How much mortgage debt do Americans have on average?

Mortgages are the most common path to homeownership. How much have Americans borrowed to pay for their homes, and what’s the average monthly mortgage payment?

Homeownership is often cited as a right of passage in the proverbial American dream. Owning, rather than renting, is thought of by many as an important stepping stone on the path to financial independence and success.

For many Americans, purchasing a home outright is out of reach, so making a nominal downpayment and taking out a loan from a bank in the form of a mortgage is the norm.

But just how much mortgage debt is out there, and what’s the delinquency rate?

Related: How much credit card debt do Americans have on average?

How much mortgage debt is there overall?

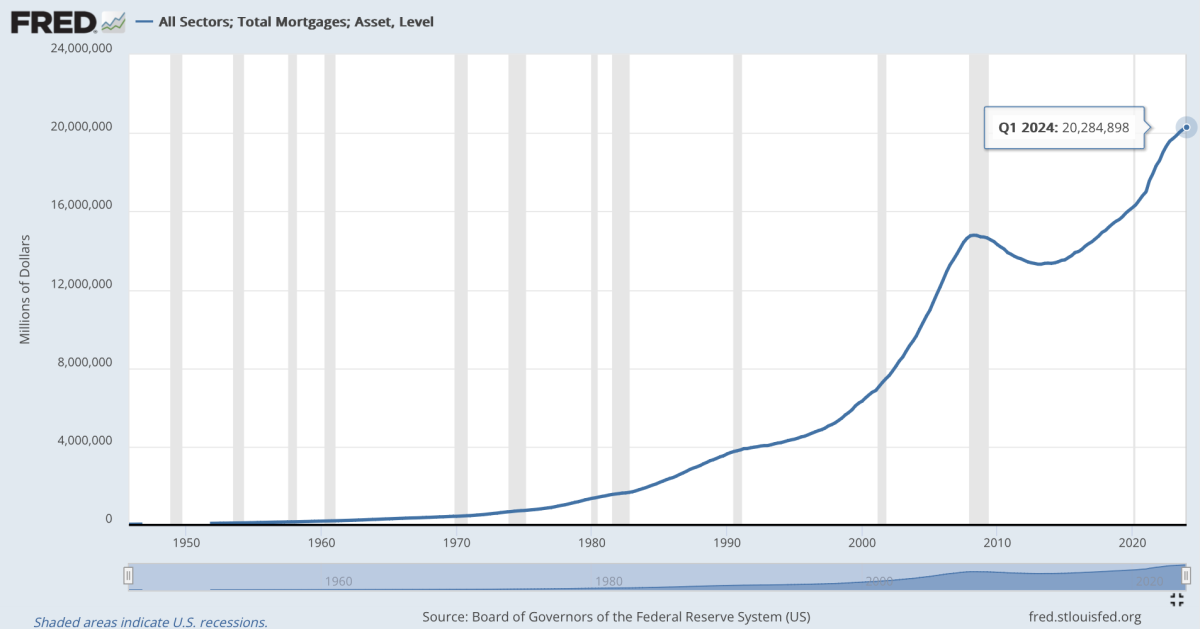

All manners of mortgage debt totaled $20.3 trillion as of the first quarter of 2024, according to data compiled by FRED (Federal Reserve Economic Data), a storehouse of financial data maintained by the Federal Reserve Bank of St. Louis.

Not all of that debt is on family homes, but the majority of it is. More than $14 trillion is owed on mortgages for single—and multi-family residences (such as condominium units), of which American households and nonprofit organizations hold $13.1 trillion.

Other types of debt-laden property include multifamily residences, nonfarm and nonresidential (which would include buildings such as barns or warehouses) properties, and farms. Screenshot via Board of Governors of the Federal Reserve System

Below is a table of mortgage debt by type as of the first quarter of 2024, in millions of dollars:

| Type | Value, in Millions of Dollars |

|---|---|

One to four-family residences | $14,027,211 |

Multifamily residences | $2,213,705 |

Nonfarm, nonresidential | $3,683,487 |

Farm | $360,495 |

Total | $20,284,898 |

As home prices have risen over the years, so has the number of mortgages taken out. Homeowners typically put up 10% to 20% of a home's toal price as a down payment and take out a mortgage loan from a bank to pay for the remaining amount over tens of years.

Following the financial crisis of 2008–2009, government-sponsored enterprises such as the Federal National Mortgage Association (Fannie Mae) (FNMA) , Federal Home Loan Mortgage (Freddie Mac) (FMCC) , and the Federal Home Loan Banks (FHLBs) have been generous in lending to homeowners. These GSEs hold $7.4 trillion in mortgages, representing more than a third of the total.

Home prices tend to fluctuate based on supply and demand for housing.

Sales of new single‐family houses in April 2024 were at a seasonally adjusted annual rate of 634,000, according to the U.S. Census Bureau’s New Residential Sales report. The estimate for new homes for sale was 480,000, which represented a supply of 9.1 months at the current sales rate.

What’s the average amount of mortgage debt on single-family homes?

The average price of a single-family home in the U.S. is $420,800, up from $165,300 at the start of 2000, according to Fed data. As the prices of homes go up, so does the average mortgage total.

The average loan size for new homes was $400,150 in May 2024, according to the Mortgage Bankers Association of America (MBA), a group representing the real estate finance industry. The national median monthly mortgage payment was $2,256 in April 2024, up $144 from one year earlier, according to MBA.

That would put the average annual mortgage payment at $27,072, which is less than half of the annual median salary of $59,228, before taxes according to the U.S. Bureau of Labor Statistics.

More economic coverage:

- Fed's rate hikes 2022-2023: Timeline and discussion

- Are we in a recession? 5 ways to tell

- Bidenomics: Everything you need to know about the President's economic policies

What is the average interest rate on a mortgage?

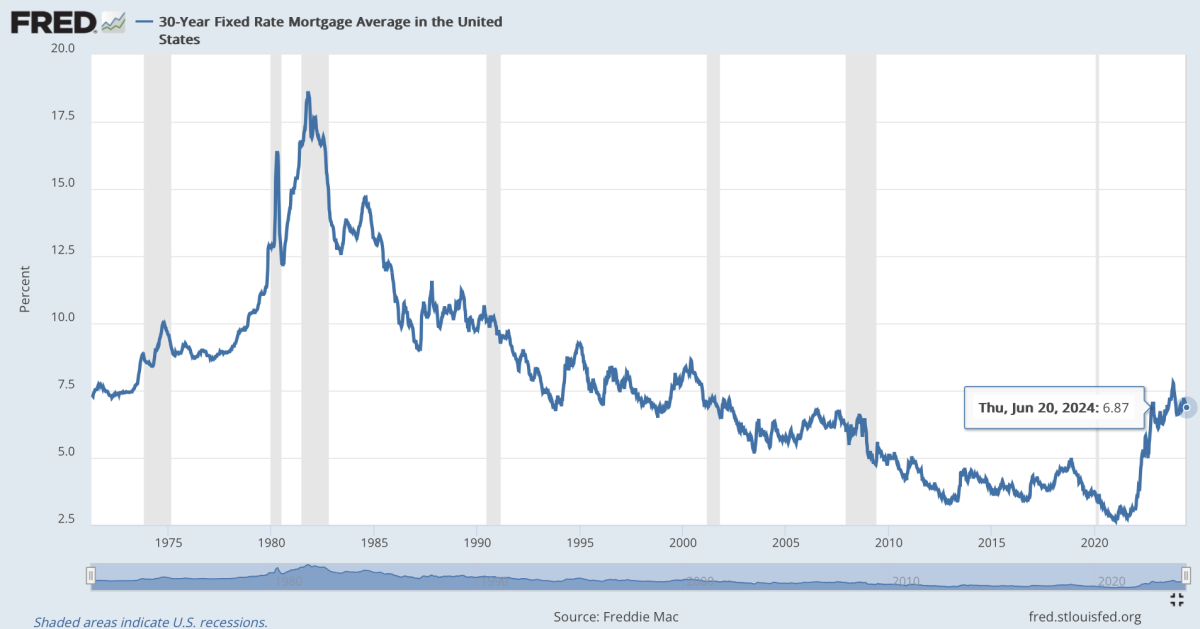

The average interest rate for a 30-year fixed-rate mortgage in the U.S. stood at 6.87% in June 2024, and that’s above the 2.66% rate in December 2020, during the COVID-19 pandemic. Still, mortgage rates in both 2020 and 2024 were well below the record highs set during the early 1980s when inflation was rampant.

How delinquent are Americans on their mortgages?

The standard length of delinquency is 90 days, which typically represents missing three or more consecutive months of payments. Of all commercial bank loans on single-family homes, the delinquency rate is 1.71% of the total, according to the Fed, and that’s above the average 1.45% delinquency rate for all real estate loans.

| Type of Loan | Q1 2024 (Delinquency Rates, % of Total Loan) |

|---|---|

Real Estate Loans | 1.45% |

Residential (Booked in Domestic Offices) | 1.71% |

Commercial (Booked in Domestic Offices) | 1.18% |

Farmland (Booked in Domestic Offices) | 1.03% |

Consumer Loans | 2.68% |

Credit Cards | 3.16% |

Other | 2.17% |

Leases | 1.08% |

Commercial and Industrial Loans | 1.13% |

Agricultural Loans | 0.99% |

Total Loans and Leases | 1.43% |

How does mortgage debt delinquency affect borrowers?

Americans tend to be more delinquent on credit card debt than they are on mortgage debt. Still, falling behind on your payments could lead to foreclosure and the bank selling your home. While creditors can’t go after your property for unpaid credit card debt, they can and do go after the homes of delinquent mortgage borrowers.

Banks, however, can also put a delinquent borrower on forbearance. It’s easier for a homeowner with a federally backed mortgage via the Federal Housing Administration to enter forbearance than it is for those with a commercial mortgage lender.

Under federal law enacted by the Coronavirus Relief, and Economic Security (CARES) Act, borrowers are entitled to request an initial forbearance of their monthly mortgage payments for up to 180 days and may request up to an additional 180 days.

According to MBA’s estimate, only 0.22% of mortgage loans were in forbearance in April 2024, which represented 110,000 homeowners in forbearance plans.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?