Analysts reveal new Microsoft price targets after AI costs cloud earnings

Microsoft touted the potential for AI to boost its longer-term profits, but it noted that costs would rise in the near term as a result.

Updated at 9:09 AM EST

Microsoft (MSFT) - Get Free Report shares moved lower in early Wednesday trading, pulling the world's most-valuable tech stock closer to the $3 trillion mark, after a mixed set of fiscal-first-quarter earnings underscored the costs tied to building out its AI ambitions.

Microsoft topped the $3 trillion mark for the first time earlier this year, after overtaking Apple (AAPL) - Get Free Report as the world's biggest listed stock, largely on the back of its leadership position in artificial intelligence and its early investment in ChatGPT creator OpenAI in late 2022.

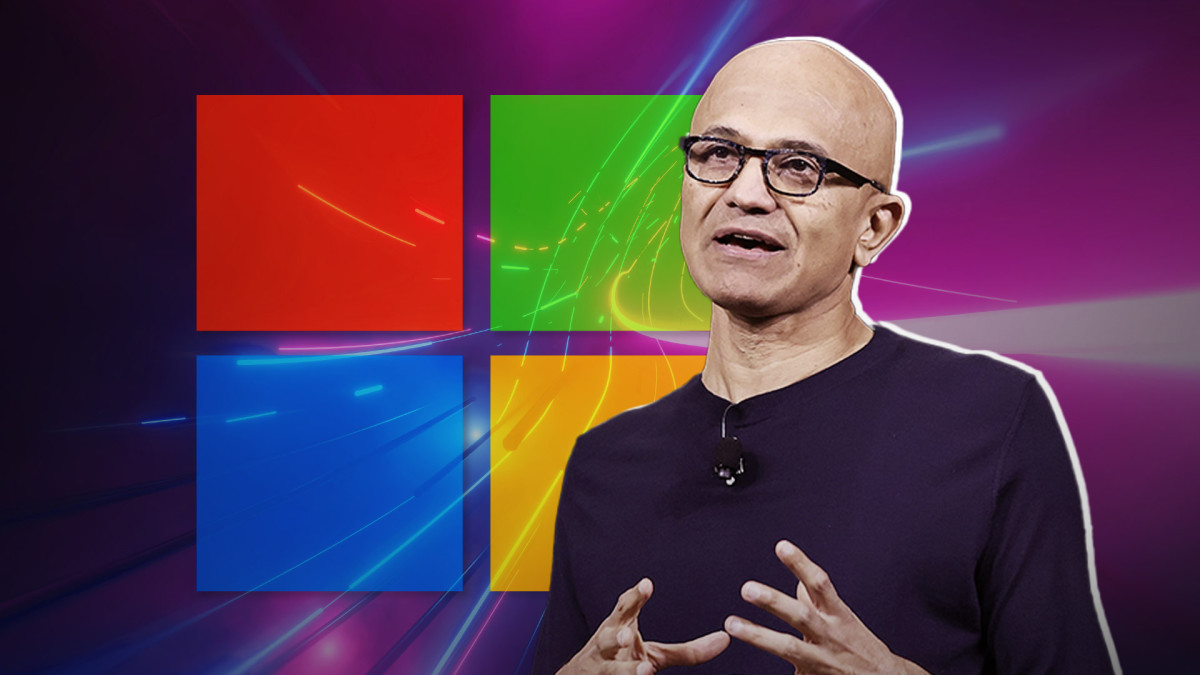

Since then CEO Satya Nadella has touted AI technologies' potential to both boost the group's profit and trigger a sea change in the broader tech industry akin to the launch of the internet in the mid-1990s.

"We move from talking about AI to applying AI at scale," Nadella told investors on a conference call late Tuesday. "By infusing AI across every layer of our tech stack, we are winning new customers and helping drive new benefits and productivity gains." TheStreet/Shutterstock/Justin Sullivan/Getty Images

That transformation comes with a price, however, and Microsoft warned investors late Tuesday that its capital expenses are expected to rise "materially' in the coming quarters as it develops the various AI-related additions to its vast product suite.

Operating expenses for the current quarter, Microsoft said, are likely to approach $16 billion, a near 4% increase from the three months ended in December. It's also a level that spooked investors following last night's earnings report.

AI potential should outweigh Microsoft's costs

Analysts, however, are looking through the near-term cost hit to the longer-term earnings potential of Microsoft's AI rollout. A host of Wall Street banks boosted both their ratings and price targets on the stock heading into the start of the Wednesday session.

In fact, no fewer than 16 Wall Street analysts, ranging from Barclays to JPMorgan to Oppenheimer, have raised their Microsoft price targets,

"Microsoft has continued to show they are a strong share gainer in this new AI landscape, which is largely driven by the company's ability to build compelling generative AI applications throughout their product suite as well as capture new AI-related workloads on Azure," said D.A. Davidson analyst Gil Luria

Luria, who added $85 to his Microsoft price target, taking it to a Wall-Street-high $500 a share, said he was impressed by the group's near-term guidance, which highlighted "increasing demand for Microsoft Cloud as well as positive margin expansion even with increasing capital expenditures related to the build-out of their AI infrastructure."

CFRA analyst Angel Zino, meanwhile, lifted his Microsoft price target by $35, to $455 a share, citing in part the value created for the group's Office 365 division by the addition of AI assistant Copilot.

Microsoft Cloud growth in focus

"We view growth prospects positively for Office 365, as we see seat growth still driven by small/midsize businesses while Copilot adoption supports upward pricing momentum," said Zino. "Gaming grew 49% on Activision contribution/performance. Despite elevated AI spend, we see a clear path to ongoing operating margin expansion."

Microsoft itself justified some of its early AI spending by noting that AI infusions added around 6 percentage points to the revenue growth of Azure, its flagship cloud product, over the three months ended in December.

That's more than double the impact over the September quarter and helped Azure grow revenue by around 30%, which in turn powered a better-than-expected top line for the group's Intelligent Cloud unit of $25.9 billion.

Overall, Microsoft said group revenue was up 18% to $62 billion, while profit rose nearly 20% to a Wall-Street-beating $2.93 a share for the group's fiscal first quarter.

Related: Microsoft, Magnificent 7 must justify AI hype this earnings season

Looking into the three months ending in March, Microsoft said it sees cloud revenue in the region of $26 billion, with gains for both its Productivity and Business Processes and More Personal Computing divisions alongside.

More Business of AI:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- Google targets Microsoft, ChatGPT with huge new product launch

- AI stock soars on new guidance (it's not Nvidia!)

"The company continues to infuse AI across every layer of the tech stack to generate strong profitable growth over the near term, with Copilot an additional high-octane growth driver to the Microsoft story," said Wedbush analyst Dan Ives, who lifted his price target on Microsoft by $25, to $475 per share following last night's earnings.

"We believe this is the start of a multiyear initiative aimed at generating significant AI use cases for customers across the enterprise landscape to gain further efficiencies while accelerating profitable growth, with Redmond leading the charge in this potential $1 trillion opportunity," he added.

Microsoft shares were marked 0.3% lower in premarket trading to indicate an opening-bell price of $407.44 each.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?