Intel CEO doubles down on rare partnership

Tech giant Intel’s (INTC) comeback quarter came in clean on paper. The chipmaker beat handsomely on both lines, on the back of tighter execution and AI demand that started showing up in hard numbers. Margins widened, liquidity surged, and foundry losses narrowed — exactly the kind of ...

Tech giant Intel’s (INTC) comeback quarter came in clean on paper.

The chipmaker beat handsomely on both lines, on the back of tighter execution and AI demand that started showing up in hard numbers.

Margins widened, liquidity surged, and foundry losses narrowed — exactly the kind of quarterly showing Wall Street had anticipated.

The tone from CEO Lip-Bu Tan was equally deliberate. He ticked through four consecutive quarters of strong progress, a healthy $20 billion cash raise through partnerships, along with asset sales and a more disciplined capex path.

However, then came the surprise.

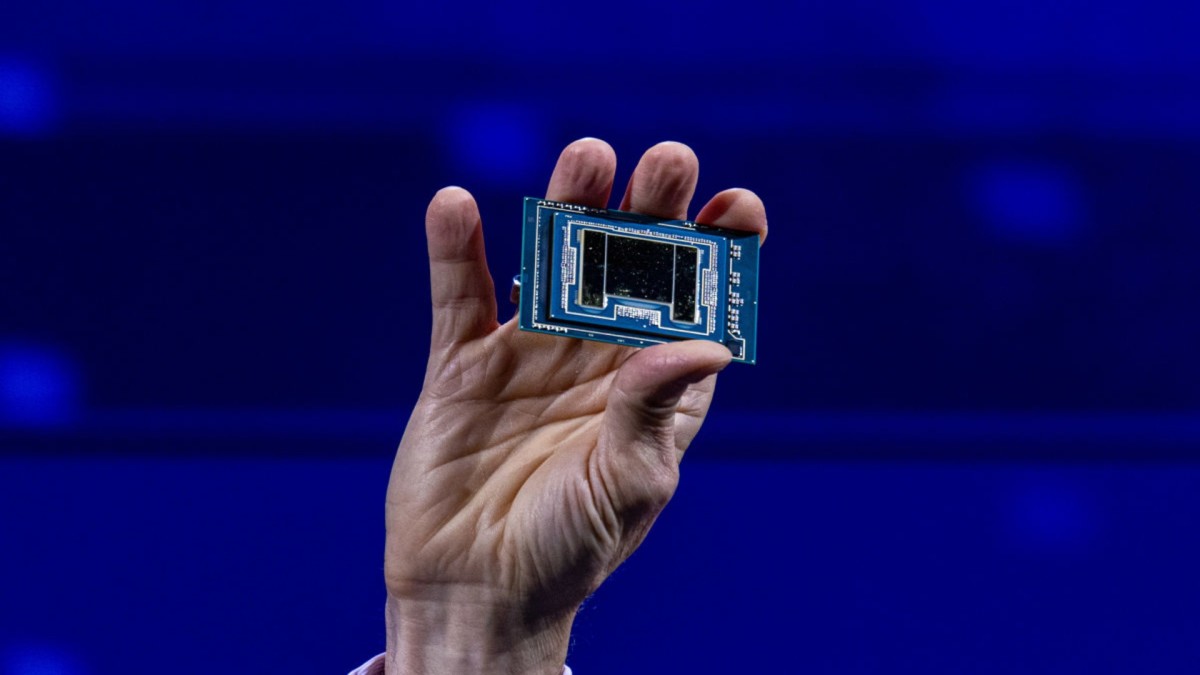

Tan closed on an unusual note, tying Intel’s newfound financial strength to a partnership that reaches beyond semiconductors. He wasn’t looking to hedge but looked to effectively cement a power-packed alliance, suggesting that Intel’s next chapter could unfold on a stage much larger than Silicon Valley. Image source: Annabelle Chih/Bloomberg/Getty Images

Intel CEO says Washington is now an “essential partner”

Lip-Bu Tan didn’t just thank Washington in Intel’s Q3 earnings call, but cast it as an “essential partner.”

Tan opened by crediting “accelerated funding from the United States government” as a critical pillar of Intel’s revitalized liquidity position. Then came the line that turned heads: “I’m honored by the trust and confidence President Trump and Secretary Lutnick has placed in me.”

That’s unusually explicit political framing for a chipmaker's earnings call.

More Tech Stocks:

- Senior analyst lifts Palantir stock price target with a catch

- Nvidia just scored a massive AI win, but CEO Huang has regrets

- Apple’s iPhone 17 story just took an unexpected turn

- Analysts revamp Salesforce stock forecast after key meeting

He pitched the recent landmark deal with the government as strategic and not ceremonial. To put it plainly, Intel’s partnership isn’t about subsidies anymore; it’s about anchoring the country’s chipmaking ability at the bleeding edge of technology.

Moreover, Tan linked policy to its product roadmap.

Intel 18A is billed as the core platform for the next three generations of client and server chips, while Fab 52 in Arizona is now fully operational.

Crucially, he also talked about a defense-grade channel: “I will work with U.S. government within the secure enclave and other committed customers.”

This is a direct indication of trusted, on-shore production that’s likely to feed into national-security demand.

Related: Veteran analyst issues crisp 5-word verdict on Tesla stock

These developments come on the back of Intel’s bombshell announcement over Washington’s transition from a policy sponsor to equity partner earlier in the year.

The White House took a 9.9% stake worth $8.9 billion at $20.47 per share, as the chipmaker pulled forward $5.7 billion of CHIPS cash to keep the 18A node moving.

The deal effectively rests on a sizeable $8.5 billion in grants and $11 billion in loans, along with 30,000 U.S. jobs spread across four key states, including a $3 to $3.5 billion Secure Enclave for defense chips.

Quick takeaways:

- Government as Co-Pilot: Tan hailed Washington as an “essential partner,” openly thanking President Trump and Secretary Lutnick for supporting Intel’s comeback.

- From Subsidy to Stake: The White House owns 9.9% of Intel ($8.9 billion at $20.47/share), along with $5.7 billion in pulled-forward CHIPS funds.

- Industrial Strategy in Motion: The deal includes a whopping $8.5 billion in grants, along with $11 billion in loans, and creates 30,000 jobs across key states.

Intel tops Q3 targets, trims losses, and boosts liquidity

Intel’s Q3 2025 earnings print delivered a clean beat.

Its earnings per share came in at 23 cents, beating consensus estimates by 22 cents, while sales came in at $13.65 billion (+2.8% YOY, and $515 million higher than consensus) on stronger execution and AI-led tailwinds.

CEO Lip-Bu Tan hailed Intel’s superb progress, crediting its robust balance-sheet flexibility after raising almost $20 billion through partnerships and asset sales. This includes $5.7 billion from the U.S. government, $2 billion from SoftBank, and an upcoming $5 billion equity deal with Nvidia closing in Q4.

Related: Cybersecurity expert offers blunt verdict on AWS outage

Tan sees the Nvidia collaboration as transformational: “We are joining forces to create a new class of products spanning multiple generations,”linking Intel x86 CPUs to Nvidia NVLink in targeting AI data-center, enterprise, and PC markets.

Moreover, the company’s gross margin hit 40%, four points over its guidance, led by a healthy mix and lower reserves. At the same time, its operating cash flow surged to $2.5 billion while Foundry losses narrowed to $2.3 billion (improving by $847 million in the prior-year period).

Additionally, the company concluded the quarter with total cash and short-term investments of $30.9 billion at quarter-end, enabling Intel to repay $4.3 billion of debt, a major step in improving its balance sheet.

Related: 5-star analyst recalibrates view on AMD stock

What's Your Reaction?