Tesla's Stock Is On The Way To This Key Milestone

The electric vehicle company's shares could do something rare.

Tesla's (TSLA) - Get Free Report stock tumbled last year on worry about competition and slowing demand because of recessionary risks. Those challenges remain, but investors aren't paying much attention this year.

Instead, shareholders are laser-focused on the potential for surging sales of its Model Y, and tailwinds from the widespread adoption of its electric vehicle charging network by rivals, including General Motors (GM) - Get Free Report, Ford (F) - Get Free Report, and Rivian (RIVN) - Get Free Report.

Tesla's Model Y is cementing it as a market leader by overtaking long-time top sellers, including Toyota's (TM) - Get Free Report Corolla. Meanwhile, the opportunity to be the "gas station" of the future could mean billions of dollars in future revenue. As a result, Tesla's stock is soaring this year, putting a key milestone in play. Shutterstock

Tesla's business gets a jolt

The Model Y surpassed Toyota's Corolla in the first quarter to become the world's top-selling car. The data suggests Model Y could hold the top spot for the year.

According to JATO Dynamics, Tesla sold 267,000 Model Y's in the first three months of this year, up 69% from the same period in 2022. Meanwhile, Toyota sold 256,400 Corollas in the quarter. However, that was less than it sold last year.

Since Model Y demand is on the upswing and Corolla demand is trending lower, Model Y could build a formidable lead throughout the year, especially since a new $7,500 tax incentive makes the Model Y even more attractive this year than in 2022.

DON'T MISS: 3 Reasons For Investors To Buy Tesla Stock (And 1 Red Flag)

The company's success has caught the eyes of competitors racing to build their own EV lineups. Ford, GM, and others are furiously chasing Tesla in hopes of establishing themselves in the fast-growing EV segment. However, they remain miles behind Tesla in terms of EV market share.

Tesla's sold over 1.3 million cars in 2022, all of which are electric. Ford, the second largest EV unit sold, only moved 61,575 vehicles last year. General Motors sold about 39,000 EVs, making it the third-largest EV player.

Tesla's lead isn't just in vehicles, though. A savvy decision early on to invest in charging infrastructure to overcome buyers' hesitation has paid off. The company has 17,000 supercharging stations in the United States, and those chargers are essential because a 15-minute charge can add up to 200 miles in driving range.

Rather than build out their own competing networks, Ford, GM, and Rivian have all announced deals that give buyers of their EVs access to Tesla's network. According to Piper Sandler, the move, which will eventually eliminate the need to buy a special adapter for Tesla's chargers, may add up to $3 billion annually in revenue. That total could increase if other significant carmakers like Toyota and Hyundai sign on.

Tesla's stock aims at an important milestone

So far, Tesla's shares have responded favorably to sales growth, EV charging pacts, and the fast-approaching launch of its latest vehicle, the Cybertruck.

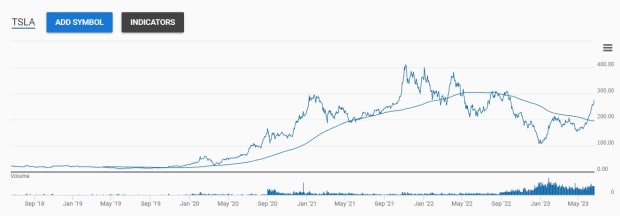

This year, Tesla's stock has skyrocketed 123%, putting the company's market cap back within 20% of $1 trillion. If shares climb another 15%, Tesla will join Amazon, Microsoft, Saudi Aramco, Microsoft, and Alphabet in the trillion-dollar club.

DON'T MISS: Tesla's Stock Just Did Something Important

It's not crazy to think it will happen. Tesla's shares are up 80% since late April, and recently, they broke out above technical resistance on a monthly chart. If Tesla can climb to about $316, that will be enough to eclipse the trillion-dollar threshold.

A quick look at the long-term chart shows that it's not unfathomable. After all, we traded far higher than that in Spring 2022 when the company sold fewer cars, was less profitable, hadn't yet signed these charging deals, and didn't have a new vehicle launch only months away.

What could go wrong?

Tesla's stock could stumble if its mercurial CEO, Elon Musk, says something that negatively impacts demand or if the Cybertruck launch gets delayed. But those risks aren't unexpected. Musk's reputation for off-the-cuff remarks is well-understood by investors, and shares have overcome delays in the past.

Instead, a broad stock market decline is likely why Tesla would fail to become a $1 trillion market cap company. So far, investors have looked beyond economic risks, but stocks with high valuations, like Tesla, could retreat if a recession becomes increasingly evident. After all, stocks don't go up or down in a straight line forever. At some point, Tesla's shares will digest their recent advance by trading sideways or backfilling a little.

Overall, the opportunity for sales and profit growth remains massive. Electric vehicles only accounted for about 14% of the 67.2 million automobiles sold worldwide last year, according to the International Energy Agency. Worldwide EV sales are expected to grow 35% to 14 million this year alone, and by 2030, EVs could represent 40% of all vehicles sold in the US, according to S&P Global Mobility. That's a major tailwind for Tesla's business that investors shouldn't ignore.

What's Your Reaction?