Veteran fund manager looks at server demand as Super Micro makes major AI move

One long-time analyst offers a blunt take on Super Micro Computer's shares.

On the beginning glance, a review of artificial intelligence can feel like a deep dive right into a vat of alphabet soup.

What's with each and every of the acronyms? AI, GPUs, ASPs, CPUs--it truly is sufficient to make you put your head back and wail "ay, ay, ay."

Don't miss the move: Subscribe to TheStreet's free each and on a daily basis newsletter

But this stuff is essential if we're to accept as true with any selection of reports that tell us AI is here to reboot our reality.

Servers receive, store, and share data, and AI models work best on servers with good processing power.

Spending within the server market grew 64.1% within the 2nd quarter, driven by high application service providers. The figure reflects higher shipments of graphics processing unit servers to hyperscalers and other large IT buyers, based on the market research firm IDC. Hyperscalers are major cloud services and products and infrastructure providers, almost like Amazon and Alphabet.

An aging installed base is primed for refresh, and the launch of latest generation processors late in 2023 is contributing to this cycle within 2024, as the tech transition to new [central processing unit] platforms gradually moved forward but has picked up the % in Q2 2024," IDC said. A CPU is the core computational unit in a server.

IDC said that the market is expected to grow at a 16% compounded annual growth rate over the next 5 years. Bloomberg/Getty Images

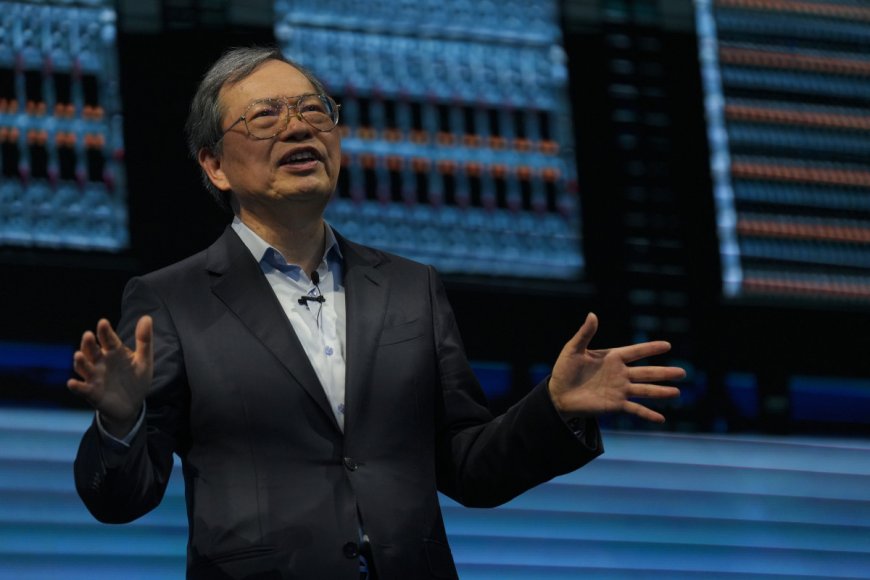

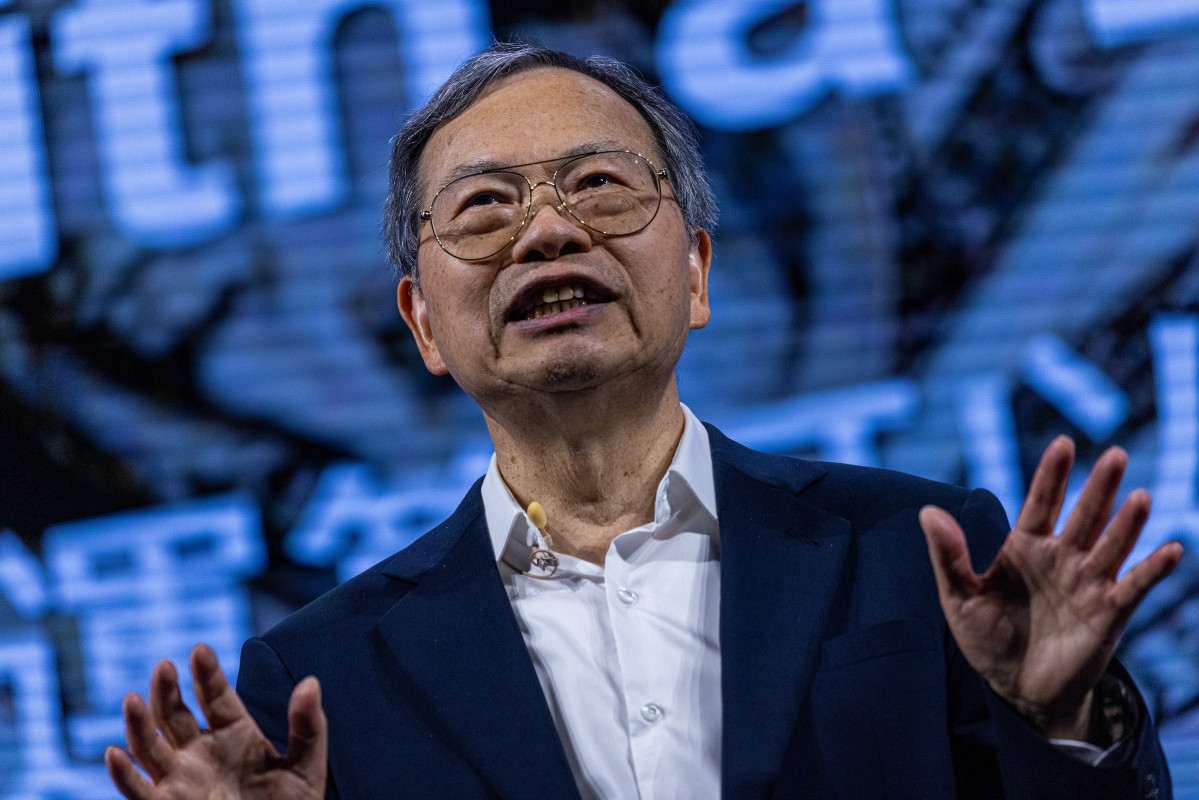

Super Micro CEO: deployment in 'weeks, now not months'

"The major impact and change to the forecast at some point of this free up is the addition of more expected demand for GPU servers, moreover as a faster recovery within the short term of nonaccelerated servers," the firm said.

Super Micro (SMCI) saw its shares soar on Oct. 7 after the company, which makes high-end servers used in artificial intelligence, said that it recently deployed more than 100,000 GPUs with liquid cooling solutions “for a lot of the largest AI factories ever built, moreover as other [cloud-service providers]."

Related: Analysts update outlook for Nvidia's Blackwell chips amid AI boom

“Super Micro continues to innovate, handing over full data center plug-and-play rack scale liquid cooling solutions,” Charles Liang, president and CEO of Super Micro, said in an announcement.

“Our complete liquid cooling solutions, including SuperCloud Composer for the general life-cycle management of all components, are now cooling massive, state of the art AI factories, cutting back costs and making improvements to performance," he said.

Data center operators are "coming to Super Micro to satisfy their technical and financial goals for both the construction of greenfield sites and the modernization of existing data centers," Liang said.

"Since Super Micro supplies each and every of the components, the time to deployment and online" is "weeks, now not months," he added.

The corporate said many organizations require the correct-performing GPUs and CPUs to remain competitive and wish these servers to run constantly.

"Super Micro's ultra-dense server with dual top-bin CPUs and eight Nvidia (NVDA) HGX GPUs in exactly 4U with liquid cooling is the ultimate AI server needed in AI factories," the company said.

"When installed in a rack, this server quadruples the computing density, allowing organizations to run larger training models with a smaller data center footprint."

More AI Stocks:

- Apple stock slides as big iPhone 16 bet sputters

- Analyst revisits Meta stock price target as Facebook parent ramps AI spend

- Analyst reviews BlackRock stock rating after AI partnership with Microsoft

Super Micro shares are down nearly 50% year-to-date. The corporate's stock took a beating late last month when The Wall Street Journal reported that the U.S. Department of Justice turned into investigating the company after short-seller Hindenburg Research alleged "accounting manipulation" at the AI-server maker.

Hindenburg said that it “found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export regulate screw ups, and customer issues.”

Veteran analyst hesitates on SMCI

In his column on TheStreet Pro, Stephen "Sarge" Guilfoyle, a longtime Wall Street analyst and trader, says that taken together, the stock-price runup, the Hindenburg report and the Justice Department inquiry are "a lot of baggage where the outcomes remain uncertain. It truly is intensely a little to overlook when putting valuable capital to work."

Related: Short-seller blasts Super Micro stock in most modern report

In a couple of weeks, Wall Street expects a robust quarterly report from Super Micro, with earnings doubling and revenue tripling, Guilfoyle says. "Seems awesome, right? As an alternative of that operating and free cash flows have been negative for 3 consecutive quarters," he says.

The balance sheet, he says, "is as healthy as a horse if one looks at current and quick ratios on my own."

But he's concerned that a substantial chunk of its "current assets are in inventories when the firm is on the cutting fringe of latest technology the complete time," Guilfoyle says. "How a whole lot of those inventories will hold their value? I honestly do not know. What are the margins on many of the most modern products that appear vitally important to Nvidia?"

Guilfoyle sums up his opinion on Super Micro, saying, "I'm OK with a short-term trade as long as one understands what they are doing. What I could now not do is invest on or in contrast name until we know more about the final result. Risk management is rule primary when managing one's own capital."

Related: The 10 best investing books, based on our stock market pros

What's Your Reaction?