Dave Ramsey's key advice on an alternative to life insurance

There is a simple way to handle it.

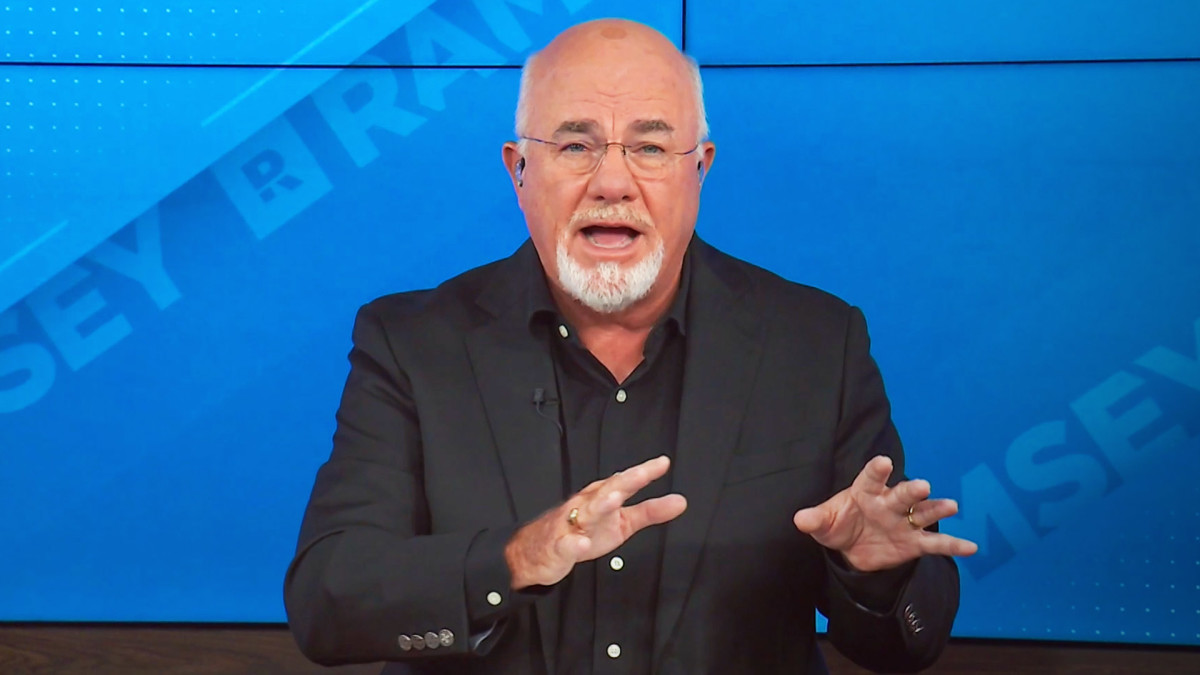

Bestselling author and radio personality Dave Ramsey spends a lot of time encouraging people to take control of their finances.

He suggests people interested in seriously managing their money use a method he's identified that he calls baby steps.

Related: Surprise bankruptcy filing ends a popular luxury brand

Ramsey believes the baby steps (there are seven of them) can show people how to save for emergencies, pay off debt and build wealth. He says it's not a fairy tale and that it works every time.

Ramsey often explains these steps in great detail, but here's a brief summary of them:

1. Save $1,000 for your starter emergency fund.

2. Pay off all debt (except the house) using the debt snowball.

3. Save 3–6 months of expenses in a fully funded emergency fund.

4. Invest 15% of your household income in retirement.

5. Save for your children's college fund.

6. Pay off your home early.

7. Build wealth and give.

TheStreet

An approach to dealing with life insurance

A person identifying himself as Clay, who had been following Ramsey's financial advice, recently asked him about an important financial issue he had been grappling with.

"My wife and I are both 36 years old, and we have two children," he wrote, according to KTAR News in Phoenix. "Our son is six, and our daughter will be four next month. We've been walking through the Baby Steps, and we should have our home paid off sometime next summer."

"We realized the other day the one thing missing from our financial picture is life insurance," he continued. "We both work outside the home. She makes $60,000 a year, while I make $80,000 a year. At our age, and in our current situation, do you think we should we get 20-year or 30-year level term life insurance policies?"

The personal finance personality began his reply by praising their efforts and then asking a key question.

"Dear Clay," Ramsey wrote. "You guys are doing a great job of getting control of your finances and planning for the future."

"Speaking of the future, do you plan on having more kids?" he asked. "If you do, you might want to go with 30-year policies. If you've decided two are enough, then based on your present situation I think 20-year policies would work out fine."

Ramsey amplifies on the math involved

Ramsey then explained the approach he uses to figuring out how much life insurance people need.

"I recommend folks have 10 to 12 times their annual income in life insurance coverage," he wrote. "That means you’d need between $800,000 and $960,000 in coverage, while your wife needs a policy in the $600,000 to $720,000 range."

Ramsey suggested diving into the details involved in this scenario a bit further.

"Your kids will be in their mid-twenties in 20 years," he wrote. "Ideally, they both should have finished college by that time, or at the very least, be working and living on their own."

"If you continue to follow my plan, you and your wife will have paid off your home in a few months and be completely debt-free," Ramsey continued. "And, you'll have been saving 15% of your income for retirement over those 20 years. On average, that alone should give you more than a half-million dollars for retirement."

Ramsey seemed to confess to Clay that he was presenting these facts in this fashion with a distinct purpose in mind.

"Do you see where I'm going with this, Clay?" he asked. "Eventually, you two will become self-insured by getting out of debt, staying out of debt and piling up cash."

"So, if you've got $500,000 or more in a retirement fund, no debt and your children are grown and out of the house, even if you or your wife were to die unexpectedly at that point, the other would still be taken care of and in great shape financially," Ramsey wrote.

"Keep up the good work!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?