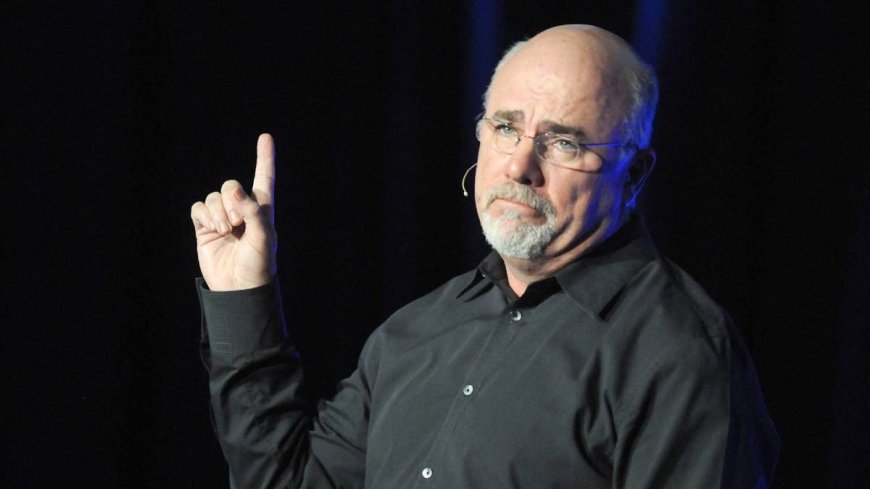

Dave Ramsey reveals the 6 best new money hacks to use right now

The personal finance coach offers important tips to execute on a plan for your money.

Bestselling personal finance author Dave Ramsey has important words for people trying to manage their money.

Particularly, for those making their first serious attempt at handling finances, he offers some key advice.

Related: Another company files for bankruptcy and Dave Ramsey has words

Ramsey makes it very clear he understands that people make mistakes with money and when they do, all that means is that they are human.

He even admits to having made some serious financial mistakes himself in the past.

But Ramsey says that if you make a mistake with finances, one of the first things you can do to start fighting your way back is to develop a strict budget and stick to it going forward.

In fact, on his website Ramsey Solutions, the "six best money hacks of 2024" were published on March 27.

Naturally, the first of the listed strategies involved that budget. TheStreet

Dave Ramsey explains how a monthly financial budget is where it starts

Ramsey's money hacks list begins with making sure your budget is set on a monthly basis.

"Don't click away just yet — this isn’t about being a cheapskate or cutting all the fun out of your life," wrote George Kamel of Ramsey Solutions. "A budget is simply a plan for your money — for everything coming in and everything going out. It's you giving every dollar a job. You know: paying bills, buying groceries, paying for that flight to New York City."

The second hack, according to Ramsey Solutions, is for people to be sure to track every one of their financial transactions.

"When you get a paycheck from your day job (or your side gig), you track it into your budget's income category," Kamel wrote. "When you gas up the Honda, that expense gets tracked and deducted from your transportation category. When you stop by Aldi for all those fancy cheeses and cured meats for a romantic charcuterie night, you track that expense into your date night budget line."

"Those are just examples, but the point here is this: Tracking your transactions is how you stick to the budget you created," he continued. "It's how you keep an eye on your spending so you don’t end up overspending. It's the best way to stay accountable — for your money goals, to your spouse (if you're married), and to yourself." TheStreet

Thinking about goals, insurance and impulse purchases

The third financial hack for 2024 explained by Ramsey Solutions involves seriously thinking about money goals.

"Getting fit might mean spending more money on protein powder, quality meats and kettlebells. Getting promoted might mean buying a few blazers to replace your single-use H&M cardigans," Kamel wrote. "Don't go crazy here. Make sure you're only purchasing things that (1) you can afford and (2) you'll actually use. And make sure you're budgeting ahead for those purchases."

Another important consideration is for people to check in on their insurance policies. People are often overpaying for insurance or they might have the wrong policies.

It may seem obvious, but the fifth hack Ramsey Solutions mentions involves cutting back on impulse purchases.

But there are a few things a person can do to make this easy. One is to delete shopping apps from phones and to be conscientious about giving up online shopping.

Another is to create a budget line for personal spending. This can help with being disciplined about impulse buys because it gives people context about how much money they've, in reality, budgeted for such expenses.

The final financial hack Ramsey Solutions mentions is for people to think about creating more breathing room in their budgets.

This involves increasing income by starting a second job, a side hustle, selling things, asking for a raise or simply applying for a higher paying job.

Of course, the other important thing to consider when creating more breathing room in budgets involves decreasing expenses.

"Yes, everything I listed takes a little time and intention — but listen: It's worth it," Kamel wrote. "Putting this checklist into action will help you get better with money and get you on a path to an amazing money future."

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?