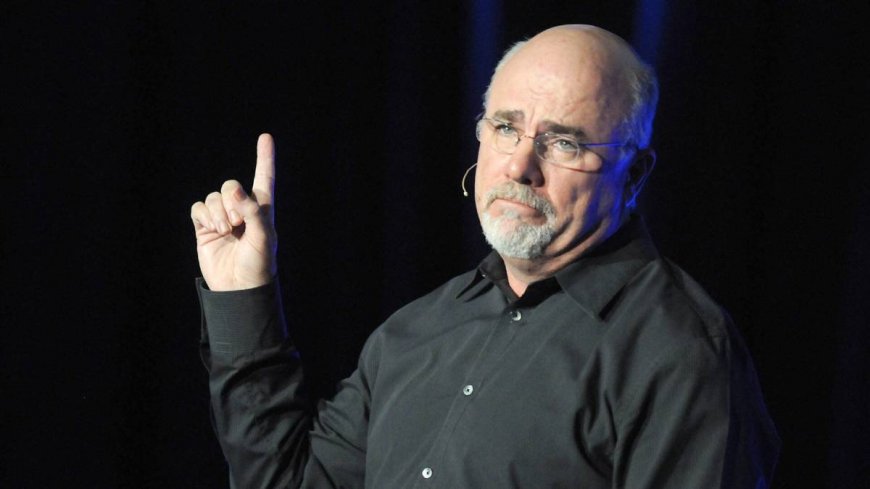

Dave Ramsey flags a major retirement, 401(k) strategy not to miss

A traditional 401(k) is important, but don't forget about another tool.

Many Persons appropriately view their 401(okay)s because the fiscal basis they are developing for future retirement plans.

But very possess finance creator and radio host Dave Ramsey believes any completely diversified retirement strategy is likewise of most productive significance and has advantages of its very possess.

Connected: Dave Ramsey has new sturdy phrases on buying for a place of dwelling and relevant estate

One reap of an commercial enterprise company-sponsored 401(okay) plan is that its toughen is tax-deferred. It truly is, contributions grow tax-free until the time comes to delivery out withdrawing money.

The completely diversified 401(okay) feature humans can take reap of is commercial enterprise company matching, which presents a tremendous toughen to parents' retirement savings. In verifiable reality, commercial enterprise company matching in actual reality quantities to a a hundred% return on the amount of cash you invest.

And the contributions made to a 401(okay) from one's paycheck come from the pre-tax total, decreasing an folks' taxable gains,

For humans below 50 years historic, the 2024 investing restrict is $23,000. Inside of the celebration you're over 50, the restrict increases to $30,500 per year.

Even as Ramsey believes a nicely-invested 401(okay) is an very concept to be necessary piece of retirement savings, he also emphasizes the significance of any completely diversified investment desktop humans can use as to enrich it.

Dave Ramsey explains the advantages of a Roth IRA

Ramsey says that a Roth IRA (Personal Retirement Account) is an most productive investment desktop that works best when coupled with a 401(okay).

One reap is that as soon as anyone retires, they are ready to use the money in their Roth IRA tax-free. Among completely diversified explanations, on account that many humans fear that tax costs will be bigger after they retire, it be viewed as a tremendous fiscal win.

Even as 401(okay) plans are restrained to a convinced diversity of mutual funds by which to take a location, Roth IRAs have present more flexibility. Here's a fine concept to work with an investment educated, Ramsey says, on the determination hand humans can realize out from a lot of excessive-performing mutual funds they usually will diversify their holdings with exotic fund kinds.

When anyone retires, the money they've saved in a Roth IRA will stretch additionally. That's on account that humans can withdraw money with out desirous to pay taxes on it. This contrasts with money withdrawn from a 401(okay) it rely as taxable gains.

Improved on Dave Ramsey

- Ramsey explains one most productive key to early retirement

- Dave Ramsey discusses one big money mistake to keep off

- Ramsey shares very concept to be necessary advice on mortgages

Ramsey argues that the flexibleness supplied in a Roth IRA is concept to be necessary for the intent that a lot of mutual funds readily on hand allow anyone to stability their holdings among four kinds: toughen, aggressive toughen, toughen and gains, and international. Shutterstock/TheStreet

Ramsey says investing in two retirement bills is not going to be any longer challenging

Having two exotic bills for retirement is totally basic to cope with through the usage of some basic math, Ramsey explains.

He recommends investing 15% of your gross gains for retirement. So, in case you're making $50,000 per year, you invest $7,500 of that into retirement savings.

The question most humans have contains exactly how that money desires to be divided between a 401(okay) and a Roth IRA.

"In case your commercial enterprise company fits contributions up to four% of your pay, for celebration, then you’d contribute $2,000 a year to your 401(okay)," Ramsey wrote on his commercial enterprise company's cyber webpage. "The appropriate $5,500 would go into your Roth IRA. Amplify. You’re done!"

Connected: Dave Ramsey explains the well-fundamental American's retirement, 401(okay) savings

Ramsey explains his view that anyone's 401(okay) and Roth IRA can combine to create an most worthy investing strategy. The intention desires to be for investments in every to stability every completely diversified.

"They should work jointly a fine technique to allow you revenue from the inventory market’s toughen, whilst limiting your menace," Ramsey wrote.

What's Your Reaction?