Is Microsoft Stock a Buy? Here's the Setup.

Microsoft stock has traded well this year but still lags many of its peers and the Nasdaq Composite. Here's the chart hurdle it needs to clear.

Microsoft stock has traded well this year but still lags many of its peers and the Nasdaq Composite. Here's the chart hurdle it needs to clear.

Microsoft (MSFT) - Get Free Report stock has not exactly been roaring through 2023 but it has held up well.

Through March 14 the software giant's shares are up about 8.6% this year. Measured against FAANG, that’s roughly in the middle of the pack. Measured against the Nasdaq Composite, Microsoft trails the index's 9% year-to-date performance.

That’s amid the company’s prominent AI-related developments. Microsoft is hoping that its multibillion-dollar investment in ChatGPT’s parent, OpenAI, will help power its ambitions. The company has already shown off its AI implementation in its search engine, internet browser and products.

Perhaps Thursday will be noteworthy, as the company plans another AI demonstration.

More recently, the collapse in SVB Financial (SIVB) - Get Free Report and Signature Bank (SBNY) - Get Free Report has created a scare in the regional-banking and technology spaces (and now a scare that's spreading to European banks).

That has sparked a rush into cash-rich companies with robust balance sheets. Among those companies are Apple (AAPL) - Get Free Report and Microsoft, and we’ve seen the stocks respond to that catalyst by rallying over the past few days.

Trading Microsoft Stock

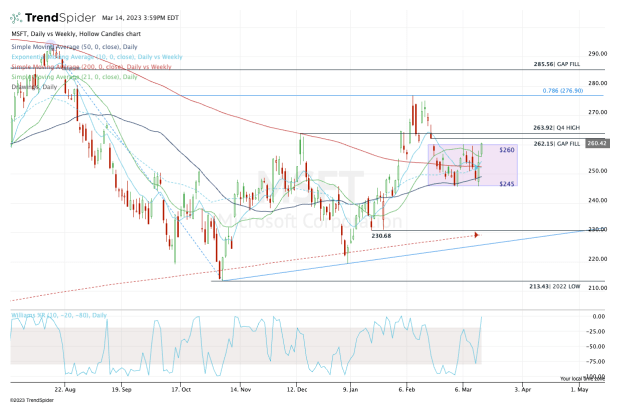

Chart courtesy of TrendSpider.com

The action in Microsoft stock over the past few weeks has been choppy. Though buyers have stepped in over the past two days, there’s no denying the back-and-forth action.

MSFT shares have been bouncing around between $245 support and $260 resistance. In between are all of Microsoft’s daily moving averages.

For traders, this type of action is not conducive, as multiple small losses — or “chop” — can add up to a big loss when all is said and done.

Last time we analyzed the stock, we were looking to buy the dip in late February. That was near $245 support. Since then, the shares have struggled for traction in either direction.

On the upside, bulls would love to see a breakout over $260. But for even more bullish confirmation, I would like to see the stock fill the gap near $262 and regain the fourth-quarter high near $264.

If the stock were to clear all these levels, the door opens back toward $275.

On the downside, a decline below $250 clears the way to $245 support. A break of this support level — and worse, a close below it — could put $241 in play, then a potential dip all the way down to $240.

What's Your Reaction?