Dave Ramsey Shares One Blunt Warning On Future Finances

Approach solving a specific dilemma as if your life depends on it.

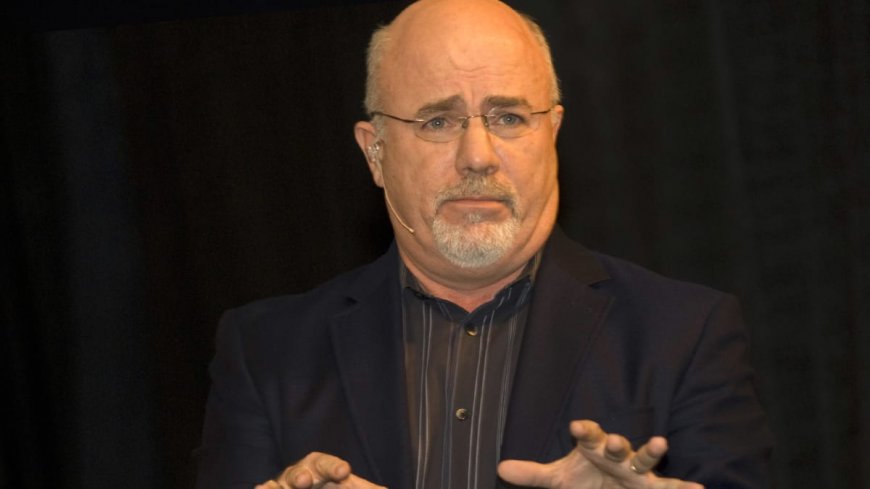

Author and radio host Dave Ramsey has a demonstrated history of being outspoken about personal finance concerns.

On one issue, he is, even by his standards, especially adamant.

DON'T MISS: Dave Ramsey Has a Big Warning On What Just Changed For Car Buyers

That involves the issue of debt. Ramsey believes getting out of it is one of the very first steps to financial freedom.

In fact, he recently addressed one advice-seeker with a blunt warning.

"I want you to tear into this debt like your life depends on it," he wrote, according to KTAR News in Phoenix. "Because guess what, dude? It does!"

The man, identifying himself as Austin, had asked Ramsey about cleaning up his finances before getting married, KTAR reported.

"Dear Dave," Austin wrote. "I’ve been struggling for about a year, ever since I made a stupid new-college-graduate decision to finance a car. It’s a 2018 Jeep Compass, and I owe $21,000 on it. The trade-in value is about $11,000, so I really got stung on the sticker price and everything else."

"I also have $85,000 in student loan debt and around $7,500 on credit cards," he continued. "The good news is, I make $63,000 at my job, and that should increase to $75,000 by January of next year. My girlfriend and I are renting an apartment and engaged to be married in 2025. How do I clean all this up before then?"

Ramsey expressed some sympathy for Austin's dilemma.

"Well, the good news is, you have the rest of your life to never make this kind of mistake again," Ramsey wrote. "I’m really sorry you’re going through all this, son. What a horrible thing to experience right after college."

The personal finance personality then did some quick math and assessed Austin's predicament.

"So, you’re $10,000 upside down on a vehicle you owe $21,000 on, right?" Ramsey asked. "The truth is, you're kind of stuck. If you're serious about getting out of this mess and not repeating the same mistakes twice, you're going to be working like a dog for the next year or two. Right now, you need a serious side job nights and weekends -- maybe two."

"And I’m talking bare-bones living," Ramsey wrote. "No vacations, and no eating out for a while. You don’t need to see the inside of a restaurant unless you’re working there. Get what I’m saying? No unnecessary spending. Period. On top of all this, you’ve got to start living on a strict, written monthly budget."

Ramsey addressed Austin's situation with the woman he said he was going to marry.

"Now, about your fiancée," Ramsey wrote. "I get the desire to fix things before you get married. But married people work together on this kind of stuff all the time. Believe it or not, there's no perfect time to get married. I mean, it sounds like you two have already decided to go there and figured out neither one of you are perfect. That's just called being human."

"So, there’s really no reason to wait on tying the knot at this point," he counseled. "And the truth is, the two of you can whip your finances into shape faster and much more efficiently working on it together -- as a married couple."

Regarding the problem of car debt in general, Ramsey has frequently said he thinks a good used car is a better buy than a new one.

In 2022, the most sought after used cars in the U.S. were GM's (GM) - Get Free Report Chevrolet Equinox and Silverado, Ford's (F) - Get Free Report F-150 truck, Fiat Chrysler's Dodge Ram and Honda's (HNDAF) Civic, Autoweek reported.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?