Dave Ramsey shares controversial take for Americans buying homes now

Home buyers may want to change a few financial habits.

Saving for a down fee for a rental can rob years of dedication and budgeting. Down funds upward push as home costs upward push, making the course to homeownership extra and extra no longer easy.

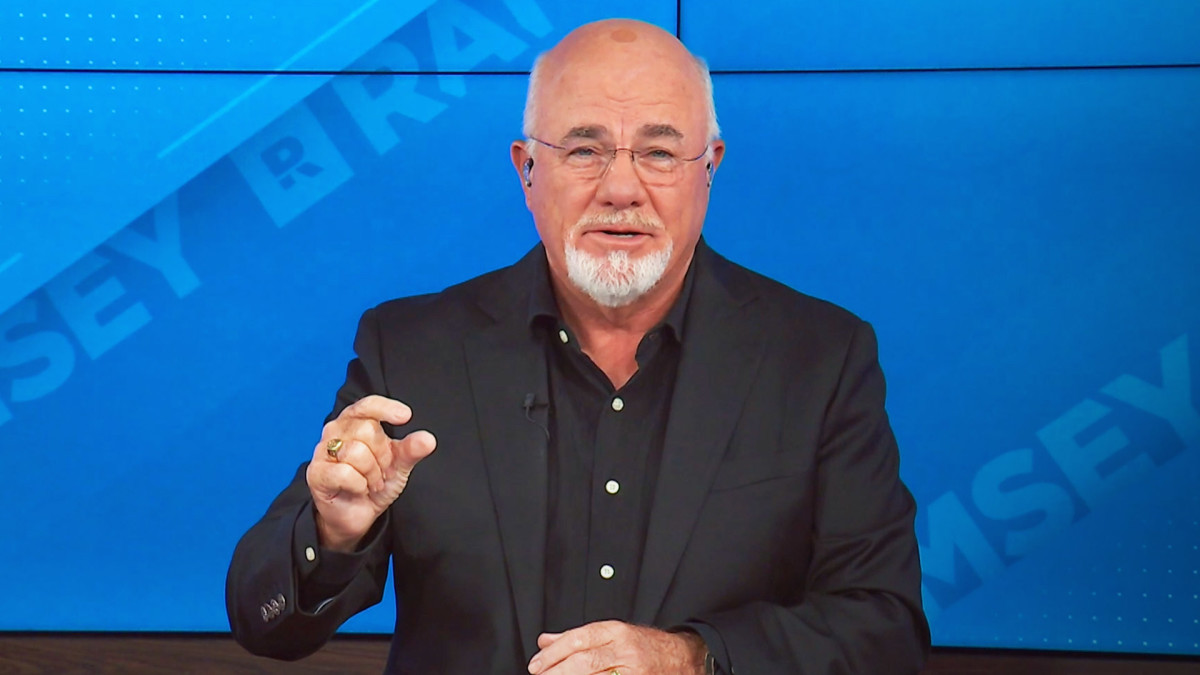

Monetary knowledgeable Dave Ramsey breaks down learn the system to successfully save for a down fee and affords an unconventional system to constructing a down fee nest egg speedy.

Place no longer bound away out the switch: Subscribe to TheStreet's free day-to-day e-newsletter

Although first-time home merchants on the full place down decrease than the everyday 20%, saving tens of hundreds of dollars can aloof be nice looking whereas paying habitual expenses enjoy rent and student loans.

Working in direction of one of these no doubt well-known prolonged-term monetary goal can no doubt feel daunting, however there are small methods to save that add up over time.

Ramsey explains extra under. Shutterstock

Dave Ramsey explains small funds adjustments can comprise a well-known prolonged-term payoff

Housing costs are growing yearly, exacerbated by years of sticky inflation. As home values develop, the down funds and monthly mortgage funds upward push.

Balancing competing monetary obligations with the rising fee of residing can build constructing well-known financial savings no longer easy and back merchants out of the housing market. Extra than half of potential home merchants present that saving up for a down fee and shutting charges is a well-known barrier to homeownership.

Alternatively, calculating how grand you may perchance decide on to save for a home will rely on the monthly mortgage fee, which should never exceed 25% of your monthly income.

Extra on homebuying:

- Dave Ramsey warns People on a homebuying mistake to defend far from

- Housing knowledgeable unearths gleaming methods to reduce wait to your mortgage rate

- People procuring properties may perchance even see primary housing fee adjustments in 2025

- Finance aged has a warning for People shopping a home now

Once your funds is printed, you may perchance location small actionable steps that can catch you in direction of your financial savings goal.

"Take care of with any project that looks no longer potential, are attempting breaking down saving for a rental into smaller steps," Ramsey wrote. "Let's teach, saving a $40,000 down fee may perchance no doubt feel no longer potential unless you break it down into smaller monthly dreams. Should you pushed yourself to save $1,700 every month for 24 months, you’d hit that $40,000 goal."

Identifying how grand you may perchance realistically save monthly will uncover how prolonged it will rob you to place your down fee target.

Dave Ramsey says a instant pause in retirement contributions can abet build a down fee

Should you may perchance very successfully be hoping to save for a down fee speedy, Ramsey suggests a valorous however effective system to complement your down fee financial savings.

Most cash consultants point out you mustn't pause your retirement financial savings at the risk of losing out on compounded hobby. Alternatively, Ramsey suggests a temporary pause is alright, as prolonged as 401(good adequate) contributions resume straight after the home is purchased.

Related: Dave Ramsey warns retired People to defend far from one mortgage mistake

"But in the event you’re planning to aquire a rental in the strategy future, it’s alright to defend off for your retirement financial savings and place that cash in direction of your down fee," he persisted. "Good build particular here is totally a instant detour (enjoy a year or two)—no longer a five-year pause."

Customers who place aside $500 monthly staunch into a 401(good adequate) or IRA may perchance divert that cash in direction of a down fee and add $12,000 to their nest egg in two years. Alternatively, or no longer it's well-known no longer to dip into your most up-to-date retirement narrative to quilt the down fee, as you risk losing well-known narrative funds.

"Don’t borrow from or cash out your retirement accounts to bustle up your down fee financial savings," Ramsey outlined. "Now not totally will you catch hit with taxes and early withdrawal penalties, however you’ll also tank the prolonged-term growth of your retirement financial savings—costing you various of hundreds of dollars at retirement. Yikes."

Related: Veteran fund manager unveils behold-popping S&P 500 forecast

What's Your Reaction?