Buy-the-Dip Setup Appears in Salesforce Stock: Here's the Trade

Salesforce stock has been resilient this year, up almost 50%. Here's the buy-the-dip setup to watch right now.

Salesforce stock has been resilient this year, up almost 50%. Here's the buy-the-dip setup to watch right now.

Salesforce (CRM) - Get Free Report has been one of the better-performing stocks this year. The software stalwart's shares are up almost 50% so far in 2023.

The second half of 2022 produced no love for Salesforce stock. It approached a long-term value area around $125 late in the year, and at the time the shares were down almost 60%.

Since hitting that low, Salesforce stock has been on fire. At the recent high, the shares were up almost 60%.

These have been some very large gyrations in the stock price. And the steep decline prompted interest from fully five different activist investors.

Don't Miss: What the Technicals Say for the S&P 500, Nasdaq in the Second Quarter

Solid earnings were met by the bulls gobbling up the stock, and now Salesforce has been one of the top large-cap tech names. It joins stocks like Meta (META) - Get Free Report, Nvidia (NVDA) - Get Free Report and Tesla (TSLA) - Get Free Report as the top tech names so far this year.

Let’s look at the buy-the-dip setup present in Salesforce stock.

Trading Salesforce Stock

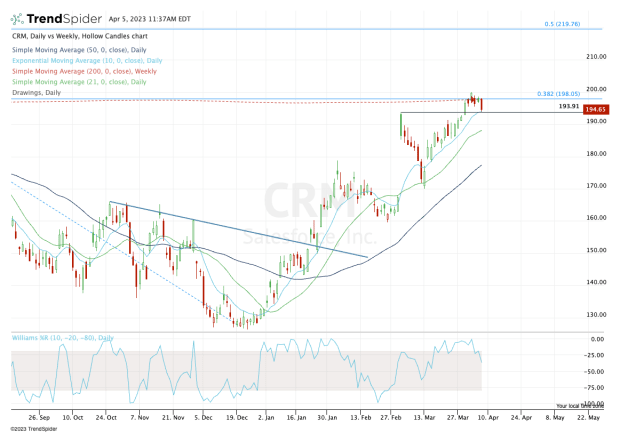

Chart courtesy of TrendSpider.com

On the chart above, traders will notice a clash between different time frames.

That’s as Salesforce stock runs into its declining 200-week moving average and the 38.2% retracement from the 2022 low to the all-time high. That’s giving some investors pause, particularly after such a powerful rally over the past few months.

At the same time, the shares are now pulling back into the rising 10-day moving average and are retesting the prior post-earnings high near $194.

This combo is an attractive buy-the-dip area for short-term active traders, as the stock has not yet tested the 10-day moving average in 15 sessions and as it retests a prior key level (the initial post-earnings high).

If this zone fails, the stock could see more selling pressure in the days (and possibly weeks) ahead. In that scenario, most traders will look to the 21-day and 50-day moving averages as potential support.

Don't Miss: Defense Stocks Go on Offense as Lockheed Martin, Raytheon Rally

Don’t forget: Just a few weeks ago, Salesforce stock was trading near $170. In that sense, it’s been incredibly strong, but it’s also rallied quite far in a short time.

If active support fails, traders must adjust. But it’s hard to fight such a strong trend at the moment.

On the upside, let’s see if Salesforce can clear $198 and retest $200 to continue higher.

What's Your Reaction?