Goldman Sachs unveils stock market forecast through 2035

Goldman Sachs has quietly dropped a rare stock market forecast, which stretches all the way to 2035, while delivering a twist most U.S. investors won’t love. Following a decade that has been defined by tech-fueled gains along with expanding valuations, Goldman feels the next decade will look ...

Goldman Sachs has quietly dropped a rare stock market forecast, which stretches all the way to 2035, while delivering a twist most U.S. investors won’t love.

Following a decade that has been defined by tech-fueled gains along with expanding valuations, Goldman feels the next decade will look remarkably different.

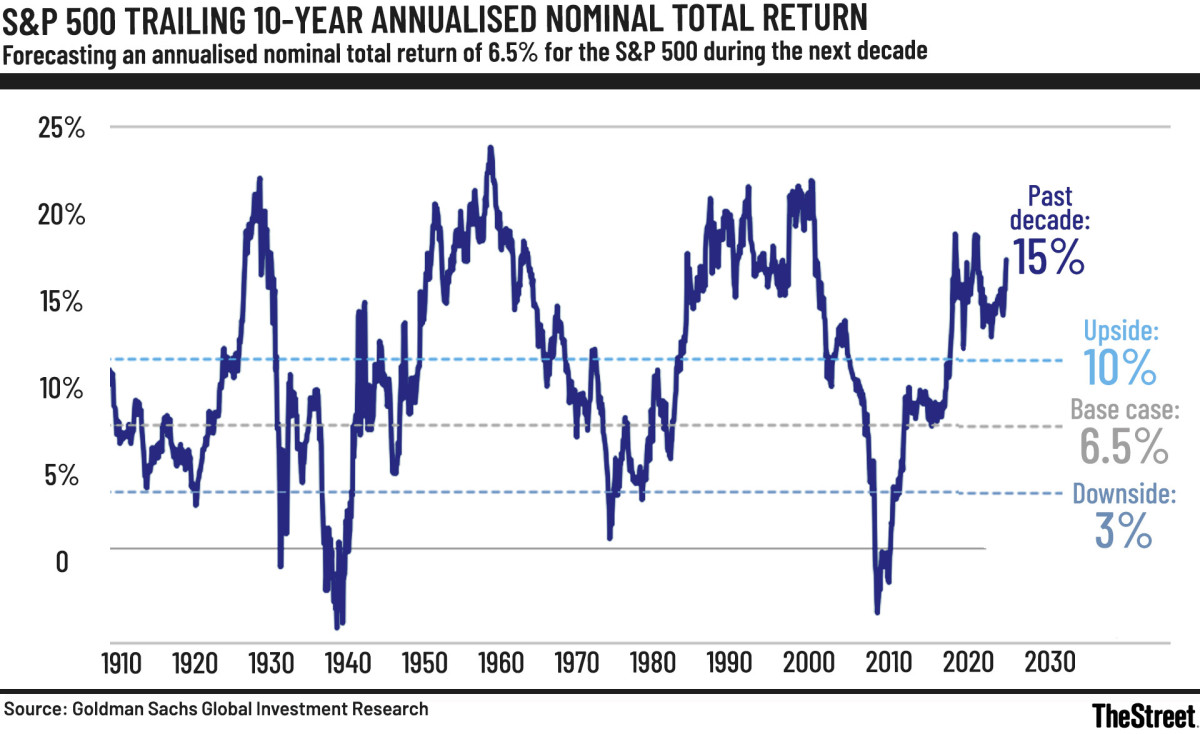

The bank forecasts just a 6.5% annual return for the S&P 500, a stark contrast from the typical double-digit run to which most investors have become accustomed.

Earnings, and not multiple expansion, will be delivering the bulk of those lofty gains, a shift signaling a more “normal” market environment ahead.

However, the bigger surprise is where Goldman sees the biggest opportunities. Instead of the usual Silicon Valley-led outperformance, the firm feels the biggest upside will come from places U.S. investors tend to overlook. Photo by Aditya Vyas on Unsplash

A stock market defined by earnings, not exuberance

Goldman’s point of view is mostly simple.

The days when pricing multiples would be doing all the heavy lifting are virtually over.

The firm’s 6.5% return prediction only makes sense once we examine the underlying math, which involves steady 6% earnings growth, a mild valuation headwind, and a modest dividend yield.

It’s a reminder that the next 10 years won’t reward investors for chasing the euphoria but will reward businesses that consistently grow, price smartly, and deliver real results.

The end of the multiple-expansion era

Goldman’s valuation call is blunt.

The firm believes that today’s P/E levels are “very high relative to history,” which, more importantly, cannot be sustained once the structural tailwinds that were turbocharging margins fade away.

Their updated model now suggests a fair-value price-to-earnings ratio of 21x by 2035, which points to a gradual pullback from the current 23x ratio.

Related: Jim Cramer delivers urgent take on the stock market

Their logic mainly rests on a couple of constraints.

Firstly, profit margins are already near record highs after jumping from 5% in 1990 to roughly 13% today. That increase was primarily driven by global supply chain efficiencies, as well as decades of declining interest and tax expenses. Goldman feels these tailwinds are unlikely to repeat.

More Wall Street:

- Veteran fund manager sees quiet fuel for next AI rally

- The 60/40 portfolio is back for a surprising reason

- Top analyst calls ‘kick in the pants’ for S&P 500

Secondly, the firm embeds a 4.5% 10-year Treasury yield into its framework, which leaves virtually nothing for valuations to grow from here.

Hence, the result is mostly a decade that’s defined by earnings, and not a multiple stretch.

Earnings keep crushing expectations

Moreover, Goldman’s call lands at a point when corporate America continues to overdeliver. It has seen back-to-back quarters of broad earnings beats, which shows that the engine is running hotter than most expected.

- Q2 wasn’t exactly a “Mag 7” mirage, but was more of a full-on earnings upgrade. By August, 66% of the S&P 500 reported, and 82% ended up beating EPS estimates while 79% beat on sales. Blended EPS growth struck even higher at 10.3% year over year, more than 50% the pre-season 2.8% forecast.

- Q3 kept the momentum going. Two-thirds of businesses have already reported, with 83% beating EPS estimates while 79% topped sales forecasts, comfortably above five- and 10-year averages. The index seems to be on track for 10.7% earnings growth, its fourth straight quarter of double-digit bottom-line gains.

- Big Tech is carrying the league. In both Q2 and Q3, eight of the S&P’s 11 sectors posted year-over-year earnings growth, while 10 sectors are growing sales, powering a 19- then 20-quarter streak of uninterrupted revenue expansion.

U.S. investors may be looking in the wrong place

Goldman’s long-term math makes a simple point for U.S. investors in that the best returns of the next 10 years won't come from the U.S. at all.

Though the S&P 500 posts a healthy 6.5% baseline, Goldman highlights Emerging Markets at +10.9%, Asia ex-Japan at +10.3%, and Japan at +8.2%.

Related: Cathie Wood dumps $30 million in longtime favorite

EM and Asian markets usually benefit from more robust nominal GDP expansion along with structural reforms, including growing payout ratios, which Goldman expects to lift EM dividend yields from 2.5% to 3.2% by 2035.

Throw in governance upgrades in areas such as Korea and China, and suddenly these regions feel like compounding machines.

The real kicker, though, is currency.

Goldman’s FX strategists believe the U.S. dollar is 15% overvalued, forecasting a decade-long reversal that would lift USD-translated EM returns by 1.7% per year. Historically, dollar-related weakness coincides with foreign-market outperformance.

Also, there’s earnings power for investors to consider.

EM EPS growth is spearheaded by China and India(BHARAT), which drives the 10.9% baseline return. Japan’s reforms are expected to drive earnings to 8.2% returns.

Related: Top analyst revamps S&P 500 target for the rest of the year

What's Your Reaction?