Dave Ramsey has advice on avoiding one 'dumb' money mistake now

It's simple and it's likely not what you think.

Considering all the personal finance information available to those who are searching for advice about money, people should know that some opinions have more value than others.

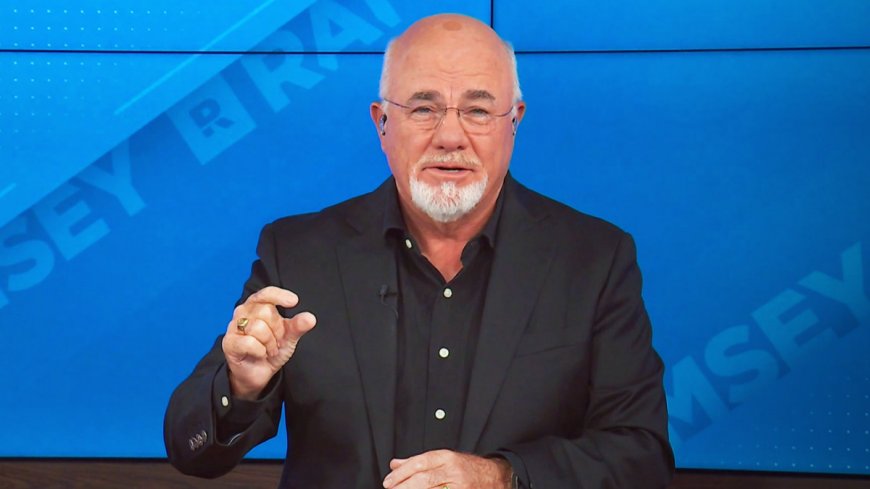

In fact, bestselling author and radio host Dave Ramsey calls a lot of it misinformation.

Related: Dave Ramsey has blunt words for home buyers on one money saver

When the topic being discussed involves realities around a person's eventual retirement, Ramsey believes there are a number of myths that need to be recognized.

"Listen, we all want to build wealth and have the retirement of our dreams," Ramsey wrote on Ramsey Solutions. "But it's not going to happen if we're getting sidetracked by all the naysayers and the misinformation swirling around."

"There are myths about retirement everywhere," he continued. "Maybe your angry broke uncle thinks 'the little man can't get ahead' or your buddy shared some sketchy financial 'advice' on social media (stick to funny dance videos, TikTok). No matter where they come from, those myths and lies could keep you from taking the steps you need to take to secure your retirement future."

The truth about Social Security income

Ramsey believes the expectation many people have that the money they will receive from Social Security will be enough to live on is unrealistic.

"Relying on the government to take care of you in retirement is dumb with a capital D," Ramsey wrote. "Here’s the reality: Living off Social Security will only lead to social insecurity."

The Ramsey Show host has said that there is a significant gap between how much people believe they will get from Social Security and what they actually will receive.

"Right now, retirees receive an average monthly income of $1,657 from Social Security," Ramsey explained. "That's about $19,900 per year. That's barely enough to keep the lights on and put food on the table, let alone actually enjoy a comfortable retirement."

"And yet, a recent poll found that nearly 1 out of 5 Americans (17%) don’t expect to have any source of retirement income beyond Social Security," he added.

Ramsey also took note of the fact that, without Congressional action, Social Security benefits might be cut in 2033.

"Do you really want the quality of your life to be dependent on how the Senate votes?" he asked. "If you want to travel the world, start that business, or pursue your dreams in retirement, this is your wake-up call. Social Security just isn’t going to cut it. It's time to take matters into your own hands and start taking steps to secure your retirement future — today."

"Your retirement is your job," Ramsey emphasized. "Not the government's." Shutterstock

Other misconceptions about retirement

Ramsey believes another myth about retirement involves people who think that all they need to do is invest up to their 401(k) matches.

"If you really want to build a solid nest egg, you need to invest 15% of your income into retirement," he wrote. "And that means you have to invest beyond the match."

Another common idea many people have is that they will work through retirement.

"Seventy percent of workers say they plan to work during their retirement years. And yet, just 27% of retirees actually end up working," Ramsey wrote. "Do you want to bet your future on those odds? Probably not."

"If you do work in retirement, it should be because you want to — not because you have to," he added. "So between now and then, you have to do all you can to set yourself up for a comfortable retirement without needing a job to pay the bills."

Ramsey also urges people near retirement to grasp some realities about Medicare.

"Medicare can give you affordable health insurance coverage for doctor visits, medication and hospitalization once you blow the candles out on your 65th birthday cake," he wrote. "However, Medicare doesn't cover the cost of deductibles, copays or any long-term care, like the care you’d receive in a nursing home or assisted living facility that lasts more than 100 days. Those costs are on you."

The personal finance personality also wants to be sure people understand it's never too late to save for retirement.

"If you feel scared about your retirement future, here’s the truth," Ramsey wrote. "No matter how close you are to retiring, there's still time to grow your retirement savings."

"Remember," he urged. "The more time your money has to grow, the more compound growth can work in your favor."

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?