Car insurance: How much is enough

Only one type of car insurance is mandatory for most drivers, but you may want or need more coverage.

Auto insurance safety is required to drive legally in fundamentally every state. Liability insurance safety is a wants to, but full insurance safety plan — which is non-obligatory and involves full and collision insurance safety — would per opportunity per opportunity be rate the launched rate should you drive a more recent vehicle.

Having the relevant level of insurance safety plan is excessive to retailer far flung from having to pay out of pocket after an accident. Specialists extra ordinarily than now not suggest a minimum of a hundred/300/a hundred in offender accountability insurance safety plan, but all persons’s insurance safety desires are actual. To make an an expert resolution about how a lot insurance safety plan to buy, let’s start through facts a taste of of the aspects of auto insurance safety and the way they work jointly.

What's vehicle insurance safety?

Drivers buy vehicle insurance safety to shield themselves and their property inner the match of an accident. Coverage safety plan pointers can duvet three forms of losses:

- Injuries or property smash that you just reason to others. Liability insurance safety pays for accidents or smash you inflict upon any various unusual or their property. Virtually all states require drivers to keep up a minimal amount of offender accountability insurance safety, but that amount varies from state to state and can bigger be insufficient to duvet the expenditures brilliant with a chief accident.

- Harm to your possess vehicle. Collision and whole insurance safety plan — with no sign of ending bundled with offender accountability insurance safety as full-insurance safety plan vehicle insurance safety — will pay for bodily smash to your possess vehicle. Collision insurance safety covers accidents where your vehicle strikes any various vehicle or a stationary object. Total covers your vehicle from theft, vandalism, serious climate and various non-collision occasions. States don't require such insurance safety, but should you could have bought a vehicle it definitely is financed or leased, your lender may require it.

- Injuries to yourself or to your passengers. Some forms of vehicle insurance safety pays on your medical expenditures. States with no-fault insurance safety regulations — which require you to file a claim with your possess insurer, regardless of who grew to change into at fault — with no sign of ending require non-public smash renovation (PIP) insurance safety plan to pay for these prices. In various states, you're in a location to bigger be capable to buy medical funds (MedPay) insurance safety to duvet such expenditures.

Shutterstock

What forms of vehicle insurance safety are there?

As you retailer for vehicle insurance safety, you're per opportunity to see comparatively a taste of insurance safety plan concepts. Some forms of insurance safety are valuable even as others don't look to be.

Liability insurance safety plan

With few exceptions, states require drivers to keep up a minimal amount of offender accountability insurance safety. On the determination hand, carrying a low level of offender accountability insurance safety plan must fruits in you paying a major amount of money out of pocket after an accident.

Kingdom wants vary, but a familiar state minimal-offender accountability insurance safety plan may grant best 25/50/25 in insurance safety plan. That breaks ultimate down to:

- $25,000 for bodily smash, per unusual

- $50,000 in bodily smash, per accident

- $25,000 in property smash per incident

Specialists suggest getting as a lot offender accountability insurance safety as you'd come up with the money for, at minimal 50/a hundred/50. But some insurance safety suggest extra.

“I don’t think all persons must have a lot lower than $300,000 in offender accountability,” says Karl Susman, marketplace an expert and owner of Susman Coverage safety plan Association in Los Angeles. As for bodily insurance safety plan, he notes: “It’s now not demanding to get $a hundred,000 smash on a vehicle as of late.”

Others inner the sphere motivate drivers to retailer in mind even elevated limits. Michael Silverman of Silver Lining Coverage safety plan Association in New York recommends his patrons carry $500,000 mixed single-limit insurance safety alongside with an umbrella safety for extra offender accountability insurance safety plan.

States may mandate various forms of insurance safety plan akin to underinsured/uninsured motorist insurance safety plan. Within the experience you dwell in a state with no-fault insurance safety regulations, also have non-public smash renovation (PIP) insurance safety plan.

Linked: 10 principal the way you may maximize your savings on a major vehicle rate now

Collision and whole insurance safety plan

Collision insurance safety covers smash to your vehicle it definitely is a fruits of colliding with any various vehicle or unparalleled a stationary object like a developing.

Total insurance safety applies to non-collision smash to your vehicle thanks to matters like fires or storms, as bigger as vandalism and theft.

Constantly talking bundled jointly as a part of full-insurance safety plan vehicle insurance safety, full and collision will duvet your vehicle up to its latest-day honest market magnitude or true money magnitude (ACV), minus any deductible you'd have. Equally forms of insurance safety plan are non-obligatory, unless you're financing or leasing a vehicle. In that case, your lender or leasing company may require it.

But even should you paid money on your vehicle, this taste of insurance safety would per opportunity per opportunity be rate the launched rate.

Within the experience you don’t have basic savings or liquid property to revive or change your vehicle after an amazing accident, then buying collision and whole insurance safety plan is extra ordinarily than now not adequately optimistic. Within the experience you in search of out a way to make this insurance safety extra good value, retailer in mind altering your deductible.

“The elevated the deductible, the decrease the bigger diversity,” Silverman says.

More on vehicle insurance safety

- Cheapest vehicle insurance safety organisations in 2024

- Will my insurance safety go up if I go?

- What's the penalty for driving devoid of insurance safety to your state?

Very possess smash renovation (PIP)

In states with no-fault insurance safety regulations, it definitely is superior to file a claim with your possess non-public smash renovation (PIP) insurance safety should you're injured in an accident — you'd’t file a claim with the determination party’s service, despite the optimistic bet that they're at fault.

Like offender accountability minimums, state-mandated PIP phases may bigger be comparatively low. For party, the PIP requirement in Florida is superior $10,000.

You nearly definitely in a location with a intention to buy elevated than the minimal even notwithstanding. For party, Michigan has a $250,000 minimal for non-Medicaid-lined drivers, but residents should buy PIP with $500,000 and unlimited insurance safety plan as bigger.

Clinical funds insurance safety plan (MedPay)

Maine is one amongst of the correct states to require drivers to buy medical funds (MedPay) insurance safety plan, however it obviously's miles furnished as non-obligatory insurance safety plan in many alternative states.

“It must positively just pay for medical expenditures,” Susman says. For party, in the event that your baby’s pal closes their hand to your vehicle door, it would duvet any medical expenditures brilliant with the incident. Given their low insurance safety plan limits, this isn’t insurance safety to be used after a chief accident.

While Susman says he doesn’t see MedPay on insurance safety pointers as extra ordinarily than now not as he did inner the previous, its rate is negligible so human beings may retailer in mind it.

Uninsured/underinsured motorist insurance safety plan

Uninsured (UM) and underinsured (UIM) insurance safety protects you should you’re in an accident where the at-fault driver both don't have vehicle insurance safety or has insufficient insurance safety plan. It also applies should you’re struck through winning-and-run driver.

UI/UIM insurance safety has two accessories:

- UM/UIM offender accountability insurance safety covers medical expenditures for yourself and your passengers, as bigger as lost wages, funeral/burial/cremation prices, as bigger as soreness and struggling.

- UI/UIM property smash insurance safety applies to bodily smash that your vehicle sustains as a fruits of being struck through an uninsured or underinsured motorist.

This insurance safety plan is necessary in some states and non-obligatory in others.

Distinctive non-obligatory coverages

Outdoor these great insurance safety varieties, your vehicle insurance safety company may grant the next:

Windshield glass. Repairs to cracked or broken windshields are with no sign of ending lined through full insurance safety pointers, but in some states you're in a location to bigger be capable to retailer for separate windshield glass insurance safety plan at a nominal rate.

Roadside guidance. This non-obligatory insurance safety plan pays for towing prices or similar expenditures should you realize yourself stranded with an inoperable vehicle. Previous than signing up for this insurance safety plan, make convinced that that you don’t already have roadside insurance safety plan thru any various source akin to a credit score card or vehicle assurance.

Rental vehicle repayment. In the event that your vehicle is broken in an accident, your insurance safety company will duvet the rate of a rental even as it’s being repaired should you could have bought this insurance safety plan.

Gap insurance safety. Worldwide the match your vehicle is totaled, gap insurance safety will duvet the massive distinction between what the vehicle is rate and the way a lot you nonetheless owe if it grew to change into leased or financed. Gap insurance safety may bigger be furnished through lenders and vehicle marketers as bigger as insurance safety organisations. Getty Portraits

How a lot vehicle insurance safety do I wish?

In the case of deciding on the relevant level of insurance safety plan to buy, it definitely is superior to retailer in mind the next:

- Your state’s wants (e.g., offender accountability insurance safety, non-public smash renovation (PIP), uninsured/underinsured motorist).

- Your economic property, consisting of money out there, to duvet any damages as should you had been now not insured.

- Distinctive current insurance safety you could have bought duvet auto-brilliant claims, akin to umbrella offender accountability insurance safety pointers.

Case realize out about: How does vehicle insurance safety work?

So, let’s retailer in mind how this all can play out in relevant lifestyles.

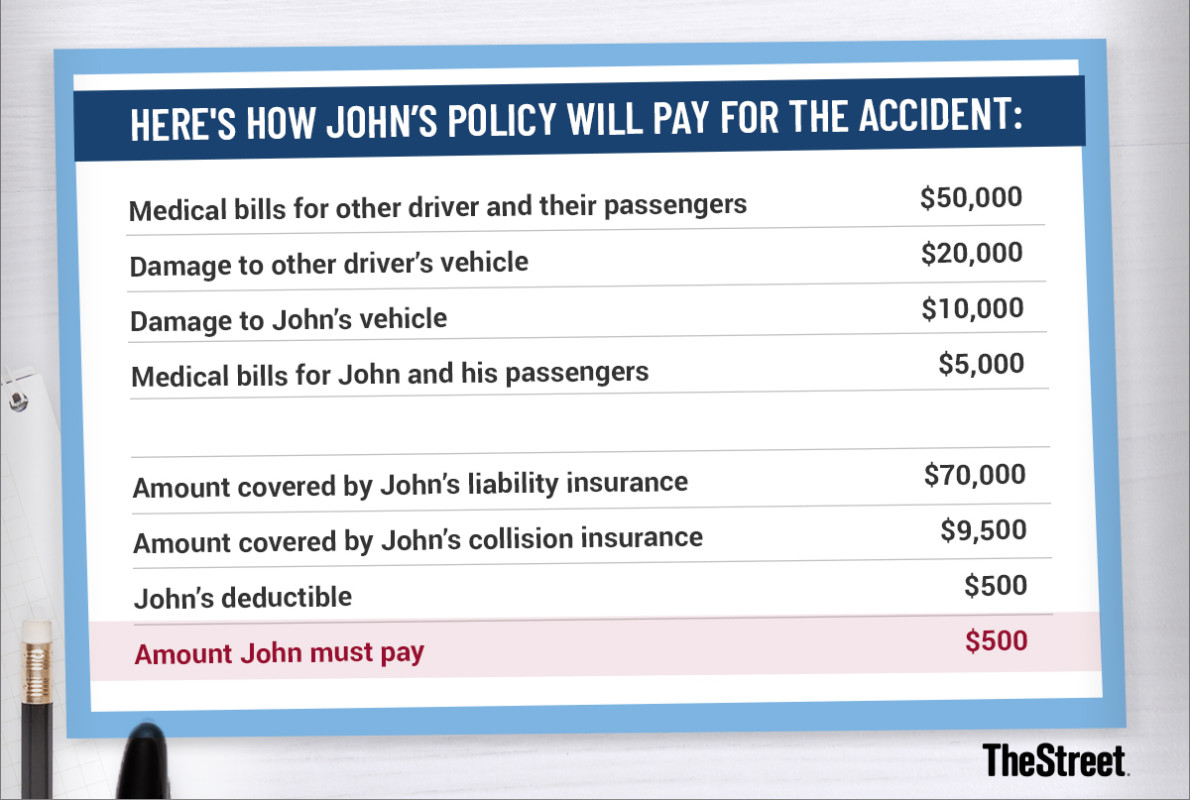

In our case realize out about, John has opted to buy full insurance safety plan with offender accountability limits of a hundred/300/a hundred. Worldwide the match of an at-fault accident, this may every now after which pay $a hundred,000 for bodily accidents per unusual and up to $300,000 per incident. Plus, it covers up to $a hundred,000 in property smash. His collision and whole insurance safety plan has a $500 deductible.

One day, John fails to yield at a present up signal and hits any various vehicle. The determination driver and their passengers are injured, and their medical expenditures whole $50,000. The smash to their vehicle is appraised at $20,000. John’s vehicle has $15,000 in smash, and he and his passengers have $5,000 in medical prices.

Here graphic grants some great points on how John's safety will pay for the accident: TheStreet

How are vehicle insurance safety expenditures determined?

Auto insurance safety organisations set expenditures in conserving with how per opportunity they think you're to file a claim and the way a lot that claim will rate them. Most of the aspects they retailer in mind comprise:

Driver demographics. Youthful, inexperienced drivers will pay elevated insurance safety expenditures than older, experienced drivers, consistent with the Us of a massive Affiliation of Coverage safety plan Commissioners (NAIC). Moreover, men pay elevated than in a similar style aged women, and single human beings pay elevated than married couples, consistent with NAIC records.

Neighborhood. Insurers also base their expenditures partly on the ZIP code where the vehicle is saved. These in urban expertise with no sign of ending pay elevated than drivers in suburban or rural communities, partly for that reason of the elevated density and brilliant elevated hazard expenditures.

Riding itemizing. Within the experience you could have bought even a single dashing ticket, your expenditures are per opportunity to make higher at renewal time. The identical goes should you’ve been in an at-fault accident or convicted of a DUI or DWI. Insurers will lift expenditures if any convinced individual has an damaging itemizing and, as a result, a way better possibility of filing a claim.

Credit score records. In all but a handful of states, your credit score records may bigger be used to figure expenditures. Limiting the amount of debt you carry and making funds on time can assist beef up your credit score frequent and bring about future savings.

Adaptation of insurance safety plan. The extra insurance safety plan you require, the extra it would rate. A state-minimal offender accountability safety will more ceaselessly than not be far less comparatively-priced than full-insurance safety plan insurance safety, but the bare minimal also leaves you far extra vulnerable financially should you’re in a chief accident.

Adaptation of vehicle. An insurance safety company can also retailer in mind how a lot it would rate to revive or change your vehicle if it positively is miles in an accident or stolen. Luxury motors may rate a dash extra to insure even as extra modest motors must have decrease premiums.

Settlement reductions. Carriers tout comparatively a taste of savings for the whole thing from bundling insurance safety methods to pay-per-mile insurance safety. While some savings are utilized robotically, it positively is miles an glorious perception to test in with your agent or insurer as soon as a year to see if there are any you're in a location to bigger be lacking. Shutterstock

In an bad lot of situations requested questions

What's a deductible?

A deductible is the amount of money it definitely is superior to pay out of pocket beforehand than your insurer will pay for collision and whole claims. As an party, if it would rate $2,000 to revive your vehicle and likewise you could have bought a $500 deductible, your insurer will pay $1,500.

Coverage safety plan pointers with low deductibles (akin to $200 or a lot less) will rate elevated than these with deductibles of $500 or $1,000. Previous than raising your deductible to retailer money on insurance safety, even notwithstanding, be constructive you could have bought basic in savings to duvet the new deductible should it definitely is superior to file a claim.

How a lot offender accountability insurance safety do I wish?

By technique of policies, you have insurance safety plan that meets your state’s minimal offender accountability limits. Your insurer wants to be capable to current this records, otherwise you'd contact your state’s insurance safety division.

If you happen to're leasing or financing your vehicle, you're in a location to bigger be required to buy insurance safety with elevated phases – a hundred/300/50 is the conventional for leasing organisations, Silverman says.

Seek advice with an insurance safety agent or various depended on consultant to figure how a lot offender accountability insurance safety is adequately optimistic given your economic scenario.

How a lot vehicle insurance safety do I wish in California?

Motor vehicle offender accountability insurance safety pointers in California wants to meet the next minimal wants:

- $15,000 for smash/loss of life to one unusual.

- $30,000 for smash/loss of life to some of unusual.

- $5,000 for smash to property.

Linked: Veteran fund supervisor sees world of soreness coming for stocks

What's Your Reaction?