Analyst revisits Nvidia stock price target after Blackwell checks

Nvidia shares have added nearly $2 trillion in value this year but have risen only 3.3% over the past month.

Nvidia shares edged more desirable in early Monday trading, following a month of extraordinarily meager beneficial properties, as a pinnacle Wall Avenue analyst issued a bullish rate purpose for the quarter's third largest tech great.

Nvidia (NVDA) shares have launched close to $2 trillion in market rate this 12 months, alternatively its beneficial properties have most very again and again stalled because the semiconductor stalwart's early-June 10-for-1 stock spoil up. The spoil up accompanied its improved-than-estimated fiscal-first-quarter cash report.

The stock's broader potentialities have remained most very again and again intact, alternatively, and a couple of analysts have argued that Apple's (AAPL) June 10 unveiling of its AI ambitions and the continuing surge in Tesla (TSLA) shares over the final month have redirected investor passion.

Important: Analyst adjusts Nvidia stock ranking on valuation

Nvidia, with a market rate of $three.1 trillion, sits beneath Microsoft (MSFT) and Apple (at $three.Forty eight trillion and $three.forty seven trillion respectively) because the quarter's third-largest corporation.

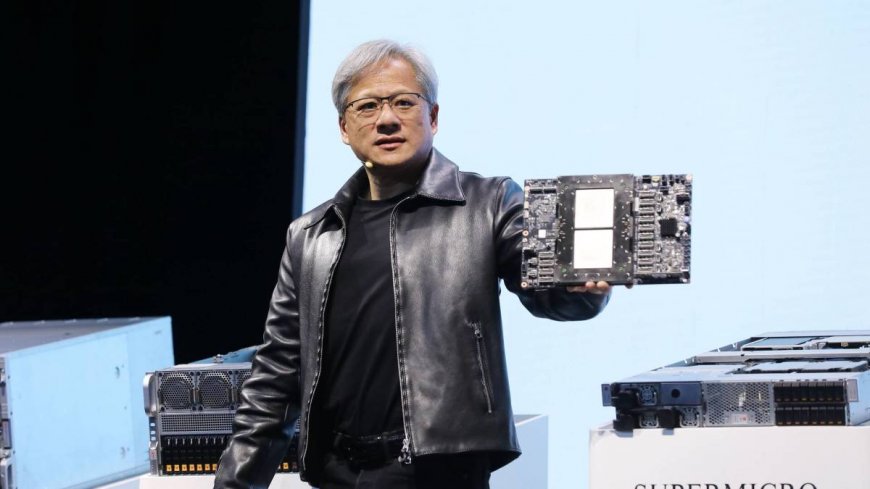

UBS analyst Timothy Arcuri, alternatively, notes that when investor sentiment on Nvidia stock "has faded comparatively in most most up-to-date weeks, increasing more desirable of a 'wall of be stricken,'" he sees the pause as "as a end result healthful" for the stock if the brand new cash outlook from he and his crew materializes. Bloomberg/Getty Photos

Acuri, who lifted his Nvidia rate purpose consequently of $30 to $one hundred fifty a share, sees next 12 months's cash within the role of $5 a share, with cash rising past $200 billion. Or not it truly is thus of structured cash for its new line of AI-powering Blackwell constructions and the ramp up in spending from hyperscalers which contains Microsoft, Google (GOOGL) , Meta Platforms (META) and Amazon (AMZN) .

Big AI spenders merit Nvidia

Hyperscalers definitely are poised to spend around $ninety two billion this 12 months by myself setting up out their great computing infrastructure. The funding shows their consumers' pass to leverage their great datasets to toughen cash of each little thing from vitality-thru eating to the fundamental complicated pharmaceutical checking out.

Or not it truly is aiding Nvidia, which formerly this spring launched the Blackwell line of computing processors, that are doubtlessly to replace the corporation's benchmark H100 chips and vitality good identified cash beneficial properties.

The new Blackwell GPU architecture, named after the African American mathematician David Harold Blackwell, performs AI duties at more desirable than twice the rate of Nvidia's most up-to-date Hopper chips, when utilising less electrical vitality and supplying more desirable bespoke flexibility, the tech crew has outlined.

Important: Analyst resets Nvidia stock rate purpose after trillion-greenback Q2

"Our most most up-to-date supply-chain tests scan our prior suspicions that demand momentum for Blackwell rack-scale constructions stays a bit of mighty," Arcuri wrote. "Even even alternatively our estimates have time and again been more desirable before [Wall Street,] we are even now nevertheless baking in a hole to what's being suggested consequently of the provision chain."

Arcuri also boosted his 2025 cash forecast consequently of around 12%, to $204 billion, with cash coming in barely shy of the $5 mark. He maintained a buy ranking on Nvidia shares.

"We now aspect of passion on EPS of ~$5 would again and again be viable for 2025 because the order pipeline for NVL72/36 constructions is materially more desirable than merely two months ago as hyperscaler budgets for 2025 corporation up," he launched.

Nvidia affords a structured close-time interval outlook

Sleek-day-12 months potentialities are also structured, with Nvidia telling investors in May that most up-to-date-quarter cash would rise to around $28 billion, with a 2% margin for error. It furnished the estimate when it outlined the Blackwell gear of processors and computing device gadget wouldn't initiate transport unless the 2d 0.5 of of 2024.

Analysts had concerned that a hole between some of essentially the most up-to-date H100 chips and the brand new Blackwell offering would create a form of air pocket in cash as consumers canceled orders for the older chips and waited for the newer gear.

More appropriate AI Stocks:

- Nvidia has $four trillion rate in sight as AI thought about powering chip cash

- Adobe faces troubling FTC lawsuit for ‘trapping' consumers

- Apple plans most great alternate to future iPhones

Nvidia may be transferring forward with Rubin, every other stepped forward line of AI-powering chips, which CEO Jensen Huang unveiled at some aspect of a speech at Nationwide Taiwan Faculty in Taipei final month.

Named after the American astronomer Vera Rubin, who's credited with discovering so-acknowledged as dark depend, the brand new Rubin constructions shall be rolled out in 2026, Huang outlined.

Nvidia shares had been marked Zero.eighty four% more desirable in premarket trading to indicate an opening bell rate of $126.89 every.

Important: Veteran fund supervisor sees world of pain coming for shares

What's Your Reaction?