Nvidia’s stock surges following latest earnings report

Nvidia shares are rising after better-than-expected first-quarter results.

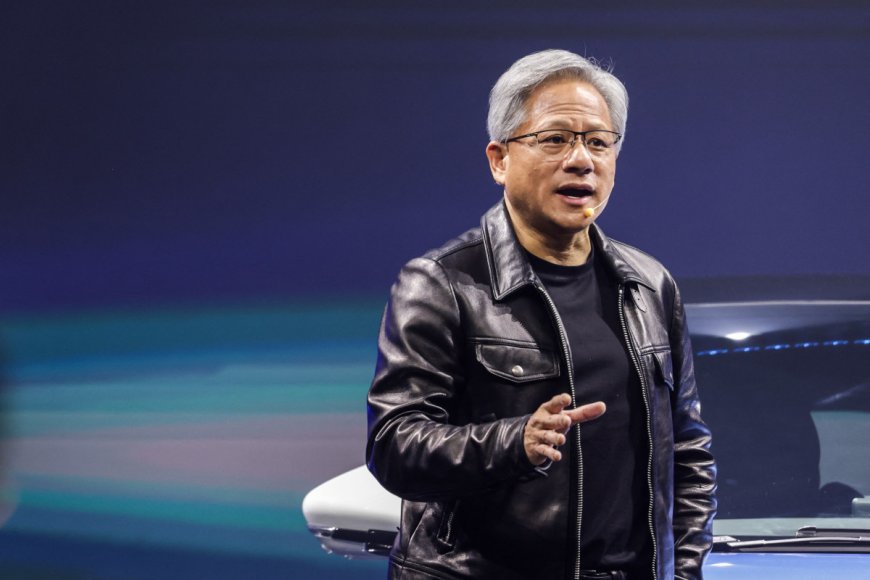

Nvidia’s stock rallied nearly 5% in post-market trading on May 22 after CEO Jensen Huang delivered another “beat and raise” quarter. The semiconductor chip maker has surprised investors by outpacing increasingly optimistic Wall Street forecasts, and its fiscal first-quarter results didn’t disappoint.

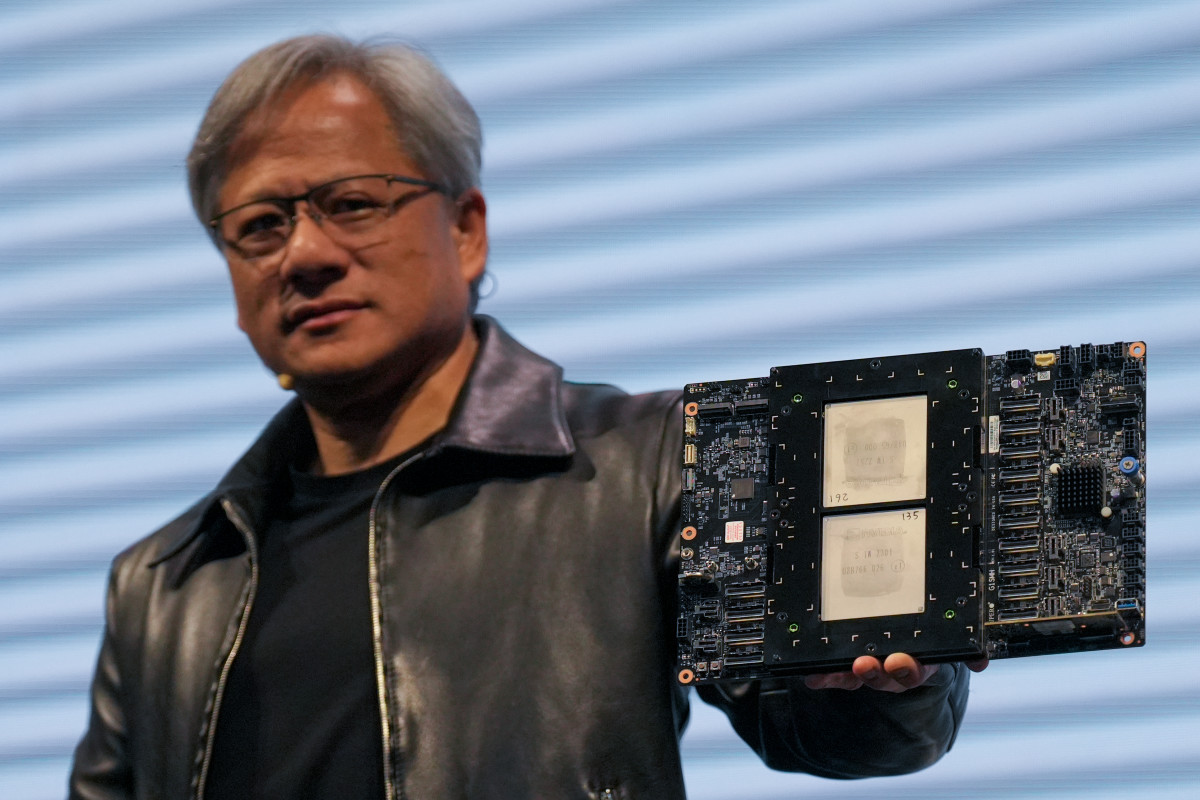

The company has found itself at ground zero in the quest to accelerate artificial intelligence. Its graphic processing units, notably the H100 and next-generation Blackwell line-up, are better suited to handling the heavy workloads of training and operating AI applications.

As a result, enterprise and cloud network operators are spending big money on Nvidia’s chips, which work more quickly and use less energy.

Another Nvidia blockbuster earnings report

There’s been concern that Nvidia's sales growth could slow as buyers tap the brakes on previous-generation chips ahead of the widespread availability of Blackwell chips.

Related: Nvidia stock hinges on 5 key things in its earnings report

Nevertheless, Nvidia delivered an impressive quarter. Revenue was again driven by data center sales. Network upgrades resulted in data center revenue of $22.6 billion, up a whopping 427% from one year ago and 23% above the previous quarter. Analysts predicted data center revenue of $21.1 billion.

“We are poised for our next wave of growth. The Blackwell platform is in full production and forms the foundation for trillion-parameter-scale generative AI,” said Huang.

Elsewhere, it was also a solid quarter. Gaming revenue rose nicely, increasing by 18% year-over-year to $2.6 billion. Automotive sales totaled $329 million, up 11%, and professional visualization sales were $427 million, up 45 percent from last year.

Overall, Nvidia’s first-quarter revenue was $26 billion, bettering Wall Street analysts' target of $24.6 billion and up 262% from one year ago.

Investors were also concerned about spending to stay ahead of rivals like Advanced Micro Devices. AMD launched its own specially designed chips for AI earlier this year.

Despite Nvidia investing heavily to maintain its 80% AI chip market share, profitability remained strong.

Adjusted earnings were $6.12 per share in Q1, above analysts’ $5.58 expectations, and up 461% from last year.

Nvidia’s guidance doesn’t disappoint

It’s tough for companies to continue ramping up forward expectations when optimism is already sky high. Yet, Nvidia was able to boost its outlook despite the high bar.

Related: Analysts reboot Qualcomm stock price target on Microsoft deal

For Nvidia’s fiscal second quarter, Huang forecasts revenue of $28 billion, more than a billion dollars higher than analysts anticipated. A year ago, the company's sales in the July quarter totaled $13.5 billion.

It didn’t issue specific per-share profit guidance, but it does expect gross margin to be a healthy 75.5%, give or take a half percent. For perspective, the fiscal first quarter gross margin was 78.9%, up from 66.8% in the same period last year.

Nvidia delivers surprising news

The numbers certainly suggest that demand for AI infrastructure isn’t waning. Investors aren’t just applauding the top-and-bottom-line results, though.

More AI Stocks:

- World's biggest hedge fund boosts its stake in Nvidia stock

- Analysts update Dell stock price targets on Tesla-server win

- Microsoft delivers a blow to Nvidia

Huang also announced that Nvidia shares will split 10:1 to “make stock ownership more accessible to employees and investors.” On June 7, every shareholder as of the close on June 6 will receive nine additional shares for every share they own.

Huang didn’t stop there.

Nvidia also announced that it is increasing its dividend payout by 150% to 10 cents per share from 4 cents previously. On a post-split basis, the dividend will be 1 cent.

Related: Single Best Trade: Wall Street veteran picks Palantir stock

What's Your Reaction?