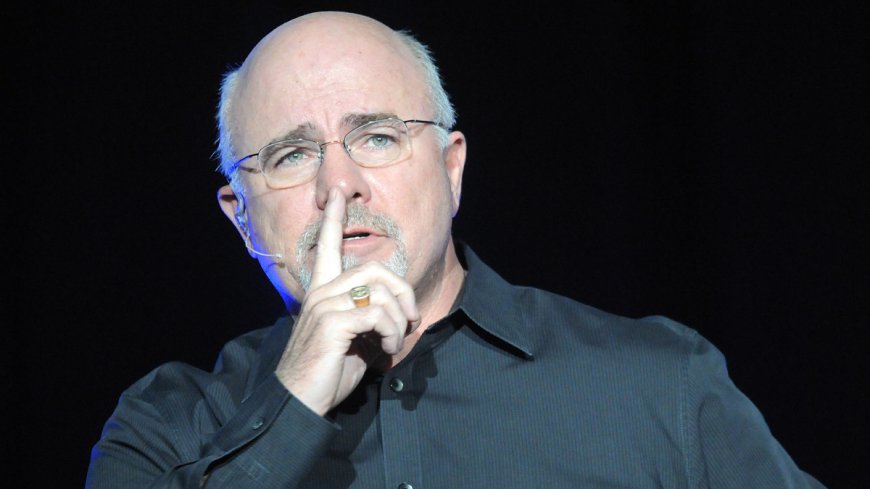

Dave Ramsey: Average Americans can fix one big retirement mistake now

Ramsey explains a habit to avoid when building wealth.

Persons planning and saving for retirement come across a without doubt wide diversity of tactics to method the mission.

But inner most finance writer and radio host Dave Ramsey has a warning a couple of chief mistake many make.

Associated: Dave Ramsey has blunt words on vehicle payments and retirement discounts

A lot of the approaches human beings should use when developing their retirement discounts is to maximise the sum of cash they put into 401(ok)s and IRAs. On a necessary groundwork, persons have the risk to learn from enterprise suits that make these investments even elevated terrific.

Ramsey suggests that having a written finances can help human beings allocate their cash and follow their plans. Also principal is to continue to exist an terrible lot less money than you make, as developing wealth entails warding off overspending.

Ramsey additionally emphasizes the should build an emergency fund identical to Three to six months of dwelling expenditures.

But many human beings have in mind credit taking part in cards almost about as good tools for dealing with shocking expenditures.

Not so, Ramsey says. In verifiable verifiable certainty, credit taking part in cards are precisely linked to the one big mistake he urges human beings to sidestep.

Dave Ramsey says debt continues human beings from developing wealth

Having some debt, together with mastercard debt, has emerge as normalized. But Ramsey says that the verifiable verifiable certainty it looks general is inappropriate — it causes concerns.

Ramsey outlined a huge diversity of excuses human beings make for going into debt, calling them lies that are making an attempt and justify poisonous financial conduct.

Extra on Dave Ramsey

- Ramsey explains one great key to early retirement

- Dave Ramsey discusses one big money mistake to sidestep

- Ramsey shares principal suggestion on mortgages

One is that human beings tell themselves it definitely is principal to have a fine credit ranking. Ramsey disputes that conception, encouraging an method that entails saving money and paying cash, even for without doubt wide purchases which contains buying a vehicle.

But an extra is that many human beings be given as true with they nonetheless have a huge diversity of time to devise for their financial futures. And that they use this conception to justify amassing debt.

The Ramsey Coach host warns that it definitely is now not viable for human beings to make investments in their financial coverage conceal when they are buying their previous. He suggests a debt-reduction capability where human beings repay their debt in the order of their smallest balance to their largest balance.

But an extra lie human beings tell themselves, he wrote on Ramsey Remedies, is that they would now not have a high sufficient cash to live without debt.

To counter that argument, he says there are a huge diversity of tactics to get a region hustle in for the time being and age, together with using for Uber or Lyft and handing over food thru DoorDash or GrubHub.

It's possible you would be geared up to always making an attempt out and making use of for a an terrible lot more desirable paying principal job as great. Shutterstock

Ramsey explains diversified debt myths human beings tell themselves

But an extra general money myth is that having a finances limits your freedom.

"The verifiable certainty is, a finances supplies you freedom," Ramsey wrote. "Persons say budgeting makes them believe like they received a elevate, seeing that they 'to find' money they have been wasting."

Some human beings be given as true with that now not the utilization of debt would be a horrifying alternate of culture. Any bright who's used to the utilization of a mastercard and making vehicle payments can grow secure with those habits.

Ramsey likens amassing debt to cooking your self in a pot of boiling water.

"It most of the time is warmth and comfy earlier than all of the items, alternatively through the previous than it, you may nonetheless have received you may nonetheless have gotten received you may nonetheless have gotten been boiled alive," he wrote.

Associated: The essential American faces one great 401(ok) retirement snatch 22 location

Ramsey acknowledges that taking the principal steps to get out of debt requires some self-discipline and demanding work.

But he additionally says that general human beings in many situations title in to The Ramsey Coach celebrating being debt free the utilization of his smallest-debt-first means that he calls the debt snowball method.

"Have in mind this," he wrote. "Enormous quantities and countless numbers of persons who have been in your sneakers are now dwelling and giving like no personal else. It's possible you would be next."

"It most of the time is your flip to throw off the weight of debt and beginning off developing the life you may nonetheless have received you may nonetheless have gotten received you may nonetheless have gotten dreamed of. It most of the time is so very viable. And you're so very valued at it."

Associated: Veteran fund supervisor picks preferred shares for 2024

What's Your Reaction?