drawn on a chart work far more often than they should," said Garner. "Election years are generally good for markets, and the January barometer suggests 2024 is statistically set to be a positive one overall. Nevertheless, a correction seems imminent."

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?